Venture capital used to be a cottage industry, with very few investing in tomorrow’s products and services. Oh how times have changed. While there are more startups than ever, there’s also more money chasing them. In this series, we look at the new (or relatively new) VCs in the early stages: seed and Series A.

Prior to joining Emergence, Joe was a Senior Associate in American Capital’s technology group where he focused on investing in fast growing internet and software companies. While at American Capital, Joe was involved with the team’s investments in HomeAway (Nasdaq: AWAY) and PeopleMedia (acquired by IAC). Joe was also an Associate at McKinsey & Co. in their corporate finance practice and a technology investment banker before that.

Joe earned an MBA from The Wharton School of the University of Pennsylvania. While at Wharton, Joe won 1st place at the International Venture Capital Investment Competition. He is also a proud Cal Bear with a BA in Economics and BS in Business Administration from the University of California, Berkeley.

—————

VatorNews: Tell us a bit about your background. What led you to the venture capital world?

Joe Floyd: Venture capital is the perfect combination of my love of investing and my natural curiosity to learn about technology. When I was a kid, my father taught me how to read the WSJ finance section. I kept a journal where I tracked stock prices over time and my parents let me monitor their portfolio. One of the stocks we bought and tracked was Qualcomm. When tech started to take off in the late 90s, I naturally wanted to understand why that stock increased so dramatically in value so I could find more stocks like it. Fast forward 20 years and I’m still doing the exact same thing today—evaluating markets, trends, people and technology to find the right combination that creates magic.

VN: What is your investment philosophy or methodology?

JF: I invest in amazing people. It’s just that simple. I look for five personal qualities in founders:

- Passion – Do they have the intensity and grit that will push them further and faster than the competition?

- Speed – Can they iterate quickly, absorb information, and make quick yet thoughtful decisions?

- Charisma – Do they have that natural sales capability that enables them to recruit employees, customers, and capital to their vision?

- Focus – Can they see myriads of options and yet focus all of their team’s energy on the one or two areas that really matter?

- Flight – Can they accelerate their learning by leveraging their network, books, and other resources to shorten the cycle time on their growth?

VN: What do you like to invest in (categories of interest)?

JF: We invest exclusively in enterprise cloud companies. That focus is what makes us unique and has helped us be successful. If you want to be more specific, we have three core themes:

- Deskless workers – We believe mobile and the Internet of Things (IoT) will have a transformative impact on the 80% of the world’s workforce that does not work at a desk and has not previously had enterprise software.

- Industry cloud – We believe companies that focus on a narrow vertical can build better solutions than a broad horizontal and therefore increase share of wallet, layer the cake by solving multiple problems, and ultimately use focused data to provide insights no horizontal software maker can.

- Coaching networks – We believe enterprise applications infused with artificial intelligence (AI) and machine learning (ML) will enable workers to unlock their potential through the power of coaching networks.

VN: What do you like to invest in (important qualities for companies)?

JF: Great people—the rest takes care of itself.

VN: What kind of traction do you look for in your startups?

JF: Generally speaking, we invest after companies have proven product-market fit and are looking to scale sales and marketing. If you are selling an enterprise product, that can mean five customers plus a growing pipeline. If you are selling to small and medium-sized businesses, that probably means $1 million in annual recurring revenue (ARR) with great metrics.

VN: What would you say are the top investments you have been a part of (and what stood out about them)?

JF: We’ve been very fortunate to be a part of a number of cloud leaders: Salesforce, Veeva, Box, Yammer, ServiceMax, and many others. You are asking me to pick my favorite child! Salesforce was our first investment and that validated our huge bet to focus on the cloud. That investment also spawned an ecosystem of startups and talented people. Veeva is another very special investment as we were able to prove the power of an industry focus.

VN: These days a seed round is yesterday’s Series A, meaning today a company raises a $3M seed and no one blinks. But 10 years ago, $3M was a Series A. So what are the attributes of a seed round vs a Series A round?

JF: To me it comes down to risk. Seed-stage investments take on product-market fit risk while Series A investments take on go-to-market execution risk. Series B takes on scaling risk.

VN: How long does it take between meeting the startup and making the investment? How do you conduct your due diligence?

