Healthcare startups: what they've been up to this year

Amwell went public, Livongo merged with Teladoc and Grail got acquired

COVID caused all sorts of problems for the healthcare space this year, but it also created opportunity. That's why the third quarter of 2020 set a record for investment, with $21.8 billion invested across 1,539 deals globally.

That includes newer entrants into the space, as well as some established startups, companies that have been around for a few years now and that have managed to make a name for themselves, while also raising a whole lot of money.

Here's some of what those healthcare startups have been up to so far this year with regards to COVID and beyond:

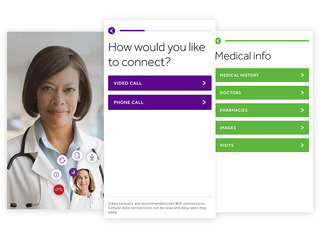

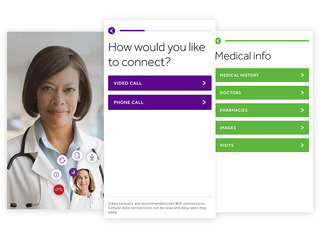

Telemedicine company Amwell raised $194 million in Series C funding across two tranches. The funding came from what it describes as "many early investors and strategic partners," including Allianz X and Takeda.

That was followed by another $100 million investment in August from Google Cloud, a deal that also included a multi-year partnership. The two companies said they will use their combined technology "to expand access to virtual care, improve patient and clinician experiences, and leverage their unique capabilities to deliver new, differentiated healthcare solutions—across the continuum of care."

Through the partnership, Google Cloud selected Amwell as its preferred global telehealth platform partner, and Amwell selected Google Cloud as its preferred global cloud platform partner. Google Cloud's artificial-intelligence and machine-learning technologies will be used to assist patients and front-line workers with intake, inquiries, and triage.

In June, Amwell filed for a confidential IPO before going public in September, raising $742 million in the process. It is now trading at $30.70 a share, up 18 percent from the $25.51 it opened with.

Livongo, a diabetes detection platform that went public in 2019, merged with telemedicine company Teladoc in August, in a deal worth $18.5 billion, or $11.33 per share of Livongo. The combination of Teladoc Health and Livongo is expected to have 2020 pro forma revenue of approximately $1.3 billion. The transaction is expected to close by the end of Q4 2020, but the combined company already signed up its first client, Florida Blue, in October.

Livongo, a diabetes detection platform that went public in 2019, merged with telemedicine company Teladoc in August, in a deal worth $18.5 billion, or $11.33 per share of Livongo. The combination of Teladoc Health and Livongo is expected to have 2020 pro forma revenue of approximately $1.3 billion. The transaction is expected to close by the end of Q4 2020, but the combined company already signed up its first client, Florida Blue, in October.

Prior to the merger, Livongo had partnered with DexCom, a company developing continuous glucose monitoring systems, in January. Dexcom offers Livongo members the ability to synch data from their Dexcom G6 Continuous Glucose Monitoring System with the Livongo platform. The partnership allows also Livongo to take data from the Dexcom G6 and then use it to offer its members personalized health insights. In addition, people who have Livongo and Dexcom Members also have access to 24/7 support from Livongo’s certified health coaches.

Livongo posted Q1 revenue of $68.8 million, up 115 percent year-over-year, and higher than expectations.

On August 5, the date of the announced merger, Livongo's stock closed at $128.06 a share. It closed on November 2 at $139.77 a share, a rise of 9 percent.

In July, Doctor On Demand raised $75 million in Series D financing led by global growth equity firm General Atlantic, with participation from existing investors, bringing its total raised to $239 million.

In the first half of 2020, the company saw record usage on its platform, growing 139 percent, for COVID-19 screenings, routine health issues, chronic conditions and behavioral health. The company more than doubled the number of people it covers in six months, to 98 million.

In February, Doctor On Demand launched its COVID health assessment, allowing patients to take a self assessment, though it eventually evolved into a lightweight diagnostic tool.

In April, the company partnered with AACS, an international consulting and principal investments firm, to explore solutions to transform Nigeria's health care system. Teladoc saw its number of visits double in the first quarter of the year thanks to COVID to 2.04 million. In Q2, visits grew to 2.76 million, and then 2.8 million in Q3. Revenue grew from $180.8 million in Q1 to $288.8 million in Q3.

Teladoc saw its number of visits double in the first quarter of the year thanks to COVID to 2.04 million. In Q2, visits grew to 2.76 million, and then 2.8 million in Q3. Revenue grew from $180.8 million in Q1 to $288.8 million in Q3.

In addition to the merger with Livongo, Teladoc also acquired InTouch Health, provider of enterprise telehealth solutions for hospitals and health systems, in January. The $600 million purchase price consisted of approximately $150 million in cash and $450 million of Teladoc Health common stock. The deal was completed in July. In January, Oscar Health partnered with Cigna "to jointly provide commercial health solutions to small businesses." Together, the two companies said they would provide integrated medical, behavioral, and pharmacy services; support from a concierge team assigned to individual members to help them understand their benefits and find care; digital-first support, including 24/7 telemedicine at no charge, an overview of copay details and benefits, deductible tracking, lab results and individual health history; tools to help review health care providers, book appointments, find facilities and check prescriptions; and broker, business and provider portals for enrollment and management.

