Airbnb raised $1.5B; Velocity raised $12M; Airtable scored $7.6M

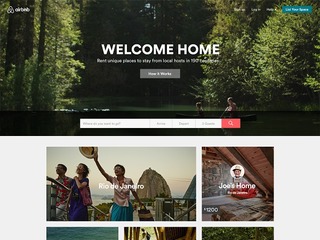

- Airbnb, a home-rental company, raised an $1.5 billion funding round, the Wall Street Journal reported. It was led by General Atlantic Inc., Hillhouse Capital Group of China and investment firm Tiger Global Management, which are collectively buying about a third of the shares allocated for the round. Singapore’s Temasek Holdings, Kleiner Perkins Caufield & Byers, GGV Capital, China Broadband Capital and Horizon Ventures also participated in the round. And, finally, a sign that that we might be getting an Airbnb IPO in the near future: several public “crossover” investment funds that the Journal says "are taking stakes in private companies ahead of initial public offerings." That included mutual-fund firms Wellington Management and Baillie Gifford who bought in the company, while T. Rowe Price Group Inc. and Fidelity Investments increased their stakes. With the funding, Airbnb's new valuation is now $25.5 billion.

- Airtable, a company responsible for making databases so easy to use that the average person can start to use them, and affordable as well, scored $7.6 million in Series A funding. The round was led by CRV with participation from Brennan O'Donnell, VP Sales & Customer Success at SurveyMonkey; Ilya Sukhar, Founder of Parse and Director of Product Management at Facebook; Joshua Reeves, CEO & Co-Founder at ZenPayroll; Kevin Mahaffey, Co-Founder and CTO at Lookout; and Othman Laraki, Co-founder of Color Genomics). Funding also came from existing seed investors Freestyle Capital, Caffeinated Capital, DCVC, Crunchfund, and Founder Collective, among others.

- Estonian mobility company coModule has secured €500,000 in capital for its seed round from renowned German investor High-Tech Gruenderfonds (HTGF) to bring mobile connectivity, data analytics and Internet of Things to the world of electric vehicles. The “Android of light electric vehicles” coModule has developed a hardware and software platform for Light Electric Vehicles (LEVs). The hardware monitors vehicle and environmental metrics and sends the data directly to the end user’s smartphone. The mobile app then visualises the available range, helping to eliminate range anxiety. Data on the vehicle is also sent to the manufacturer of the LEV who can then make better product development decisions and utilize the direct communication with the end user.

- Courier startup Zoom2u has closed an $850,000 funding round that will be used to fund its growth throughout Australia. The funding round was co-led by Temando non-executive director and Ellerston Capital advisory board member Anthony Klok, who will join Zoom2u’s board. Gandel Invest founder Tony Gandel also participated in the round. Zoom2u’s on-demand courier service allows businesses and individuals to book same-day or overnight deliveries. Its mobile app allows customers to track their couriers in real time. Launched in September last year, Zoom2u is available in Sydney, Melbourne, Brisbane and Adelaide. In its first month the startup booked 250 deliveries, increasing to 1000 in December. It’s now doing 2000 deliveries per month and earning $60,000 in monthly revenue. It has its own fleet of couriers and its smartphone app allows Zoom2u to easily on-board new couriers as the startup grows.

- Mumbai-based financial services firm MyCFO has raised nearly $1.5 million from the Sameer Koticha, promoter of the ASK Group, a 3-decade-old investment advise firm based in Mumbai.

Sources close to the development told ET that a definitive agreement for the deal has been signed, adding that the stake taken by Koticha is substantial.

- Mobile marketplace for beauty services, Stayglad has raised angel funding for an undisclosed amount from Sahil Barua (Delhivery) and Tracxn labs. stayglad Stayglad is a platform that enables customers to get beauty, styling and ‘get ready’ services at their doorstep. Stayglad can help customers find verified, trained, experienced and certified beauty service professionals who will use best products and standardized procedures.

- Blue Medora, a Grand Rapids, Michigan-based provider of cloud systems management platform, landed $4.6 million in Series A venture capital funding. The round was led by Ann Arbor-based Michigan eLab, with participation from current investors Start Garden, Grand Angels and other equity holders. In conjunction with the funding, Michigan eLab’s Doug Neal will join Blue Medora’s Board of Directors. The company, which has raised $6 million in total funding, intends to use the funds to grow engineering, sales and marketing teams.

- Drippler, a Tel Aviv, Israel-based provider of personalized recommendations on apps, features, and accessories, raised $4.5 million in Series A funding. The round was led by Titanium Investments with participation from TMT Investments, iAngels, Reuven Agassi, Yanki Margalit, David Assia and Christian Gaiser. The company intends to use the funds to further develop its technology and data offerings, as well as building its team in its Tel Aviv headquarters and newly opened San Francisco office.

- UrbanClap, a mobile-based services marketplace, secured $10 million in funding from its existing investors SAIF Partners and Accel Partners. The Gurgaon-based startup plans to invest the funds to scale up its operations across the country, strengthen its technology, and grow its 100-member team to 500-plus.

- Velocity, a London, UK-based lifestyle app, raised $12 million in Series A funding. Backers included former Thomson-Reuters CEO and Chair of Morgan Stanley’s Technology Committee, Tom Glocer, and Initial Capital Partner, Shukri Shammas, with Chrystal Capital sole book runners. The company intends to use the funds for international expansion.

- Onefinestay – which lets you rent out private luxury homes – announced a $40 million funding round, as competition in the hospitality space continues to heat up. The money, which the British start-up said would be spent on training, technology and global expansion, takes its total funding to $80 million. Intel Capital was one of the investors in the round, which also included Hyatt Hotels -- despite onefinestay being a competitor to major hotel chains.

If you are interested in being included in our funding roundup, submit your press release or blog post about your financing round to mitos@vator.tv.

Image Source: practiceprocedure.com