Fast forward to today. The words “startup,” “entrepreneur,” and “innovation” are used fast, loose and furious by both parties in Washington. Last week the White House announced Startup America, a public/private initiative to accelerate accelerate high-growth entrepreneurship in the U.S. by expanding startups access to capital (with two $1 billion programs); creating a national network of entrepreneurship education, commercializing federally-funded research and development programs and getting rid of tax and paperwork barriers for startups.

What’s not to like?

My observation. Startup America is a mashup of very smart programs by very smart people but not a strategy. It made for a great photo op, press announcement and impassioned speeches. (Heck, who wouldn’t go to the White House if the President called.) It engaged the best and the brightest who all bring enormous energy and talent to offer the country. The technorati were effusive in their praise.

I hope it succeeds. But I predict despite all of Washingtons’ good intentions, it’s dead on arrival.

Dead on arrival

I got a call from a recruiter looking for a CEO for the Startup America Partnership. Looking at the job spec reminded me what it would be like to lead the official rules committee for the Union of Anarchists.

There are three problems. First, an entrepreneurship initiative needs to be an integral part of both a coherent economic policy and a national innovation policy – one that creates jobs for Main Street versus Wall Street. It should address not only the creation of new jobs, but also the continued hemorrhaging of jobs and entire strategic industries offshore.

Second, trying to create Startup America without understanding and articulating the distinctions among the four types of entrepreneurship (described later) means we have no roadmap of where to place the bets on job growth, innovation, legislation and incentives.

Third, the notion of a public/private partnership without giving entrepreneurs a seat at the policy table inside the White House is like telling the passengers they can fly the plane from their seats. It has zero authority, budget or influence. It’s the national cheerleader for startups.

The four types of entrepreneurship

“Startup,” “entrepreneur,” and “innovation” now means everything to everyone. Which means in the end they mean nothing. There doesn’t seem to be a coherent policy distinction between small business startups, scalable startups, corporations dealing with disruptive innovation and social entrepreneurs. The words “startup,” “entrepreneur,” and “innovation” mean different things in Silicon Valley, Main Street, Corporate America and Non Profits. Unless the people who actually make policy (rather than the great people who advise them) understand the difference, and can communicate them clearly, the chance of any of the Startup America policies having a substantive effect on innovation, jobs or the gross domestic product is low.

1. Small business entrepreneurship

Today, the overwhelming number of entrepreneurs and startups in the United States are still small businesses. There are 5.7 million small businesses in the U.S. They make up 99.7% of all companies and employ 50% of all non-governmental workers.

Small businesses are grocery stores, hairdressers, consultants, travel agents, internet commerce storefronts, carpenters, plumbers, electricians, etc. They are anyone who runs his/her own business. They hire local employees or family. Most are barely profitable. Their definition of success is to feed the family and make a profit, not to take over an industry or build a $100 million business. As they can’t provide the scale to attract venture capital, they fund their businesses via friends/family or small business loans.

2. Scalable startup entrepreneurship

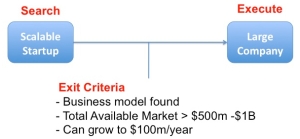

Unlike small businesses, scalable startups are what Silicon Valley entrepreneurs and their venture investors do. These entrepreneurs start a company knowing from day one that their vision could change the world. They attract investment from equally crazy financial investors – venture capitalists. They hire the best and the brightest. Their job is to search for a repeatable and scalable business model. When they find it, their focus on scale requires even more venture capital to fuel rapid expansion.

Scalable startups in innovation clusters (Silicon Valley, Shanghai, New York, Bangalore, Israel, etc.) make up a small percentage of entrepreneurs and startups but because of the outsize returns, attract almost all the risk capital (and press.) Startup America was focussed on this segment of startups.

3. Large company entrepreneurship

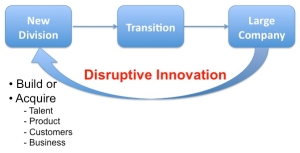

Large companies have finite life cycles. Most grow through sustaining innovation, offering new products that are variants around their core products. Changes in customer tastes, new technologies, legislation, new competitors, etc. can create pressure for more disruptive innovation – requiring large companies to create entirely new products sold into new customers in new markets. Existing companies do this by either acquiring innovative companies or attempting to build a disruptive product inside. Ironically, large company size and culture make disruptive innovation extremely difficult to execute.

4. Social entrepreneurship

Social entrepreneurs are innovators focus on creating products and services that solve social needs and problems. But unlike scalable startups their goal is to make the world a better place, not to take market share or to create to wealth for the founders. They may be nonprofit, for-profit, or hybrid.

So what?

Each of these four very different business segments require very different educational tools, economic incentives (tax breaks, paperwork/regulation reduction, incentives), etc. Yet as different as they are, understanding them together is what makes the difference between a jobs and innovation strategy and a disconnected set of tactics.

Go take a look at any of the government organizations talking about entrepreneurshipand see how many of its leaders or staff actually started a company or a venture firm.Or had to make a payroll with no money in the bank. We’re trying to kick-start a national initiative on startups, entrepreneurs and innovation with academics, economists and large company executives. Great for policy papers, but probably not optimal for making change.

Rather than having our best and the brightest visit for a day, what we need sitting in the White House (and on both sides of the aisle in Congress) are people who actually have started, built and grown companies and/or venture firms. (If we’re serious about this stuff we should have some headcount equivalence to the influence bankers have.)

Next time the talent shows up for a Startup America initiative, they ought to be getting offices, not sound bites.

Lessons Learned

- Lots of credit in trying to “talk-the-talk” of startups

- No evidence that Washington yet understands the types of entrepreneurs and startups; how they differ, and how they can form a cohesive and integrated jobs and innovation strategy

- Not much will happen until entrepreneurs and VC’s have a seat at the table