PayNearMe, the company that’s giving cash a comeback, is expanding and bringing on a new investor. The company announced Tuesday that it’s launching PayNearMe Express, a new self-service system that will allow any business to sign up to begin accepting cash payments. Additionally, PayNearMe is also announcing a $10 million round of funding led by August Capital, with help from existing investors Khosla Ventures, Maveron, and True Ventures.

To recap, PayNearMe is a cash payment platform that allows consumers to make transactions online and pay in cash at their local 7-Eleven or ACE Cash Express store. A number of high profile companies accept cash payments through PayNearMe, including Amazon, Progreso Financiero, Westlake Financial Services, and Greyhound, among others.

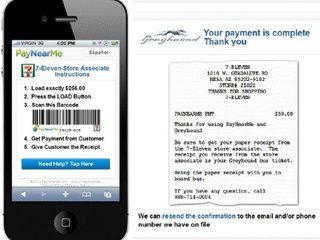

The new PayNearMe Express allows any business, large or small, to sign up to accept cash payments through PayNearMe. The merchant can sign up and direct customers to PayNearMe.com, where they can print out a barcode to take to their local 7-Eleven or ACE. There, they can pay in cash to complete the transaction.

“As we’ve been out signing up merchants who wanted to be paid with cash, we kept hearing from smaller businesses who wanted to use PayNearMe, but didn’t have any IT resources, of if they did have them, they were tapped out,” said PayNearMe founder and CEO Danny Shader. “PayNearMe Express, because it does not have any IT requirements, expands the number of merchants who could take advantage of cash payment network from hundreds to tens of thousands.”

Business is booming. Shader says that PayNearMe volume was up 325% in 2012 compared to 2011.

PayNearMe was in the news back in October when it paired up with property management software company AppFolio to allow renters to pay their rent online using cash. Like PayNearMe’s cash-payment solutions for online shopping and loan repayment, renters living in a unit managed by AppFolio’s software can simply make their transaction online, at which point they’ll get a special barcode, which they can print out or receive on their mobile device.

Shader told me in October that more than 30% of PayNearMe users are using the service from a mobile device.

“PayNearMe excels at doing what no one else in the payments landscape has attempted – innovating with cash,” said David Hornik, general partner at August Capital and PayNearMe board member, in a statement. “We enthusiastically support the PayNearMe team as they scale and continue to help the millions of Americans who are unbanked or underbanked plus those who simply prefer to pay with cash.”

Indeed, 24% of U.S. households don’t have a debit or credit card, and 89.2% of underbanked households have used an alternative financial service. And then there’s the 54% of U.S. adults who say that cash is just their preferred method of payment.

Shader says the company plans on using the funds for: “driving business through our three channels: direct to large accounts; indirect through partners we’ve been signing who augment their plastic and ACH payment capabilities to include cash through us; and self-service through PayNearMe Express.”