Facebook jumped out of nowhere and snapped up the hottest photo sharing app on the market — Instagram, right as the company announced its $50 million Series B round of funding from Sequoia, Thrive Capital Greylock, and Benchmark. No one in the tech sphere saw that series of events happening that close together.

Last week was a hectic, but promising time for Instagram as word spilled out that everyone was lining up to be a part of the service — from Android users to venture capitalists.

The popular photo-sharing app, which launched on Android last week, was expected to receive $50 million at a $500 million valuation, bringing the total funds raised to $57 million.

The app was an instant hit, reaching one million users in only two months after launching in October 2010 and also disclosed publicly that it was growing past 30 million users — and saw 1 million downloads on Google Play with the Android release.

Now, Facebook wants to be the one wrangling this continued leader in photo sharing — jealous much? Today, Facebook announced that it has just finished a deal to acquire mobile photo sharing app Instagram for approximately $1 billion in cash and stock. Instagram will, some might say thankfully, remain a standalone app from Facebook, but the services will add on a great deal more integration.

Now, Facebook wants to be the one wrangling this continued leader in photo sharing — jealous much? Today, Facebook announced that it has just finished a deal to acquire mobile photo sharing app Instagram for approximately $1 billion in cash and stock. Instagram will, some might say thankfully, remain a standalone app from Facebook, but the services will add on a great deal more integration.

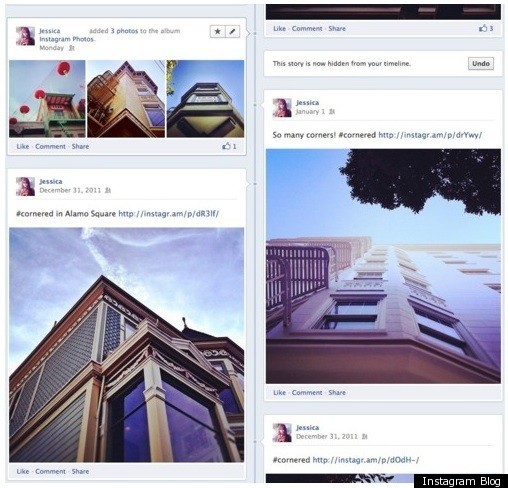

Talk was circulating last year that Facebook was going to try and create an app that was specifically designed for photo capturing and posting — and anyone that has tried to load more than one photo onto Facebook via your smartphone can attest that this was a great alternative. But now it appears that Facebook has crunched the numbers and would prefer to just snap up the already established Instagram as a means to that end.

While many people do tie their Instagram activity to Facebook and other social networking options, Instagram would also likely benefit with a closer tie to Facebook’s nearly 900 million member base, since there is always room to grow.

I can only imagine how excited Andreessen Horowitz is that the $500 million valuation quickly resulted in $1 billion in cash and stock — ca-ching.

This means that Instagram will gain all the innovative design and engineering resources under Facebook’s charge, while Facebook will be able to garner the ingration of a beloved service and only a handful of employees.

As we inch closer to the Facebook IPO (expected in May), the social networking giant continues to show its ability to diversify its revenue stream and its functionality with acquisitons, advertising opportunities and key partnerships — all of which continue to excite investors and might set out a blueprint for the next tech companies that want to IPO.

The public spent the last three months estimating just how big the company and its bankers were going to go with in the S-1 form — with many estimates placing the valuation of the company near $100 billion and the total amount the company would raise in its public debut near $10 billion.

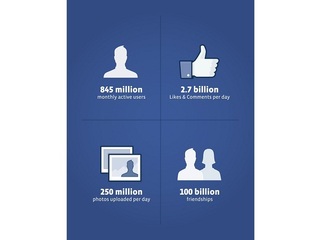

In the filing, Facebook disclosed that it has 845 million MAUs as of Dec. 31, 2011, an increase of 39% as compared to 608 million MAUs as of Dec. 31, 2010.

Following up the less-than-stellar showings of several recent tech IPOs (from the likes of Pandora, Groupon and Zynga), Facebook appears to be leaning on the conservative side in order to insure a stronger clamor for shares out of the gate.

Just last week, Facebook announced that it will be traded on Nasdaq under the ticker symbol “FB.”

Nasdaq won a battle with the New York Stock Exchange for one of the highly largest tech IPOs ever — Facebook. Nasdaq hosts Apple, Microsoft, Amazon and Google, while the NYSE have smaller public tech companies like LinkedIn, Yelp and Pandora Media.

Mark Zuckerberg posted the following to his Timeline about adding Instagram to his catalog:

I’m excited to share the news that we’ve agreed to acquire Instagram and that their talented team will be joining Facebook.

For years, we’ve focused on building the best experience for sharing photos with your friends and family. Now, we’ll be able to work even more closely with the Instagram team to also offer the best experiences for sharing beautiful mobile photos with people based on your interests.

We believe these are different experiences that complement each other. But in order to do this well, we need to be mindful about keeping and building on Instagram’s strengths and features rather than just trying to integrate everything into Facebook.

That’s why we’re committed to building and growing Instagram independently. Millions of people around the world love the Instagram app and the brand associated with it, and our goal is to help spread this app and brand to even more people.

We think the fact that Instagram is connected to other services beyond Facebook is an important part of the experience. We plan on keeping features like the ability to post to other social networks, the ability to not share your Instagrams on Facebook if you want, and the ability to have followers and follow people separately from your friends on Facebook.

These and many other features are important parts of the Instagram experience and we understand that. We will try to learn from Instagram’s experience to build similar features into our other products. At the same time, we will try to help Instagram continue to grow by using Facebook’s strong engineering team and infrastructure.

This is an important milestone for Facebook because it’s the first time we’ve ever acquired a product and company with so many users. We don’t plan on doing many more of these, if any at all. But providing the best photo sharing experience is one reason why so many people love Facebook and we knew it would be worth bringing these two companies together.

We’re looking forward to working with the Instagram team and to all of the great new experiences we’re going to be able to build together.