Which sectors won, and which ones lost, during the pandemic

While food delivery and telemedicine gained, ride-sharing and co-working saw big drops

With 2020 finally almost behind us (FINALLY!) we can begin to look back and take stock of what happened and how things shook out.

Every single aspect of our lives was upended over the past 12 months, from the way we see our doctors to how we work to how we view education, and, frankly, some sectors were simply in a better spot than others to take advantage of that change. Telemedicine companies and food delivery soared as people turned to companies that would allow them to continue to live their lives from the comfort and safety of their own homes. Conversely, ride-sharing and co-working spaces took big hits as people suddenly had nowhere to go, and no desire to see anyone in person.

Of course, the long-term effects of 2020 will not be felt for months, or even perhaps years. There's no way to know which of these new behaviors are going to be permanent and which will be quickly abandoned once we get back to some semblance of normalcy. For now, though, these are the spaces that won, and the ones that lost, during the pandemic:

Winner: telemedicine

The clear winner of 2020, and the space that suddenly saw itself become the center of the conversation, was telemedicine. These services, which has been widely available but underused, with only eight percent of patients having tried it by last year, growing so quickly that it is now estimated that 20 percent of all medical visits this year will be done through telehealth.

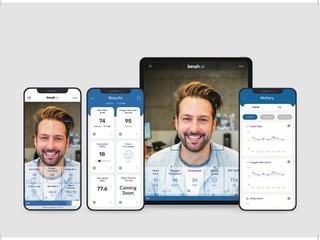

The space, unsurprisingly, also saw a huge increase in investments, with dollars into this sector going from $1.6 billion to $2.8 billion, a 72 percent increase from Q2. Year-over-year, the amount invested nearly doubled. Companies like Amwell, MDLive, Carbon Health, Eko Health, and Binah.ai, just to name a few, all raised funding this year. Amwell also went public, raising $742 million at a $3.69 billion valuation.

The big question going forward is how sustainable this all is. Now that people have tasted telemedicine, will they like it so much they want to keep it? Or will they want to go back to the old way of doing things, such as traveling to see their doctor in person, once the pandemic ends? The reality will likely fall somewhere in between, where telemedicine numbers go down but still remain higher than they were pre-pandemic.

Loser: ride-sharing

Even before the pandemic, things were looking so rosy for Uber and Lyft. Both companies went public in 2019, and both were considered disappointments, with each of their stocks ending the year down roughly 40 percent. Once COVID hit, though, with people being essentially locked inside with nowhere to go, things got really bad.

For Uber, the company's grossing booking went from $15.8 billion in Q1 to $10.2 billion in Q2, a 35 percent decrease from the year prior. Lyft, meanwhile, got hit much harder: it reported Q1 revenue of $955.7 million which then fell to $339.3 million in Q2, down 61 percent year-over-year and roughly a third of what it had been just a quarter before.

It's not all doom and gloom though, as Q3 saw a bit of a bounce back for both companies: in Q3, Uber's gross bookings were $14.7 billion, still down 10 percent year-over-year but up 44 percent from Q2. Lyft's Q3 revenue was $499.7 million, a decrease of 48 percent year-over-year, but an increase of 47 percent from Q2. Plus, while both Uber and Lyft saw their stocks drop earlier in the year, to a close of $14.82 for Uber and $16.05 for Lyft in March, both stocks have rebounded and are now up for the year 73 percent and 13 percent, respectively.

Winner: food delivery

So what saved Uber, and allowed it to recover faster than Lyft? Uber Eats, its food delivery service, a space that thrived as people were forced to stay home: in the second and third quarter, the four biggest food-delivery apps, which also includes Doordash, GrubHub and Postmates, saw their revenue rise a collective $3 billion.

