Javelin Venture Partners, a five-year-old seed- and early-stage venture firm, is set to announce that it’s raised $125 million for its Javelin Venture Partners Fund III. This just a couple years after raising $105 million for Fund II, and $75 million in 2008, when Jed Katz and Noah Doyle founded the firm.

The Javelin team expects to invest anywhere from $500,000 to as much as $4 million in roughly 20 startups, with some capital reserved for follow-on rounds.

At the same time, Alex Gurevich, who works in Javelin’s Santa Monica, Calif. office, has been promoted to Partner. Gurevich is pictured up top (first person from the right) at a Vator Splash event in LA.

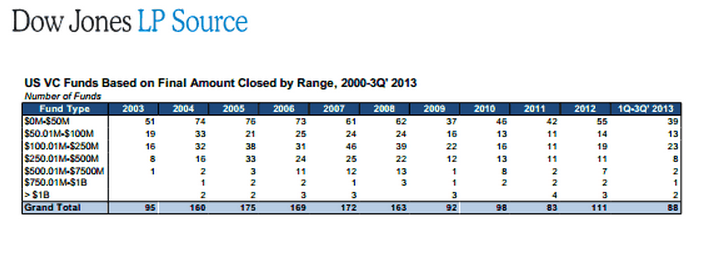

Javelin’s fund close comes at a time when the number of funds raised between $100 million and $250 million is rising. To wit, there have been 23 funds in this size range raised in the first six months of this year. That’s the highest amount since 2008, when 39 funds in this range were raised for the entire year, according to Dow Jones VentureSource.

Javelin Venture Partners III will continue to focus on the same areas of interest. To get a good understanding of what the partners are interested in, you can check out their Vator profiles.

Javelin Venture Partners III will continue to focus on the same areas of interest. To get a good understanding of what the partners are interested in, you can check out their Vator profiles.

Gurevich is interested in big data, business intelligence, mobile and online gaming. He’s active in Telerivet, The Hunt, Thumbtack, Prismatic, Spotsetter, Uncovet, and Engrade.

Doyle (pictured left at a Vator Splash event) is active in 3Scale, Correlated Magnetics, Pixalate, SkyTree and KopoKopo.

Katz (pictured right at a Vator Splash event) is interested in software as a service (Saas), business to business (B2B), business to consumer (B2C), enterprise software, and mobile.

Katz (pictured right at a Vator Splash event) is interested in software as a service (Saas), business to business (B2B), business to consumer (B2C), enterprise software, and mobile.

Javelin has been quite active. Among some companies that stand out include Nexenta, Thumbtack (which won Vator’s first-ever startup competition and event), Skytree, Famo.us, Correlated Magnetics, BoostCTR and Engrade. Some seed-stage investments include Spikes, SmartAsset, and 3Scale.

The average investment is $1.5 million and the average ownership stake Javelin takes in the companies is between 20% and 30%.

Given the groundswell of new money coming into the seed-stages, Katz believes that more and more companies are pitching them when they’re farther along. “Since angel funding has become much more accessible, companies will have probably made it a little further along by the time they pitch us,” said Katz. “So for the good companies, valuations have increased a bit, but still reasonable for both parties.”