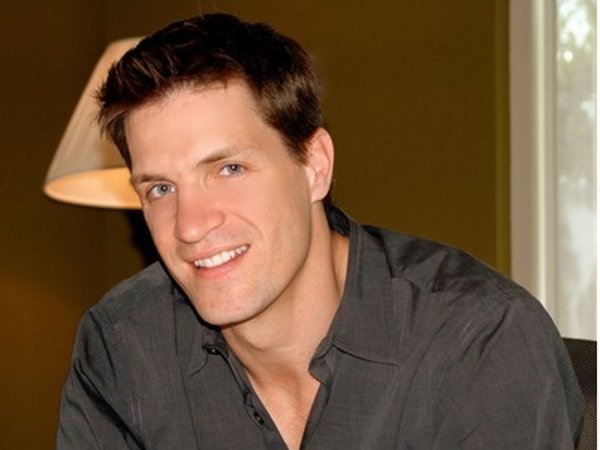

Vator Splash tends to follow a tried-and-true formula: Keynote, presenter pitches, keynote, presenter pitches, and VC panel, with some booze thrown in to spice things up (how did anyone ever give a pitch sober?). But this time, we took a slightly different route. In addition to a drinking game introduced by MC Ezra Roizen that’s bound to become tradition (drink when you hear the word “freemium”), one of the keynotes, Shawn Colo, did not deliver a speech, but rather sat down with Bambi on stage for a little tete-a-tete.

Vator Splash tends to follow a tried-and-true formula: Keynote, presenter pitches, keynote, presenter pitches, and VC panel, with some booze thrown in to spice things up (how did anyone ever give a pitch sober?). But this time, we took a slightly different route. In addition to a drinking game introduced by MC Ezra Roizen that’s bound to become tradition (drink when you hear the word “freemium”), one of the keynotes, Shawn Colo, did not deliver a speech, but rather sat down with Bambi on stage for a little tete-a-tete.

Following a brief introduction by investor John Hawkins from Generation Partners (who actually introduced Shawn Colo and fellow Demand Media co-founder Richard Rosenblat), Bambi and Shawn took the stage, and here is what they chatted about.

BF: Shawn is a first-time entrepreneur, have you ever said–‘man, I’m really good at this?’

SC: Private equity guys should think of themselves as entrepreneurs. I took an idea I knew was big enough and partnered with the right guys to ensure success.

BF: Back when this idea was just in your head, before it took off in 2006, what was your thesis about media?

SC: There were a couple of themes: the emergence of new monetization platforms. When Google went big, I was focused on the monetization. It became clear that in the future, you weren’t going to go to a portal to get information, you were going to get it from a friend. I knew it was a multibillion dollar opportunity…I spent some time with Spectrum and got an idea for the European market. I couldn’t see any real barriers to it and I just continued to test that thesis by asking smart people what they thought about it. The mistake that entrepreneurs make sometimes is that they take their idea and hold onto it and don’t want to tell anyone about it because they’re worried they’ll steal it, and I remember thinking that, but then I said screw it, I had to ask people about it.

BF: What were some of teh assumptions you had about the media industry that in hindsight were way off?

DC: I thought the way branded ad sales were handled five years ago weren’t going to be going five years later. I thought, in five years this thing will be so efficient and so well-targeted that brand…. In the life cycle in any company you’re going to face challenges and decision points. IN the teeth of the recession, when we had started the company, we had a user-generated content model. The eHow model saw some success, some traction, but we didn’t get quality content, we knew we had to scale the platform to get the price point we needed.

BF: What about a decision that went wrong?

SC: When you make a mistake and you learn from it, that’s a good thing. There have been a number of acquisitions that we made…one in particular, I thought we could be both a B2C publishing business and a B2B publishing business. We did a couple of things in the aviation market place that turned out to be…they didn’t work out. We’ve got such a great team…we had a good solid vision to build something in the casual games business, but then we realized that market was moving so fast we just wouldn’t be able to compete.

BF: You started in private equity. Before you made the decision to become an entrepreneur, did you have doubts before you made that transition?

