On Thursday, a major event is going to happen: the vote on the withdrawal of the United Kingdom from the European Union, also known as Brexit.

If England does decide to leave the EU, that will obviously have big ramifications for countries not just across the continent, but across the world, as it may undermine the entire organization, and the peace between member states that has come out of it over the last few decades.

Remember the last time European countries started invading each other? It was called World War II, and I think we’d all like to avoid that happening again. That’s why both President Obama and Prime Minister David Cameron have both urged for voters to stay in the EU.

So, yeah, there are big things riding on this vote, and there’s a lot to potentially discuss about it. At Vator we focus on tech, so we are going dive into one aspect of the vote: how will it affect investing if England leaves the European Union?

The European investing scene

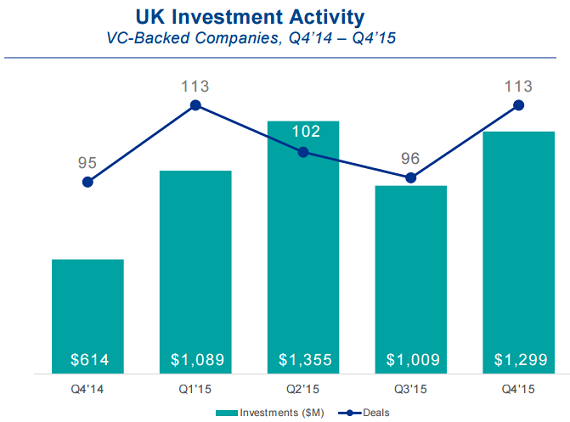

Before getting into how investing would be affected, it’s important to get a sense of the startup scene in Europe, and in London. In both cases, last year was a strong year for their startups scenes, according to the Global Venture Capital Report – Q4 2015 from CB Insights and KPMG.

In 2015, total venture capital to Europeanstartups topped $13 billion in deal value for 2015, growing nearly 60 percent from $8.4 billion in 2014. The number of deals also rose 10 percent to 1,387 in 2015, up from 1,267.

European VC investment dropped slightly during Q4, but every single quarter during the year saw at least $3 billion invested.

Even as capital dipped in Q4, the United Kingdom was able to buck that trend, with the number of investments rising 18 percent to 113, up from 96 the previous quarter, while dollars went up 29 percent to $1.3 billion, up from $1 billion in Q3.

London saw 72 deals, or 64 percent of the total number, and $582.4 million invested, or 44 percent of all dollars that went into U.K. startups.

“The UK continues to have a favorable environment for entrepreneurship, supported by a number of government incentives – especially in the Fin Tech space, where the country wants to develop into a market leader. These incentives could also be having a positive impact on UK VC investment overall,” it says in the report.

These numbers show European and U.K. startup ecosystems going strong, even in the face of a potential downturn, something that may now threatened by the upcoming vote.

How will it affect investing?

When I spoke to investors in England about how they felt about the country leaving the EU, there was a uniforn concensus that it would a bad thing for both startups and investors.

While the U.K., and London in particular, could be called the “Silicon Valley of Europe,” that could change quickly is the country leaves the EU, cut off from potential resources and dealflow.

- “If there is a vote to leave I think it will impact the ability of UK start ups to access funding , particularly from the US. It could also stem the flow of start ups from continental Europe to the UK, because if UK is not in EU they will be outside the single market,” said Simon Walker, a partner in the Corporate Technology group at international law firm Taylor Wessing.

“While the quality of UK based start-ups may not be effected by a vote to leave the EU, US investors might be concerned that the success of a UK based start-up would be hampered if it does not have direct access to a market of 500 million and instead has to contend with trade tariffs.”

- “Brexit would be a bloody disaster for London’s tech scene. There is no upside, as we are already ranked 6th easiest place to do business in the world by the World Bank. There are plenty of downsides, including restricting tech startups access to the EU market, to specialist labour and the paralysing uncertainty for years if we leave and a highly likely recession. So I am for remaining,” said John Spindler, CEO of Capital Enterprise, a not-for-profit membership organisation for those who invest in entrepreneurs in London.

- “The forthcoming UK referendum is a real watershed moment for the UK, both as a nation and as a tech hub. The potential ramifications which a ‘leave’ vote could have on our VC landscape and our vibrant, but nascent, startup landscape are vast. At the very heart of the issue is the fact that a Brexit would fundamentally impinge on the decisions of European entrepreneurs to start up and scale out from London, making it a far less appealing prospect. This coupled with the restrictions our leaving the EU would inevitably place on recruitment from continent’s rich pool of tech talent, mean that from my perspective, we’re certainly stronger together,” said Nic Brisbourne, Managing Partner, Forward Partners, a London-based venture capital firm.

“Over the past few days it seems as though there has been a collective pause as those poised to vote consider the brevity of Brexit. I’m hopeful that voters will see that after a very trying eight years in the wake of the economic downturn, that ushering in any potential shocks to the wider market is extremely risky.”

- “Doing a startup is hard – really hard. I find it hard to understand why any entrepreneur would consider voting for Brexit and effectively taking an isolationist policy when the internet is bringing down barriers around the world and becoming increasingly more competitive. It would be like trying to compete in the Olympics whilst trying to swim with a pair of Wellington boots on,” said Jon Bradford, formerly a Startup Lead at Techstars London.

How will the Brits vote?

Of course, how all of this plays out depends on which way the vote comes down. It seems like it’s going to be close, though there has recently been an increase in support for staying, with 45 percent in favor, and 42 percent wanting to leave. Sadly, that may be a reaction to the murder of British politician Jo Cox, the British Labour Party Member of Parliament for Batley and Spen, by a right-wing political extremist last week.

Each side has a strong reason to either want to stay, or leave, the European Union. In February, searches in the UK for “leave” related EU searches outnumbered “stay” searches by a margin of nearly 5 to 1, according to data from Hitwise, a division of Connexity.

Among searches focused on “EU leave,” the findings suggest concerns and motivations are closely linked to immigration policy, while those who searched for ‘EU stay,” are more concerned about economics.

“The Hitwise data reveals expats’ situations are the biggest concern among people searching for ‘EU Referendum,’ while house prices rank as the main worry among those searching for ‘Brexit,’ suggesting Brits are primarily concerned about their and their family’s living situation after the vote,” said John Fetto, senior analyst at Hitwise.

Every age group is pretty close in their feelings about staying or leaving, though those ages 18 to 24 are a little more likely to want to stay, and those aged 55 and older are a little more likely to want to leave.

(Image source: the-ballot-box.blogspot.com)

(Image source: the-ballot-box.blogspot.com)