I just spent a few weeks in Japan and China on a book tour for the Japanese andChinese versions of the Startup Owners Manual. In these series of 5 posts, I thought I’d share what I learned in China. All the usual caveats apply. I was only in China for a week so this a cursory view.Thanks to Kai-Fu Lee of Innovation Works, David Lin of Microsoft Accelerator, Frank Hawke of the Stanford Center in Beijing, and my publisher China Machine Press.

The previous post described how China built its science and technology infrastructure. This post is about the how the Chinese government engineered technology clusters.

–

The Torch Program

In size, scale and commercial results China’s Torch Program from MOST (the Ministry of Science and Technology) is the most successful entrepreneurial program in the world. Of all the Chinese government programs, the Torch Program is the one program that kick-started Chinese high-tech innovation and startups.

In the last decade Torch managed to break free of China’s state central planning bureaucracies. Of all the Chinese innovation programs, Torch is the one that was run like a startup – iterating and pivoting as it learned and discovered. This enabled Torch to evolve with China’s rapidly global economy.

Torch has four major parts: Innovation Clusters, Technology Business Incubators (TBIs), Seed Funding (Innofund) and Venture Guiding Fund.

Innovation Clusters

Industries have a competitive advantage when related companies cluster in a geographical location. Examples are Hollywood for movies, Milan for fashion, New York for finance and today, Silicon Valley for technology entrepreneurship. The early clusters occurred by happenstance of geography or history. But the theory is that you can artificially create a cluster by concentrating resources, finance and competences to a critical threshold, giving the cluster a decisive sustainable competitive advantage over other places. Israel, Singapore and now China are the three countries that have successfully put that theory into practice.

The Torch program createdInnovation Clusters by creating national Science and Technology Industrial Parks (STIPs), Software Parks, and Productivity Promotion Centers.

The Torch program createdInnovation Clusters by creating national Science and Technology Industrial Parks (STIPs), Software Parks, and Productivity Promotion Centers.

The first Science and Technology Industrial Park was Zhongguancun Science Park in Beijing. It has become China’s Silicon Valley. (This was the area I visited in this trip to China.) In addition to the one in Beijing, China has set up 53 additional industrial parks and in them are ~60,000 companies with 8 million employees. Industry or technology specific versions of these clusters have been set up; for example Donghu in Wuhan – specializing in optoelectronics, Zhangjiang in Shanghai – focusing on integrated circuits and pharmaceuticals, Tianjin – biotech and new energy, Shenzhen – telecommunications and Zhongshan – medical devices and electronics.

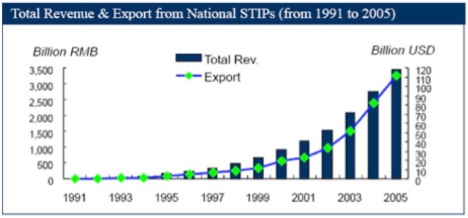

The Science and Technology Industrial Parks contributed 7% of China’s GDP and close to 50% of all of China’s R&D spending.

In addition to the 54 Science and Technology Industrial Parks, the Torch program also set up an additional 32 Torch Program Software Parks.

Another key part of China’s cluster strategy was collaboration between research and business, as well as between large enterprises and tech-based small and medium enterprises. It did so by building a national network of a 1,000+ Productivity Promotion Centers. They provide consulting, promotion, product testing, hiring, training and incubation services to startups.

Technology Business Incubators (TBIs)

While the Innovation Clusters designated specific areas of the countries where high tech was to occur, it’s the Technology Business incubators located inside these clusters where the startup companies physically reside. Much like incubators worldwide, they provide startups with office space, free rent, access to university technology transfer, etc.

By 2011, there were a total of 1034 Technology Business Incubators across China, including 336 as National incubators, hosting nearly 60,000 companies. (20% of the National Incubators were privately-run and their percentage is steadily increasing.) In recent years Business Incubators have developed into diverse models. For example, the Ministry of Education and the Ministry of Science and Technology teamed up to put 45 incubators in universities. There are close to 100 specialized incubators for companies founded by returned overseas Chinese scientists and engineers. There are a dozen sector-specific incubators (a Biomedicine Incubator in Shanghai, Advanced Material Incubator in Beijing, a Marine Technology Incubator in Tianjin, etc.) These incubators are mostly clustered in the eastern coastal regions, and disproportionately target TMT (Technology Media and Telecom) and Biotech.

Some of the startups coming out of these incubators have become large international companies including Lenovo, Huawai, Suntech Power, etc.

Seed Funding (Innofund).

The best analog for China’s InnoFund is the U.S. government’s SBIR and STTRprograms. Set up in 1999, Innofund offers grants ($150 – $250K), loan interest subsidies and equity investment. Innofund is designed to bridge early stage technology companies that have innovative technology and good market potential but are too early for commercial funding (banks or VCs.) Innofund applicants have to be in high-tech R&D, have less than 500 people, at least 30% of the employees have to be technical and the majority of the company owned by Chinese. The ultimate goal of Innofund is to get the startups far enough along in technology and market validation so other sources of financial capital (banks, VC’s, corporate partners) will invest.

Since its establishment, there’s been over 35,000 applications with 9,000 projects approved and close to a $1 billion allocated.

Most Venture Capitalists in China viewed the Innofund the same way most U.S. VC’s treat the SBIR and STTR programs – they never heard of it, or they think it takes too much time to apply for too little money. And with the same complaints; tedious, relationship driven application process, bureaucratic reporting requirements, and outcomes often measured in quantity and not quality. However, for startups who have gotten an Innofund grant, it does provide the same positive cachet as an SBIR andSTTR grant – the government has reviewed your technology and thought it was worthy.

Venture Guiding Fund

In 2007 the Ministries of Science and Finance raised the stakes to get VC’s focused on funneling more VC money into growing startups – they set up a Venture Guiding Fund. The Venture Guiding Fund invests directly into VC funds, co-invests with VC’s, and covers some VC bets. It does this with four programs: 1) A fund of funds, holding < 25% equity in VC firms, requiring only a fixed rate return; 2) the fund will co-invest with other VC firms matching up to 50% of other VC firm’s equity investment or a maximum of $500K; 3) Risk subsidies for VC firms, where the fund will be compensated for the cost and loss of VC firms which have made investments in technology-based startups; and 4) Grants for portfolio reserves, where the fund will provide grants for technology-based startups which are being incubated and coached by VC firms.

Part 3, the next post describes the rise of Chinese venture capital.

Lessons Learned

- The Torch Program is the worlds largest “lets engineer entrepreneurial clusters” experiment

- Torch has four major parts: Clusters, Business Incubators, Seed Funding, and Funds to support Venture Capital firms

- Torch was the rare government program that was run like a startup – iterating and pivoting as it learned and discovered.