Daily funding roundup - April 19, 2016

FusionOps secured $25M; Insightly raised $25M Series C; Wootric secured an oversubscribed A round;

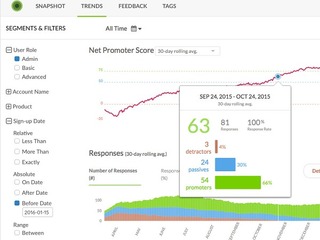

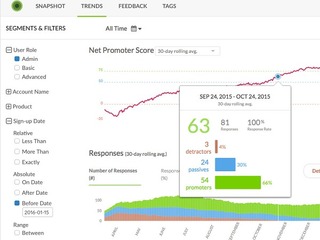

- Wootric, an in-application Net Promoter Score (NPS) platform for boosting customer happiness, secured an oversubscribed $2.6 million Series A funding round led by Cloud Apps Capital Partners, with additional participation by CSC Upshot. Wootric is among the first investments made by CSC Upshot's new $400M fund dedicated primarily to U.S. startups. The capital will be used to further drive product development and expand sales and marketing. Cloud Apps Capital Partners' Matt Holleran and Judy Loehr have joined the company's board of directors.

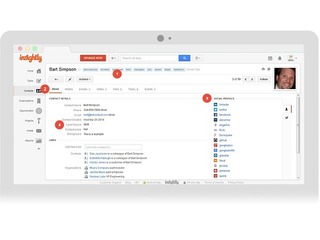

- Insightly, a CRM platform that is dedicated solely to small and growing business, raised $25 million in a Series C round of funding. The round was led by Scott Bommer, venture investor and founder of SAB Capital, with participation from existing investors Emergence Capital Partners, Cloud Apps Capital Partners and Sozo Ventures. The company had previously raised $16 million, bringing its total capital raised to more than $40 million.

- TripChamp Ltd., a corporate travel booking platform, completed a $2 million Series B round of funding. The Austin company plans to used the capital for corporate growth and to increase its customer service channels. The funding increases to $6.2 million the amount of investment capital TripChamp has raised from a syndicate of angel investors since launching.

- Waltz Networks, a San Francisco, CA-based startup using control schemes to enable networks of all sizes to be self-managing, raised $8.15 million in Series A funding. New Enterprise Associates made a $6.75 million investment while National Science Foundation provided a $1.4 million grant. The company intends to use the funds to expand its hiring and product development efforts.

- Diamanti, formerly known as Datawise.io, emerged publicly with $12.5 million in funding after its team worked in stealth for more than three years.The startup's Series A round, which closed in 2014, comes from CRV, DFJ Venture, GSR Ventures and Goldman Sachs . Diamanti aims to raise a Series B of about $25 million later this year, according to Mr. Chou.

- TapInfluence, a provider of an influencer marketing automation platform, closed $14 million in financing led by Noro-Moseley Partners with participation from existing investors Grotech Ventures and Access Venture Partners, as well as new investor Knollwood Investment Advisory. Contributions were also made from MergeLane, a startup accelerator for women-led companies, and super angel Robin Ferracone, founder and CEO of Farient Advisors, and a respected strategic SaaS investor.

- Rinse, a consumer service that combines the high quality care your clothes deserve with the convenience, simplicity, and dependability your busy schedule demands, announced a $6 million Series A funding round. The latest round is led by Javelin Venture Partners. Other participants in the round include Arena Ventures, CAA Ventures, Accelerator Ventures, Expansion VC, Structure Capital, Otter Rock Capital, and Base Ventures. The Company has raised $9.5 million to date.

- Threat Stack, a Boston, MA-based cloud security and compliance management platform, secured $15.3 million in Series B funding. The round was led by Scale Venture Partners with participation from existing investors Accomplice and .406 Ventures. In conjunction with the funding, Ariel Tseitlin, a partner at Scale, will join the company’s board of directors.

- FusionOps, provider of the Supply Chain Intelligence Cloud, secured $25 million in Series C funding from both new and existing investors. The Series C round was led by Georgian Partners, with participation from existing investors including New Enterprise Associates (NEA) and Prabhu Goel, chairman of FusionOps. The new funding will be used to further extend FusionOps’ leadership in actionable intelligence for the supply chain, expand international sales operations, and continue investing in world-class customer success. In conjunction with this financing, Tyson Baber of Georgian Partners will join the FusionOps board of directors.

If you are interested in being included in our funding roundup, submit your press release or blog post about your financing round to mitos@vator.tv.

Image source: blog.credit.com

Mitos Suson

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsRelated Companies, Investors, and Entrepreneurs

Scale Venture Partners

Angel group/VC

Joined Vator on

|

Scale Venture Partners chooses markets for investment based on our insights into trends drawn from primary research with incumbents, customers, competitors and our network of experts. We select companies we think are going after something great. Our investment strategy makes "scale" relevant to you for two reasons. We operate in markets where you can create large scale success. We work side by side with you to help scale your business to reach its market potential. |

Most of our investments are mid to late stage, when the software is being used, the chip is in the fab, and the therapy is being tested on humans. It may still feel early to you. You may be just starting to build out your go-to-market team. It's at this stage that our own practical operating experience drives the best rewards. |

Related News