To wit, even as Uber's overall revenue declined throughout the year, the amount it was making from Eats was rising, going from $3.4 million in Q2 2019 to $6.9 million in Q2 2020, a 106 percent increase; at the same time, Uber's ride-sharing revenue dropped 73 percent. In Q3, delivery revenue jumped 191 percent year-to-year, while ride-sharing segment fell 51 percent in the same time frame. GrubHub, meanwhile, grew from $363 million in revenue in Q1 to $459 million in Q2, a 26 percent increase, then to and $494 million in Q3, a 53 percent year-to-year increase.

Doordash made $1.9 billion in the first nine months of 2020, more than double the $885 million it made in all of 2019. The company leveraged that into an IPO earlier this month, in which it raised $3.4 billion at a $39 billion valuation, making it the seventh largest tech IPO ever. It's difficult to see that happening in a pre-COVID world.

Loser: co-working spaces

Perhaps no part of life was disrupted more for most people than how they work. In February just under 3.5 percent of the population worked from home, a number that has now shot up to more than 50 percent of workers in the U.S. As such, those companies that had predicated their model on shaking up the workspace, and giving people more ways to collaborate in-person, were hit especially hard.

WeWork, for example, saw its revenue grow 45 percent in Q2; while that might sound like solid growth, it was actually down significantly from past gains, in which the company routinely doubled its revenue. By Q2, the company's revenue had declined by 8 percent year-to-year and it spent $500 million in cash in Q3 as sales fell 13 per cent and its membership based dropped 11 percent.

Most troublingly, a report from June predicted that the global co-working spaces market would decline roughly 12 percent, from $9.27 billion in 2019 to $8.24 billion in 2020.

Conversely, the company that won work collaboration in 2020 was Zoom, as it allowed people to continue to collaborate with each other without risking infection by meeting face-to-face. That company grew from $328.2 million in revenue in Q1 to $663.5 million in Q2 to $777.2 million in Q3. Seems like so-called "Zoom fatigue" hasn't hurt the company yet.

Winner: education

While adults had to learn to do their work from home, kids had it equally tough, needing to transition to remote learning.

As such, global venture funding for edtech companies hit $4.1 billion in the first half of 2020, an increase of $1.5 billion from the same time in 2019; that included $706 million in the U.S. Some of the companies that raised funding include Roblox, which raised $150 million; Coursera, which raised $130 million; CampusLogic, which raised $120 million; MasterClass, which raised $100 million; and Udemy, which raised $50 million.

One company in the edtech space that has seen its revenue go up all year in Chegg, which grew from $131.6 million in Q1 to $153 million in Q2 to $154 million in Q3, a 64 percent increase from the same period in 2019. At the same time, the company's stock price has more than doubled since the start of the year, from $38.04 a share to $88.53.

Loser, then winner: travel

Outside of going to the movies, the thing that I miss most about the old world is traveling. Every year I would try to take at least one trip to a new place; at the very least I would always go home to spend a couple of weeks with family. This is the first year I wasn't able to celebrate the holidays with them. And I am not alone in that by any means: overall, the travel industry in general has lost billions due to COVID, with spending at $10.8 billion, half of what it was last year.

Initially, Airbnb took a big hit thanks to the pandemic, with a survey in June finding that nearly half of hosts didn't feel safe renting to guests, while 70 percent of guests were afraid to book with the company. In addition, 64 percent of guests had cancelled or planned to cancel an Airbnb booking. On average, hosts lost over $4,000 in the few months since the start of COVID.

In the first nine months of 2020, Airbnb made $2.5 billion, down from the $3.7 billion it made in the first nine months of 2019, a 32 percent drop. However, the company saw a pretty dramatic turnaround after a terrible Q2: while revenue fell 60 percent from Q1 to Q2, going from $841 million to $334 million, the company wound up making $1.3 billion in Q3, a stunning 289 percent increase quarter-to-quarter, which it was then able to translate to a $3.5 billion IPO earlier this month, the sixth largest ever for the tech space.

(Image source: centerfinplan.com)

Related News

Eko raises $65M to expand its telemedicine capabilities