Deflating tech bubble is return to "old normal"

First Round publishes note amidst stabilizing financial market and sustained fear of recession

Seed-stage venture firm First Round Capital today publicly published (as it did a year ago) the quarterly letter it sent to its limited partners, discussing the ongoing tech bubble deflation and affirming much of what has been put forth by investors across the past few months.

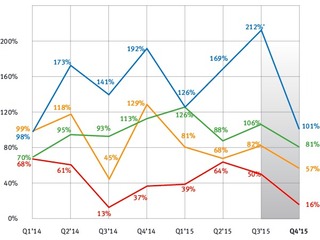

Namely, we are seeing the technology industry returning to an “old normal.” For the past few years, writes First Round, founders have mostly operated under the assumption that future investors care mostly care about growth and that additional funding rounds (at a low cost of capital) can always be raised. And the assumption has been fair.

But now First Round agrees with the growing sentiment that the tripling in valuations we’ve seen in the past couple years, and the metrics used to calculate those valuations, don’t pair well reality. That means, going forward, investors will increasingly compel founders and other company leaders to prioritize unit economics, profitability, and burn rate over just plain growth for the sake of growth.

Additionally, echoing what we heard at our Post Seed event last fall, this also means companies can no longer expect that next funding round to be there when they need it. And if it is there, the terms won’t look as positive for the entrepreneur as they did in 2015 or 2014.

Here’s a good summary of the letter from First Round:

"We believe that starting in 2016, private and public companies will (once-again) begin to be valued in an increasingly consistent fashion. This change can (and will) be painful for many private companies. Companies that need to raise additional capital will have to price-test in the capital markets — and many will raise at lower prices than they previously did. And we worry that many private companies may unfortunately find that there is no market-clearing price at which they can obtain additional investment."

The letter from First Round comes as global markets showed another week of gains, with the Dow Jones Industrial Average up 2.2 percent this week (to 17,006) but still down 2.4 percent for the year and the Nasdaq up 2.7 percent this week (to 4,717) but down 5.8 percent for the year.

Even the perennial diver Twitter is up 7.9 percent for the week to $19.35, though it’s still down 16.3 percent for the year. Facebook, which has done pretty well despite market conditions, is up 0.44 percent this week to $108.39 and up 3.6 percent for the year.

Apple is up 6.3 percent to $103.01 this week, and for the year it’s down 2.1 percent. Alphabet (Google) is up 0.7 percent to $730.22, and for the year it’s down 6.1 percent.

And yet, for all the gains, the financial markets don’t provide a one-to-one picture of whether we’re headed for a recession. That's why, using economic data from jobs and retail sales to gross domestic product, J.P. Morgan forecasted on Feb. 12 a 32 percent chance of a recession in the next year. Much less optimistic, Rogers Holdings Chairman Jim Rogers told Bloomberg there’s a 100 percent chance the U.S. economy will be in a recession sometime in the next year.

Related Companies, Investors, and Entrepreneurs

First Round Capital

Angel group/VC

Joined Vator on

We’re not a traditional venture firm.

We move at startup speed. We’re transforming a portfolio of individual companies into a connected community of entrepreneurs who inspire, support and educate each other

Related News

First Round Capital promotes Cyber Monday deals

As Yahoo falters, Microsoft becomes the M&A leader