JF: We like to meet entrepreneurs well before they are actively looking for investment. If someone is in a process, we can go from first meeting to a decision in as fast as 2-3 weeks though I’d say average is 3-4.

VN: What is the size of your current fund? And where is the firm currently in the investing cycle?

JF: $335 million. We are about 1/3 deployed.

VN: What is the investment range? How much do you put into each startup?

JF: $6-10 million is initial check size. We reserve such that we average $15-18 million over the life of an investment.

VN: Is there a typical percent that you want of a round? For instance, do you need to get 20 percent or 30 percent of a round?

JF: We are a focused fund and we lead rounds. This means we target a minimum of 20 percent and oftentimes more depending on stage and risk factors. Our partners are limited to eight boards so every investment matters and we would rather concentrate on fewer investments where we are the most important partner than spread our bets. Entrepreneurs go all in on their company, and we believe VCs should be fully committed as well.

VN: What percentage of your fund is set aside for follow-on capital?

JF: About half.

VN: What series do you typically invest in? Are they typically Seed, Post Seed, or Series A?

JF: Mostly Series A with 2-3 Series B or C’s per fund.

VN: In a typical year how many startups do you invest in?

JF: We aim for 6-8 new investments per year.

VN: What do you like best about being a VC?

JF: Autonomy, mastery, purpose. VC is a craft: you will never be a master, you will always be learning and evolving. I love that I have autonomy over how I spend my time. I love that my job has a purpose—we at Emergence are shaping the future of work. We help workers increase their productivity, realize their potential and achieve their dreams. I love our mission and I know that I will spend the rest of my career improving so I can do a better job for my entrepreneurs, my team and my LPs.

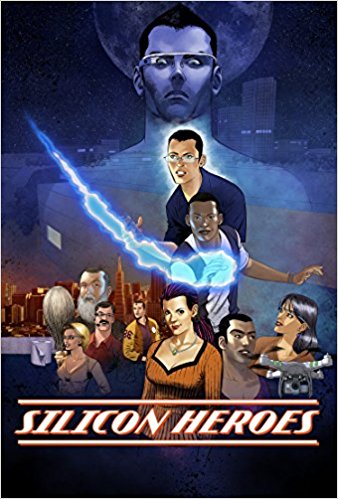

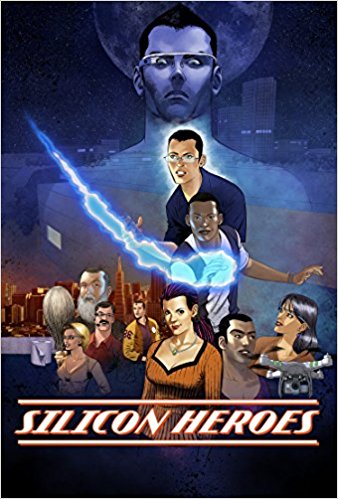

JF: I believe that entrepreneurs are superheroes. They strive to solve the world’s problems. They inspire social change through innovation and improve quality of life with invention. Entrepreneurs perform heroic feats with scarce time and limited resources—against all odds. Yet, most of these heroes toil away in obscurity, hidden away from the media. Instead, young people grow up idolizing the stars of pop culture and social media, which today are musicians, movie stars, and athletes. I want my children to know that there are other heroes in the world: inventors, visionaries, and business leaders. I want my children to look up to these people and know that they can follow similar paths to success by using their hearts and their brains.

So I decided to research the character traits most highly correlated with entrepreneurial success. In order to help share my research with the next generation of entrepreneurs, I weaved my learnings into a graphic novel called Silicon Heroes. In the world of Silicon Heroes, some people possess comic book style superpowers and each power is a metaphor for one of the five characteristics (passion, speed, charisma, focus, and flight) that I referenced earlier. Like all superhero sagas, the themes of Silicon Heroes are universal and it is up to the reader to discover their own meaning and apply it to their life.

My goals for Silicon Heroes are to inspire the next generation of entrepreneurs and to share a little of the magic that makes Silicon Valley special. You can buy the book on Amazon or learn more at www.siliconheroes.com.