SC: Yeah, I had been with a great firm for ten years and it was growing and I was evolving there. I tried to structure it so that I took out as much risk as possible. I made it so that we knew that we weren’t going to run out of money in six months.

BF: What would your advice be to the entrepreneurs out here to leave their cushy job?

SC: It’s not easy. You have to have a good partner with a complementary skill set–if you’re on your own it’ll be harder. Do that downside scenario planning. If this thing fails and I’ve put in two or three years, how will I feel about that compared to the trajectory I would’ve taken if I’d stuck with my cushy job?

BF: Who’s been your mentor?

SC: Um…I think I’ve been pretty fortunate to have a lot of mentors. I really respect the guys at Spectrum, they have a great track record as investors. They lead by example. They’ve been great. Richard Rosenblat too–Richard is a guy whose had a lot of success, and part of that success if just being so aggressive–so quick to make decisions. He doesn’t over-analyze things, he reads things and makes a quick decision.

BF: Are you the analytical one?

SC: Yeah, if you make a mistake in the private equity business you’re going to get in big, big trouble. I can’t afford to take a zero, and you’re going to put a lot of time into a deal. You’d rather miss a great deal than do a bad one.

BF: A lot has changed since 2005. There’s a lot more access to capital…how is it different starting a company today than when you started?

SC: The platforms…I think it’s both a blessing and a curse. There are companies like Tweetdeck, those platforms are new, people are looking for innovation. You can claim some territory in those markets pretty quickly. But Facebook could change its mind and then your business is screwed. We built our platform on Google and we knew the rev share mechanism and we felt like it was predictable at the time.

BF: We’re in LA now, are there any differences in starting your business in LA than Silicon Valley?

SC: I lived in the valley for a number of years. i think one consistent thing to me is that LA companies tend to make money right away, they tend to get profitable quickly, which…I think is a good thing.

BF: Why is that?

SC: I think there’s more of a hustler culture here. People want to make money.

BF: Is there not as much access to capital here?

SC: I think…people are just more focused on making money here.

BF: I want to talk a little bit more about distribution. You started Demand with distribution in mind. How would you advise a company here that’s relying on a distribution platform like Facebook?

SC: When I think about the media business in general pre-2005, when you think about the distribution mechanisms…cable, radio…those are different distribution mediums. The distribution and consumption experience is the same. You differentiate yourself with content. But with the Internet, the product experience is more important than the actual content. As a media company in this era, I can’t even imagine a business that doesn’t think about content creation and distribution at the same time. This is a big mistake the traditional media companies make: They thought they’d take their content and just refashion it and put it on the Internet. But now what you see are companies who design their content with Internet users in mind.

BF: How has the media experience changed in the last five years and where is it going?

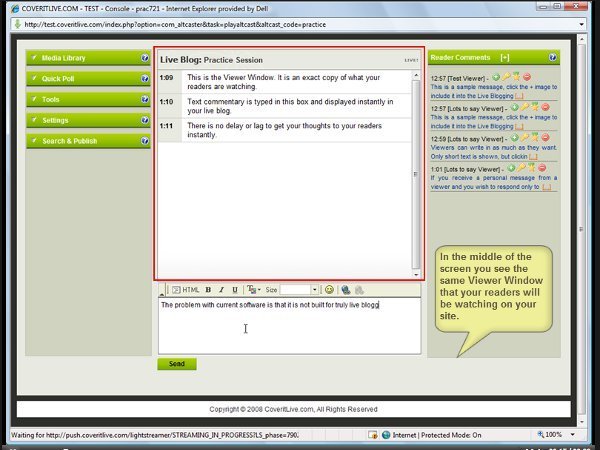

SC: There’s been a lot more action in video. One of our acquisitions, CoveritLive, is just killing it, and what we have to figure out is how to take that company and turn it into a video experience.

BF: What are some of the hot trends you’re seeing in the LA area?

SC: People make a lot of noise about the Facebook platform, but not a lot of people talk about YouTube as a social platform. The LA community is well positioned to capitalize on that.

BF: Now we’re going to wrap it up with a little word association game.

Entrepreneur: Gutsy

Venture capitalist: rich

Media: cool

Google: rich

IPO: fun

Vator Splash: awesome