The day when our mobile phone is all we need to leave the house is getting closer

Your wallet is in danger of becoming as obsolete as the pocket watch. With tech companies zoned in on turning your mobile devices into methods of payment, consumers are going to find a lot more value in keeping their smart phones close -- and merchants are clamoring to pick the services that give them the best competitive edge.

Frankly, once public transit, cars and my front door get mobile applications I will be happy to retire my beaten up wallet.

The first strong contender in this race to create the most mobile of payment services was Square, with its finger-pad-sized dongle and complimentary application that allowed vendors and merchants to enter credit card payments using their iPhone or iPad. The concept was quite ingenious and simple. Man small businesses were popping up in farmers' markets, food truck posses and other spontaneous locales that made credit card machines logistically difficult and pricy. Square made collecting a payment as quick and affordable as using a banking app to transfer money.

Anyone could swipe their credit card through a Square dongle for quick payment and receive a receipt in their email inbox once the transaction is complete. Merchants also had no hardware or service payments to make, just a 2.75% fee per transaction.

Then, early this month, Square announced its plans to further disrupt the point-of-sale system for even more retail and restaurants around the globe with the launch of its updated iPad app: Register.

The San Francisco company founded by Twitter's Jack Dorsey first tackled the credit card machine by creating a an iPhone accessory to mobilize, digitalize, and simplify what is needed to complete a credit transaction and now it is expanding its reach by re-thinking the whole POS for businesses.

The new Square Register was unveiled on Sunday evening to extend the credit features to now accept cash payments, lets merchants create list menu items, and tracks the history of customers' purchases.

Currently, nearly 75% of U.S. merchants are in the market for tablets and tablet apps to incorporate into their business and more than half of retailers are gearing up to use a mobile POS device within a year to 18 months, compared with a slim 6% now.

The status quo POS systems are often cumbersome in size and pricing -- many cost in the thousands per year to install and maintain, while Square has the attractive price tag of $0 and just charges a percentage fee based on the number of transactions logged into the system.

Square, which makes its money by collecting transaction fees, has helped merchants process sales for $4 billion worth of goods — double what it announced late last year. More than 1 million people are able to accept credit cards with Square. Their average purchase is $75.

Square has no plans at this time to launch a version of Square Register for Android tablets.

Founded at the tail-end of 2009, Square has veiled exceptional growth year-over-year in the volume of sales transactions. By the close of 2011, the tech startup boasted that it was clocking in $2 billion in sales and now the company says it is processing $4 billion in payments per year.

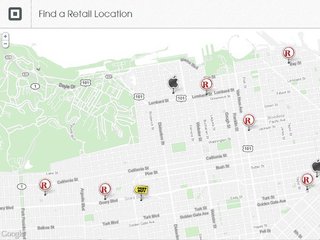

This growth comes after a busy year of growth for the young company. In 2011, Square clocked in 1 million merchants using the mobile payments platform (which equates to one in eight merchants that accept credit cards in the US). In the fall, Square also announced that it was registering $11 million in payments per day (up from $4 million a day in July) and nabbed Sir Richard Branson, Kleiner Perkins, Visa, and other investors that handed over $100 million. Square also inked retail deals with Apple, Wal-mart, Best Buy, Radio Shack, and Target.

This year, Square also added OfficeMax and select UPS Store locations to its list of big business gets and now is eyeing more companies with those traditional POS systems.

More personalization and functionality that comes with the iPad app and completely new UI include better integration with Card Case so that merchants can publish their business’ profile to the Card Case. This will allow customers to find retailers in the Square Card Case directory. The app will also notify merchants when regular customers or new customers arrive at their store using Card Case.

The app also offers functionality so that merchants can customize permissions for employees on the register, giving merchants control and access to specific features, settings, or sensitive information in their sales reports -- all based on levels of security access. The app also interfaces with registers so that merchants can wirelessly print receipts or open a cash drawer to make change.

