Pew: Smartphone payments will be mainstream by 2020

Pew Research found that 65% of experts expect mobile payments will be widely adopted in 8 years

Mobile payments could become as common as swiping a credit card by 2020, according to the latest report released by the Pew Research Center today.

Approximately 65% of experts surveyed in the study agreed that mobile payments would take off by 2020, while 33% of experts agreed with a more negative statement, which said that consumers wouldn’t trust mobile payments to replace cash and credit cards by 2020.

I'm sure that PayPal, Square, Google, Visa, LevelUp, PayDragon and others are taking notice of what the buzz is about mobile payment adoption, especially now that users have grown more comfortable shopping and checking their banking information via their pocket-sized computers.

This survey only offered two scenarios to choose from -- adoption and lack of trust -- so there is no middle ground to draw from in this survey.

Recent Pew Internet surveys have found that one in 10 Americans have used their cell phone to make a charitable contribution by text message; more than one-third of smartphone owners have used their phones to do online banking services like paying bills or checking a balance; and 46% of apps users have purchased an app using a mobile device. So the comfort is growing with phone transactions, but all of these mobile payment companies that have been making waves over the last few months are hoping that you'll feel fine leaving home with just your phone in the very near future.

Previous research from comScore found that 38% of smartphone owners have used their cell phone to make a purchase of music, e-books, movies, clothing and accessories, and daily deals as well, just as mobile retail continues to grow with vigor.

Laura Lee Dooley, an online engagement architect and strategist for the World Resources Institute, expressed her fear that there are still significant trust issues and said consumers’ fears will drive the industry. “There will always be people who are concerned with the security of their transactions,” she wrote in the study, “so the concern of someone hacking into your financial flows will continue to grow, and personal security and device-tracking companies will become an integral and major component of the marketplace.”

But because so many people are turning to their mobile devices for more functionality and information, the infrastructure and tools for safe mobile purchasing have been advancing rapidly in recent months and could quickly douse the concerns that crop up.

“For many of these experts, ‘mobile money’ represents more than just existing processes adapted to a new, more portable form factor,” Janna Anderson, director of Elon’s Imagining the Internet Center and a co-author of the study, said in a statement. “They see this as an opportunity to implement security measures that are lacking in our current financial systems, to offer consumers more control over their spending, and to even reinvent the way we think about the concept of ‘money’. Top people from Microsoft, Nokia and Netflix were among the many who said it is up to those who control transaction systems to set the timetable for adoption.”

Since other countries have been using mobile payments in one form or another, it only seems inevitable that the US will fall in step and spread the mobile options very soon, but it is definite that changes and evolutions will be a part of this process so that more people feel as comfortable clicking their phone as they do cracking open their wallet. It will likely become another option of payment and accountability for those that like to manage their money in their own personalized way.

Mobile security

With each of the new ways to exchange funds, there is always the concern about security and each company has been working on ways to increase customer confidence in their tools. One of the constants across all the services is the ability to track the payments you have made and accepted within the application so you have a simple history available all of the time.

Another method that many of the services offer is the ability to receive a digital receipt after each transaction into your personal email address. This option clearly keeps people informed of any activity going on with the service and credit card connected to it.

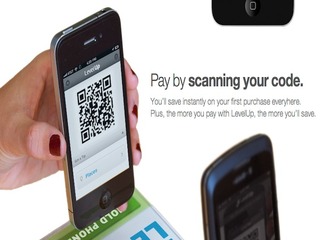

Some of the companies, such as LevelUp, also offer a pin code option so that each time you are about to complete a transaction, you have to enter a unique pin to insure that someone can't just use your phone for fraudulent purchases.

And Square's new Pay with Square app also has people build profiles that include a the photo and name of the person who owns the account to give another level of security.

But, of course, none of these are fool-proof and anyone that steals your phone could still have access to these mobile wallet services -- much like a real wallet. So the best advice is to take advantage of all of the security options you can with the various services by uploading a photo, adding a pin and syncing up to an email account that you check frequently.

Since mobile-payment technology in the United States is still in its infancy, we can expect credit card companies and the mobile payment service will spend the next year or so educating people and working with one another to create better protections to avoid fraud when moving toward convenience -- especially since everyone is expecting Visa to deliver its own proprietary payments system very soon.

Related Companies, Investors, and Entrepreneurs

PayDragon

Startup/Business

Joined Vator on

PayDragon is a mobile shopping app that lets smartphone users order and pay remotely for goods and services. PayDragon translates the convenient one-click shopping experience to the real world by enabling consumers to easily browse, scan, shop and pay for items on the go. Launched by the team behind Paperlinks, a leader in QR code marketing and mobile commerce, the PayDragon app is available for free on iPhone and Android.

PayDragon is headed by CEO and Founder Hamilton Chan.

Related News

Bump allows people to transfer money with a phone tap

PayDragon wants to abolish waiting in line with an app

H&R Block backs mobile payment platform, Wipit

Wallets! Who needs them?

Square wants to replace POS systems with new iPad app