Ele.me raises $1.25 billion for food delivery in China

Chinese food delivery unicorn gets huge infusion of cash from Alibaba Group and affiliate

Editor's Note: Our annual Vator Splash Spring 2016 conference is around the corner on May 12, 2016 at the historic Scottish Rite Center in Oakland. Speakers include Nigel Eccles (CEO & Co-founder, FanDuel), Andy Dunn (Founder & CEO, Bonobos), Mitch Kapor (Founder, Kapor Center for Social Impact); Founders of NextDoor, Handy, TubeMogul; Investors from Khosla Ventures, Javelin Venture Partners, Kapor Capital, Greylock, DFJ, IDG, IVP and more. Join us! REGISTER HERE.

While foodtech companies struggle for market share and bow to consolidation in most of the world, the latest news from China seems to buck the trend.

Ele.me, a Shanghai-based food delivery platform, today announced that it has secured a $1.25 billion investment from Alibaba Group Holding and Ant Financial, an online payment services provider and affiliate of Alibaba.

Alibaba is contributing $900 million to the round and Ant is contributing $350 million. No word yet on what this does to Ele.me’s valuation, which was last pegged at $4.5 billion.

Ele.me is no stranger to gargantuan funding rounds. The company raised the largest foodtech round in the third quarter of 2015 with a $630 million Series F led by CITIC Capital and supermarket chain Hualian.

Other participants in that round included Tencent, JD, and Sequoia Capital. (That’s interesting in of itself, since Sequoia this year led an approximately $1 billion financing round in JD, a Beijing-based e-commerce company that competes with both Alibaba and Tencent. Basically, Chinese tech giants and investors are just as tangled, if not more so, than they are in the states.)

In addition to the new funding, terms of the deal state that Alibaba’s own online food services platform Koubei will cooperate with Ele.me. I’m reaching out to the company to learn further details about this “cooperation” and what it means for consumers of each service.

Ele.me already works with another fast-growing Chinese company called Dada, which is like Postmates. That service, which raised $300 million in January at a $1 billion-plus valuation, connects freelance drivers with delivery assignments. For example, if Ele.me needs somebody to pick up restaurant orders and deliver them to the customer, a driver from Dada may execute that order.

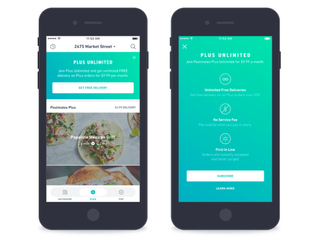

Another Postmates-like service, London-based Jinn, just closed a $7.5 million Series A led by Samaipata Ventures with participation from Elderstreet, Bull Partners, and existing angel investors earlier this month. Meanwhile, in the U.S., Postmates recently launched a subscription service called Postmates Plus to compete with the likes of Amazon and Google. Though Postmates and Jinn both offer general-purpose delivery services, both have demonstrated through their marketing tactics a keen interest in owning the food delivery space.

Like the news out of China today, India saw a big deal for a food tech startup recently. Grocery delivery service BigBasket, an Instacart-like service bringing food to five million monthly users across a dozen cities in India, just secured $150 million in funding led by the Abraaj Group last month.

Related Companies, Investors, and Entrepreneurs

Related News

Top investments from the most active VCs of 1Q 2016

Postmates Plus hoping to dominate food delivery

China’s newest unicorn Dada raises $300 million

Funding up 55%, deals more than double in food tech space