DUOS expands AI capabilities to help seniors apply for assistance programs

It will complete and submit forms, and integrate with state benefit systems

Read more...

Openview Venture Partners announced Wednesday that it closed it's larges venture capital funding round ever.

This third round, at $200 million, was initially intended to be around the $150 million mark but was met by increased demand.

Openview has invested in e-commerce software firm ZMags (which works with 3,000 customers including Disney and Express) as well as a data backup software firm Acronis Inc.

OpenView has 18 companies in its portfolio from its first two funds (totalling $240 million). OpenView focuses on investments expansion-stage companies, offering between $2 million and $20 million in funding, and usually focuses on investing in B2B software companies.

Since its inception, the firm has completed more than 100 projects on behalf of these companies, spanning recruiting, market research, product management, agile product development, lead generation, sales team development, and go-to-market strategies and tactics among other areas.

The firm has helped fill dozens of roles across the country for its portfolio companies, including placing more than 50 people in portfolio companies in 2011 alone.

Openview was original created as the Boston arm of New York’s Insight Venture Partners, in 2004, but in 2006 the Boston team decided to become its own firm.

Part of the rationale behind this larger funding round is that the company plans to increase the time period it will use the investments over, thinning three years will be a more suitable dispersal time period than the two years it has used in the past.

Since its founding the firm has invested globally and has approximately $445 million in total capital under management.

Another firm with a strong background in software investment, Emergence Capital, announced last month that it raised a $250 million fund, bringing the total funds under its management to $575 million.

Emergence also invests as low as $1 million, but has a sweet spot of between $3 million to $6 million. The companies that it typically invests in have valuations below $10 million, but can be as high as the high teens in pre-market valuation.

While some firms that focus on consumer technology, such as Andreessen Horowitz, which has invested in Airbnb, Twitter, Digg and Zynga, landed $1.5 billion about six weeks back.

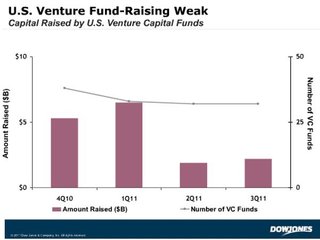

This year seems to be adding up as a rebound in VC fundraising, after last year where the funds were mostly going to early-stage companies rather than expanding established brands. If you're a VC fund focused on early-stage investing, then you probably had a good shot of raising some funds from limited partners in 2011. Still the pace of VC fundraising is slower than the the rate of their investments, raising some concerns that money will eventually dry up.

Venture firms based in the U.S. raised $16.2 billion across 135 funds in 2011, up 5% from a year ago, according to a newly-released report by Dow Jones LP Source. At the same time, however, fewer firms raised funds as the number of firms that raised new funding dropped by 12% last year.

The top five early-stage firms that raised funds include Khosla Ventures, which raised $1 billion in October, Founders Fund, which raised $625 million for early-stage investments, General Catalyst, which raised $500 million, Accel Partners, which raised $475 million and Redpoint Ventures, which attracted $400 million.

It will complete and submit forms, and integrate with state benefit systems

Read more...The bill would require a report on how these industries use AI to valuate homes and underwrite loans

Read more...The artists wrote an open letter accusing OpenAI of misleading and using them

Read more...Angel group/VC

Joined Vator on

The declining cost of IT infrastructure combined with pervasive connectivity has created opportunities for new companies with innovative business models to penetrate large markets and reorder the competitive landscape.

Emergence Capital has been at the forefront of this trend with early investments in SaaS, digital media and mobile services companies and brings deep experience and network resources to its portfolio companies. This focused team oriented approach has led to investments in industry leaders such as Salesforce.com and SuccessFactors. Emergence manages $325 million across two funds and is actively seeking new investment opportunities.