How does Course Hero make money?

The company offers a freemium model, where users can pay to access more content and ask questions

Read more...

Square may or may not be entertaining the thought of an IPO this year. The rumors have been making their rounds—supposedly of talks with banks, like Goldman Sachs and Morgan Stanley. And Square hired former Salesforce.com exec Sarah Friar as its new CFO last year.

The company is on track to generate $1 billion in sales this year from the $30-or-so billion in transactions it expects to process, according to a report from the Wall Street Journal. In 2013, the company reportedly generated $550 million from the $20 billion in transactions it processed. However, some 70-80% of that revenue gets funneled back to credit card companies, so Square’s revenue was more likely in the range of $110-165 million.

While the company has admitted that it’s not profitable, CEO Jack Dorsey is rumored to be brewing a new strategy that will quickly move the company to profitability.

In the meantime, how exactly does Square make money?

Let’s start with the processing fees. Square charges 2.75% per swipe, or 3.5% plus 15 cents per manually entered transactions. So if you swipe a card for $100, you’ll get $97.25 out of the whole shebang.

Now, that 2.75% fee isn’t straight profit for Square. Square is an aggregator, not a credit card processor. A company called Paymentech processes transactions for Square and J.P. Morgan Chase is Square’s acquiring bank. That means Square has to pay interchange fees that banks charge (the fee charged for money transferred from an acquiring bank to the issuing bank) and the assessments that major credit card companies charge. Interchange fees and assessments are identical across all processors and no processor can charge a lower rate than another.

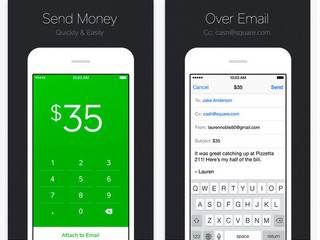

BUT, debit cards come with lower transaction fees. Square still charges merchants 2.75%, but keeps the savings for itself. This may be the driving force behind Square Cash, the company’s recently announced peer-to-peer payment service. Square Cash is free, and users need only send a friend an email to the person they want to pay CCing Square and including the amount. Square will then email you to ask for your debit card, no Square account needed.

Square had, at one time, offered the option of paying a flat rate of $275 a month for companies processing less than $250,000 a year, but Square discontinued this option in November.

Square charges the same 2.75% transaction fees on online transactions via the Square Market. Brilliant. While you’re waiting for everyone to catch on to the Square reader, why not just sell shit yourself? The Square Market is fairly broad—it’s not a niche marketplace, so you’ll find everything from coffee beans to handmade soap and throw pillows. What it does drill down on is local merchants and artisans, so it’s reminiscent of Etsy in its focus on small makers and merchants.

Square also generates revenue on its hardware sales. Naturally, there’s the Square card reader—the dongle you plug into your smartphone or tablet (I really, truly love merchants at the farmer’s market when they use Square). Those retail for $9.99, so they probably break even on cost of production.

But then there’s the Square Stand, a combination reader/register stand, which runs $99. Square recently announced that Square Stand is now available in over 1,000 Staples locations (there was even a promotion in which customers who bought a Square Stand at a Staples location during November 2013 would get a Staples gift card worth $200).

So what’s up Jack Dorsey’s sleeve? If the rumors hold true, we’ll be seeing a new money-making Square strategy soon.

The company offers a freemium model, where users can pay to access more content and ask questions

Read more...The company sells a premium version of its free product to parents, schools and districts

Read more...Initially a platform for renting textbooks, it now makes 90% of revenue from software subscriptiions

Read more...