Global AI in healthcare market expected to rise to $164B by 2030

The market size for 2023 was $10.31 billion

Read more...

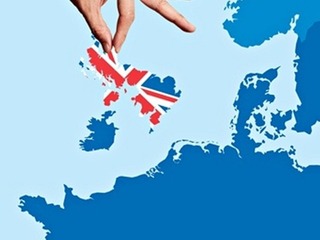

The repercussions from Brexit keep on coming.

Following the United Kingdom's decision to leave the European Union last week, causing the Pound to drop and markets to crash in the process, the country saw its credit rating get downgraded on Monday. S&P Global Ratings lowered the UK's credit rating from AAA from AA, with a "negative" outlook. And, Fitch cut its rating from AA+ to AA+, also with a negative outlook.

None of this can mean anything good for the country's investing ecosystem. In advance of the vote, many investors were already worried about what it would mean to be divorced from mainland Europe, and they really freaked out once the vote actually came down.

Many UK-based investors not only have investments in companies based in other countries within the EU, some of them also have offices there. Pitchbook has identified six UK firms that ate likely to be affected by Brexit, based on how many EU investments they made over the last two years.

Northzone Ventures - offices in London, Stockholm, New York and Oslo.

The firm has made 21 investments in companies based in other EU countries over the last two years, including Distribusion Technologies (Germany), Spotify (Sweden), iZettle (Sweden), Lesara (Germany), Trustpilot (Denmark), and Boomlagoon (Finland).

Index Ventures - offices in London, San Francisco, Geneva, and Jersey.

The firm made 19 investments, including in Menu Next Door (Belgium), Auxmoney (Germany), Armada Interactive (Finland), Pets Deli (Germany), Collibra (Belgium), and Typeform (Spain).

DN Capital - offices in London and Melo Park

Over the last two years, DN Capital made 13 investments in other EU countries, including HomeToGo (Germany), Happn (France), Take Eat Easy (Belgium), and Mister Spex (Germany).

Piton Capital - office in London

In all, Piton Capital has made 11 investments into mainland EU. They include McMakler (Germany), ManoMano (France), Take Eat Easy (Belgium) and docplanner (Poland).

Highland Capital Partners Europe - offices in London and Geneva

Highland also made 11 investments over the last two years, including Outfittery (Germany), Intersec (France), WeTransfer (Netherlands), and Social Point (Spain).

Imprimatur Capital - office in London, Riga and Singapore.

The firm made 10 investments into European Union countries, outside of the UK. They include BranchTrack (Latvia), inSelly (Bulgaria), QS Biodiesel (Hungary) and NeoZeo (Sweden).

Investing in Europe

2015 was a strong year for the startups scenes in both the UK and Europe in general, according to the Global Venture Capital Report - Q4 2015 from CB Insights and KPMG.

In 2015, total venture capital to European startups topped $13 billion in deal value for 2015, growing nearly 60 percent from $8.4 billion in 2014. The number of deals also rose 10 percent to 1,387 in 2015, up from 1,267.

European VC investment dropped slightly during Q4, but every single quarter during the year saw at least $3 billion invested.

Even as capital dipped in Q4, the United Kingdom was able to buck that trend, with the number of investments rising 18 percent to 113, up from 96 the previous quarter, while dollars went up 29 percent to $1.3 billion, up from $1 billion in Q3.

London saw 72 deals, or 64 percent of the total number, and $582.4 million invested, or 44 percent of all dollars that went into U.K. startups.

"The UK continues to have a favorable environment for entrepreneurship, supported by a number of government incentives – especially in the Fin Tech space, where the country wants to develop into a market leader. These incentives could also be having a positive impact on UK VC investment overall," it says in the report.

Since July of 2014, U.K. investors have completed 235 deals in other EU countries, or 11 percent of the total deals made to the area.

(Image source: ecgassociation.eu)

The market size for 2023 was $10.31 billion

Read more...At Culture, Religion & Tech, take II in Miami on October 29, 2024

Read more...The company will use the funding to broaden the scope of its AI, including new administrative tasks

Read more...