So just as Square has been chipping away at what the credit card system can be for merchants, it also looks to shake-up the (mostly unchanged) POS system so that smaller merchants and vendors can gain the analytics and convenience without all the upfront and maintenance costs that can dampen any carry-over revenue for small businesses.

New mobile payment apps

PayPal is the first business to really start splashing in the Square pool when the eBay payment arm announced this month that it, too, will provide a phone dongle to help small businesses accept purchases wherever they are.

PayPal unveiled the design of its triangular dongle, which will process mobile payments for small businesses internationally.

The dongle is called PayPal Here and fans out to avoid stress on the audio jack when merchants run credit cards through the system. Also unveiled Thursday was the complimentary app that is similarly designed to the Square app with some of the same features that were recently updated when Square started zoning in on the entire POS process (so that it can account for cash and check payments as well as have designated buttons for item prices).

The PayPal here allows small business owners to show the customer the total, as well as allow customers easy tip-of-the-finger signing.

One feature that is interesting is the ability to scan cards if the dongle is lost or damaged. A merchant can scan the card (or checks) to secure payment. A great way to assure no revenue is lost.

Until now, PayPal has been a leader in the secure online payment market and has only recently set its sights on retail locations such as Home Depot. Square, on the other hand, has jumped out as the leader in mobile payments since its inception in 2010. Square has already processing $4 billion in transactions each year, take 2.75% for transaction fees.

When you sign up to be a part of the PayPal Here system, you will receive a PayPal debit card -- which is central in capturing the lower transaction fees. This card results in a 1% return for purchases made using the card. With that one percent back, PayPal says its transaction fee will be 1.7% (which is 1.05% less than Square, but for customers that don't use the PayPal debit card, the transaction fee is virtually identical).

The PayPal app, called “local,” is a customer loyalty app that helps merchants recognize frequent customers and offer service assistance and deals.

PayPal already has 17 million users using its mobile application, but the loyalty and nubile points go to the young and innovative Square, which has already struck a cord with one-fifth of the credit-card accepting merchants in the US.

But some, less tech-savvy companies may be drawn in by the name-brand comfort that comes with PayPal and the familiarity with the business' end-to-end encryption to and security systems.

The PayPal Here card reader and merchant app for iPhone are both available today exclusively to select merchants in the United States, Canada, Australia and Hong Kong. It will be generally available to more merchants in those select countries next month. The Android version of the PayPal Here merchant app will also be available next month.

Another company that has been gaining traction is a dongle-less mobile app called LevelUp. This mobile payment service allows users to input their credit card information and creates a unique QR code for the user to scan at participating locations.

The company has also built in a loyalty program so that people can receive discounts if they get friends to add the application or they use the service often. The Cambridge, Mass.-based company was founded less than a year ago and has received investments from Google Ventures, Balderton Capital, Highland Capital Partners, Dream It Ventures and the Bantam Group.

Payment apps versus mulitasking apps

While the market for specific mobile payment apps already seems to be booming along with startups and veterans, there are also a couple companies that are trying to add mobile payment services to their existing applications.

Two of the most resent and discussed are the London-based Hailo taxi application and the information sharing app Bump.

Hailo is making waves by creating a mobile network that matches passengers and licensed taxi drivers to help keep people from being stranded on deserted streets and keep taxi drivers busy. Some people might be familiar with the growingly popular mobile service Uber that has a similar set-up, but with the less-wallet conscious black car services.

The Hailo Driver Network can be accessed via iPhone or Android apps and allow drivers to accept credit cards and factor in tipping options.

The app has already been downloaded nearly 200,000 times. The company was founded by three London cab drivers and three entrepreneurs in back November 2010 and is looking to use this latest round of funding to bring its service to America, and continue to build out the network in London and Dublin.

The network aspect of the app also allows drivers to access traffic issues, messages other drivers about where usage is light or heavy, add airport information and and several other social elements.

For those in need of a taxi, the app will tell you how close the nearest drivers are to your location, and you can then request a pickup. When the driver is nearing arrival, the app will ping you that your driver is close to your location and you can even rate drivers and see previous comments about their service.