In January, Oscar Health partnered with Cigna "to jointly provide commercial health solutions to small businesses." Together, the two companies said they would provide integrated medical, behavioral, and pharmacy services; support from a concierge team assigned to individual members to help them understand their benefits and find care; digital-first support, including 24/7 telemedicine at no charge, an overview of copay details and benefits, deductible tracking, lab results and individual health history; tools to help review health care providers, book appointments, find facilities and check prescriptions; and broker, business and provider portals for enrollment and management.

In June, Cigna and Oscar announced that it would be offering plans to small businesses in Atlanta, the San Francisco Bay Area and across Tennessee, including Nashville, Memphis, Knoxville, and Chattanooga. The plans are expected to be available in Q4 2020.

That same month, Oscar revealed that it raised $225 million in venture funding from existing investors Alphabet, General Catalyst, Khosla Ventures, Lakestar and Thrive Capital, among others. New investors Baillie Gifford and Coatue also joined the round.

In September, Oscar partnered with MercyOne, a connected system of health care facilities and services, in order to offer Oscar Individual and Family health insurance plans in 23 counties in Iowa beginning in 2021.

Iowa residents in Black Hawk, Cerro Gordo, Dallas, Dubuque, Jasper, Madison, Marion, Plymouth, Polk, Warren, Woodbury, Jackson, Jones, Buchanan, Delaware, Bremer, Chickasaw, Butler, Floyd, Hancock, Franklin, Mitchell, and Worth counties will be able to purchase Oscar Individual and Family health plans. These health plans are anticipated to be sold on the federal health insurance exchange, with coverage to begin on January 1, 2021.

It was also reported that the company has hired banks in anticipation of going public next year.  In March, cancer detection company GRAIL raised a $390 million Series D round of funding from new investors Public Sector Pension Investment Board and Canada Pension Plan Investment Board, as well as two undisclosed investors and existing backers including Illumina. The round brought GRAIL's total funding to more than $1.9 billion.

In March, cancer detection company GRAIL raised a $390 million Series D round of funding from new investors Public Sector Pension Investment Board and Canada Pension Plan Investment Board, as well as two undisclosed investors and existing backers including Illumina. The round brought GRAIL's total funding to more than $1.9 billion.

In September, the company filed for an IPO, with estimates that it could raise up to $500 million. In its IPO filing, the company said it would be launching its multi-cancer early detection test, called Galleri, in 2021.

In October, however, it was announced that GRAIL was bought by biotech company Illumina for $8 billion in cash and stock. Illumina says it expects to close the transaction in the second half of 2021.

In April, insurtech company Bright Health, started the year by acquiring Medicare insurance plan Brand New Day. No financial terms of the deal were announced. Brand New Day is continuing to operate as part of Bright Health, keeping its 305 employees, while its current leadership, including founders Jeff and Jay Davis, joined the Bright Health Plan leadership team and continue to lead local market operations. The acquisition was completed in May.

In March, in response to the COVID pandemic, Bright Health announced an updated COVID-19 coverage policy that included free diagnostic testing and early prescription refills.

In April, the company hired a new CEO, promoting Bright Health's President G. Mike Mikan, who took over as CEO from Bob Sheehy, who had served in the role since the company's founding in 2015. Sheehy transitioned to serving as Executive Chairman of the Board. In addition, the company also added Jeff Immelt to its Board of Directors.

In September, Bright Health raised $500 million in a Series E round, bringing its total raised to over $1.5 billion. The funding came from funds and accounts advised by Tiger Global Management, T. Rowe Price Associates and Blackstone, with follow-on investments from existing investors including NEA, Bessemer Venture Partners and Greenspring Associates.

In October, the company helped launch the Healthy Living Coalition, an alliance for action and solutions focused on improving food systems and helping close nutrition gaps that disproportionately impact underserved communities. Other partners include Bank of America, Beyond Meat, Chobani, Hint Inc., JPMorgan Chase, Lineage Logistics, Panera Bread, Pret A Manger, Oak View Group, The Vitamin Shoppe and WWE. Non-profit partners include American Diabetes Association, Feeding America, Wholesome Wave, and WhyHunger.

"At Bright Health, we serve a diverse and sometimes vulnerable population that may not always have access to good food when they need it. We know first-hand the impact that high-quality nutrition has on overall health and are proud to further our commitment to supporting healthy communities through this partnership," Tom Valdivia, M.D., Chief Health Officer and Co-founder at Bright Health, said.

(Image source: singularityhub.com)

Related Companies, Investors, and Entrepreneurs

Doctor On Demand

Startup/Business

Joined Vator on

Related News

Insurtech company Bright Health raises $500M

With new acquisition, Bright Health is coming to California

Telemedicine company Amwell raises $194 million