Facebook acquires Android photo app Lightbox

Social network giant already holds record for most acquisitions pre-IPO, and two other records

Updated with additional information on pre-IPO numbers

When Facebook goes public this week, it will have already broken the record for acquiring the most companies before going public. But that doesn’t mean it is planning on slowing down anytime soon.

Now, Facebook has added one more company to its repertoire to make its acquisitive record even bigger.

Android photo app Lightbox is becoming part of Facebook, company founders Thai Tran and Nilesh Patel announced on their blog Tuesday.

Facebook is only acquiring Lightbox staff and technology, not the company or its photos, so the service itself will cease to exist. Users have until the middle of next month to download their photos off of Lightbox.

“We started Lightbox because we were excited about creating new services built primarily for mobile, especially for the Android and HTML5 platforms, and we’re honored that millions of you have downloaded the Lightbox Photos app and shared your experiences with the Lightbox community,” Tran and Patel wrote.

Facebook had already purchased 12 venture companies before going public, and its purchase of Lightbox pushes that up number to 13. Before going public, Zynga had eight pre-IPO acquisitions, while Google and LinkedIn only had two.

One company, if it goes public, that could eventually break Facebook's record is Twitter, which has bought 11 start-ups, according to Dow Jones VentureSource.

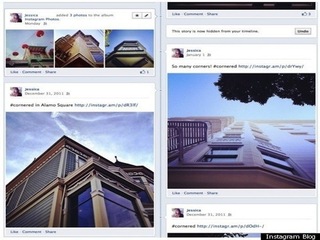

Facebook has recently purchased a number of start-ups, including location based app Gowalla in December; Instagram, who Facebook infamously bought for $1 billion in April; and social discovery app Glancee in March.

New Castle, Delaware-based Lightbox debuted in June 2011, and received $1.1 million in seed funding from Index Ventures, Accel Partners, SV Angel, 500 Startups and angel investors.

Other Facebook IPO records

Beyond having the most pre-IPO acquisitions, Facebook is also going to be the largest venture-backed IPO in history, blowing the previous record holder, Google, which had an IPO of $24.6 billion, out of the water. Facebook is on track to more than quadruple Google’s IPO; it could end up with a valuation of $104 billion. The only other companies with IPOs over $10 billion are Corvis, with $14.2 billion, and Groupon, who had $13.4 billion.

Facebook has also smashed the previous record for the amount of venture capital raised while private. The social networking giant raised $2.2 billion. That is a billion more than the previous No. 1 record holder, which is broadband company Clearwire, having raised $1.2 billion in 2007. Twitter now ranks No.3, with $1.1 billion as a private company, whileFisker Automative is No. 4 with $1 billion, and Solyndra rounds out the top five with $950 million.

On top of that, with Facebook adding yet more shares to its IPO on Wednesday, it could wind up selling all of its shares for $16 billion. That would make it the third largest IPO to date, behind Visa and General Motors, and the largest tech IPO ever.

(Image source: neowin.net)

Related Companies, Investors, and Entrepreneurs

Glancee

Startup/Business

Joined Vator on

Remember the feeling of talking to someone new, realizing that you have a dear friend in common and that you both love that artist only you know about? Glancee helps you discover these hidden connections and meet with people important to you. Explore the profiles of people nearby and be notified when somebody has common friends or mutual interests. Text or call, meet up for a coffee, and stay in touch. Create new, meaningful connections with new people just like you.

Related News