Eventbrite files for IPO, looks to raise $200M in its public offering

The company, which takes fees from every ticket sold, saw revenue climb 51% to $201.6M in 2017

2018 has already seen a number of major tech companies either go public or file for the IPOs, mostly notably Dropbox and Spotify, as well as Smartsheet, Pluralsight, Zuora and DocuSign. According to Pitchbook, the first half of 2018 saw total deal value for VC-backed IPOs of $6.9 billion, putting it on pace for the second biggest year since 2012, and that was the year of the record breaking Facebook IPO.

2018 has already seen a number of major tech companies either go public or file for the IPOs, mostly notably Dropbox and Spotify, as well as Smartsheet, Pluralsight, Zuora and DocuSign. According to Pitchbook, the first half of 2018 saw total deal value for VC-backed IPOs of $6.9 billion, putting it on pace for the second biggest year since 2012, and that was the year of the record breaking Facebook IPO.

To put it mildly, it's a good time for companies to consider going public, and there are plenty of them that have been sitting out the last few years, waiting for the right moment.

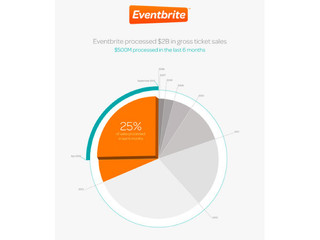

One of those is event planning services company Eventbrite, which filed its S-1 form with the Securities and Exchange Commission on Thursday. The company plans on raising $200 million in its filing, which would make it the fourth largest tech IPO of the year.

It will list its stock on the New York Stock Exchange under the ticker symbol “EB.”

Eventbrite makes its money from fees taken out of every ticket sold on the site, offering various packages that will determine those fees.

"If you’re charging for ticket sales, our fees vary by package. In the U.S., our Essentials package costs 1% of the ticket price and $0.99 per paid ticket (maximum Service Fee: $19.95) plus 3% payment processing per transaction; our Professional Package is 2.5% of the ticket price and $1.99 per paid ticket (maximum Service Fee: $24.95) plus a 3% payment processing fee per transaction; our Premium Package has custom pricing. We designed each package to fit the specific needs of our organizers," the company says on its website.

In 2017, Eventbrite brought in revenue of $201.6 million, a 51 percent increase from the $133.5 million it saw in 2016. While the company saw a loss of $33.4 million last year, that was also a 4.6 percent decrease from its $35 million loss the year before.

In the first half of this year, Eventbrite saw $142 million in revenue and a $16 million loss, a 61 percent and 50 percent increase, respectively.

Founded in 2006 by husband and wife team Kevin and Juliz Hartz, Eventbrite had raised $332.3 million in venture funding from investors that includes Tiger Global Management, T. Rowe Price, Sequoia Capital, 137 Ventures, DAG Ventures and Tenya Capital.

Julia has been CEO of the company since 2015, when Kevin left to join Founders Fund as a venture capitalist.

The upcoming IPO market

With IPOs hot right now, there are a number of other companies that could be going public this year. The most obvious is Uber, which just hired a new head of finance, a move that has signaled to many that the company is looking to finally exit.

Other companies that have long been looked at as potential IPOs include Airbnb, Lyft, Palantir, Pinterest, WeWork and SpaceX, all of which have raised over $1 billion in venture funding and all of which have valuations of at least $1 billion.

Related Companies, Investors, and Entrepreneurs

Eventbrite, Inc.

Startup/Business

Joined Vator on

Eventbrite is the world’s largest self-service ticketing platform, and enables people all over the world to plan, promote, and sell out any event. The online event registration service has helped organizers process over 130 million tickets in 179 countries, and makes it easy for everyone to discover and share the events with people they know. In this way, Eventbrite brings communities together by encouraging people to connect through live experiences. Eventbrite's investors include DAG Ventures, Sequoia Capital, T. Rowe Price, Tenaya Capital and Tiger Global. Learn more at www.eventbrite.com.

Julia Hartz

Joined Vator on

Kevin Hartz

Joined Vator on

Related News

Dropbox vs Box: how do their IPOs compare?

Eventbrite hits new milestone: $2B in tickets sold

Kevin Hartz becomes a partner at Founders Fund

Eventbrite raises $60M at $1B valuation

A look at which companies might go public in 2018

Kevin Hartz's Eventbrite democratizes events

2015 was a bad year for IPOs, but will 2016 be any better?