Unlike the confusing demand-based prices connected to Uber, users are charged based on what the taxi’s meter reads for the trip. With Hailo, you enter your credit card information once and the app will always use this information for payments-- but you have the choice if you wish to pay with cash.

In London, more than 3,200 taxi drivers have already downloaded the app since its launch last November and the company claims that the average pickup time is around 2 minutes.

Hailo can work with any taxi company since it simply sits on top of the meter and allows drivers who don’t pickup fares via the Hailo app to input a charge manually through the app for a credit card payment.

Hailo created revenue by taking a percentage of each fare that is processed via its pickup app. This is really changing how commerce can progress since so many businesses are trying to break into the mobile market with their own apps designed for easy search and purchasing.

Bump, on the other hand, seems to go be focused more on a friend or business environment where people are sharing expenses and may owe one another money for a dinner or vacation rental. The iOS app allows users to transfer money via PayPal to anyone in arm’s reach.

So no more need to write your friends a check or scramble to look for cash when splitting the bill at a restaurant, just bump phones and its all even. It seems simple enough that even tech luddites could figure that one out. But there are a few disadvantages to this method. One, you have to all have iPhones -- not a big issue is San Francisco, but definitely a factor elsewhere. And, you also have to be in arms reach of the person -- so no pinging a friend the payment you owe them when they are at their office and you are at yours.

This is just the latest development out go the Bump Labs, Bump‘s experimental wing of app inventions. The company is currently releasing this app as a separate entity from their business card and info sharing app that has been installed 84 million times, to see if the idea gains traction.

For tapping payments, all you have to do is connect your PayPal account ahead of time, then enter the amount you want to pay, bump your iOS device against a friend’s, and confirm the payment. Bonus -- as long you use a checking account connected to your PayPal, there’s no fee for the transfer. If you use a credit card in your PayPal account there is a fee, much like PayPal's mobile wallet and Square's mobile payment systems.

The four-year-old company with around $20 million in funding, has tried to incorporate more services in its app since 2010, but often drops them to stick with simplicity. In fact, Bump was one of the first companies PayPal looked to for its API but dropped that functionality in favor of opening a window on mobile devices.

Another advantage of this app is that Bump Pay allows users modify how secure they want the app to be. They can choose to enter their PayPal password once and have the app remember it, or they can choose to enter their password every time.

For now, the service only works with PayPal, but the company may explore more payment services to incorporate and will consider adding tools that could help people split bills, add tip and other things that would be handy to keep in app.

Mobile security

With each of the new ways to exchange funds, there is always the concern about security and each company has been working on ways to increase customer confidence in their tools. One of the constants across all the services is the ability to track the payments you have made and accepted within the application so you have a simple history available all of the time.

Another method that many of the services offer is the ability to receive a digital receipt after each transaction into your personal email address. This option clearly keeps people informed of any activity going on with the service and credit card connected to it.

Some of the companies, such as LevelUp, also offer a pin code option so that each time you are about to complete a transaction, you have to enter a unique pin to insure that someone can't just use your phone for fraudulent purchases.

And Square's new Pay with Square app also has people build profiles that include a the photo and name of the person who owns the account to give another level of security.

But, of course, none of these are fool-proof and anyone that steals your phone could still have access to these mobile wallet services -- much like a real wallet. So the best advice is to take advantage of all of the security options you can with the various services by uploading a photo, adding a pin and syncing up to an email account that you check frequently.

Since mobile-payment technology in the United States is still in its infancy, we can expect credit card companies and the mobile payment service will spend the next year or so educating people and working with one another to create better protections to avoid fraud when moving toward convenience -- especially since everyone is expecting Visa to deliver its own proprietary payments system very soon.

I'll start getting a frame ready, since I just don't think I'll be needed my wallet much longer -- and it might just be a collectors item.

Related News

Square squeezes in a new investment from Visa

PayPal launching a dongle to compete with Square?

Find Square card reader with store locator feature

Square kicks it up a notch with hands-free payments

Virgin Group's Richard Branson invests in Square

Square now processing 1M payments a day