When Airbnb was young: the early years

25,000 users in one year, revenue at $200/week, and a $20K seed round from Y Combinator

As our readers know, Vator has started a series called When they were young.

As our readers know, Vator has started a series called When they were young.

It's a look back at the modest days of startups, what traction they had in their first few years, and how they evolved. In the end, we hope to provide a glimpse into what great startups looked like in their first three years.

Stories like these are always well received because it reminds us that anyone, regardless of pedigree and environment, can rise above the noise and have great influence. They show us the value of being resilient, persistent, and committed. If we can follow their footsteps, maybe we too can have similar success.

Our first segment in this series focused on Facebook. This segment is on Airbnb.

— Airbnb's First Year —

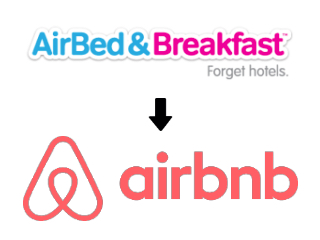

Launched: August 2008 as AirBed & Breakfast

Founders (ages at the time): Joe Gebbia (27), Brian Chesky (27), and Nathan Blecharczyk (24)

Initial Company Description: "Book rooms with locals, rather than hotels," according to an early pitch deck.

First funding - at launch: As a way to promote the platform, Airbnb launched at the Democratic National Convention in 2008, when Barack Obama was formally nominated. The company also needed capital to continue bootstrapping the platform, so the team bought hundreds of boxes of cereal and rebranded them as Obama O's and Cap'n McCains. Priced at $40 per box, five percent of the proceeds went to the nominee's campaigns and the rest went to Airbnb's coffers—amounting to $30,000.

First investment - at three months - $20K seed: "On June 26, 2008, our friend Michael Seibel introduced us to seven prominent investors in Silicon Valley," said Airbnb CEO Brian Chesky. "We were attempting to raise $150,000 at a $1.5M valuation. That means for $150,000 you could have bought 10% of Airbnb." In all, the company received five rejections, while the other two firms didn't bother replying.

The company couldn't live off the proceeds of its presidential cereals for long though. Of Airbnb, Paul Graham (co-founder of Y Combinator) said "the idea is terrible," but he liked the founders because they "won't die" and are "very imaginative." So Airbnb was accepted into Y Combinator for the spring 2009 class, which meant the company had raised its first official funding: a $20,000 seed round.

Second investment - at eight months - $600K seed: Airbnb presents at the Y Combinator Spring 2009 Demo Day, where they officially rebrand from "Air Bed & Breakfast" to "Airbnb." They make a good impression, ultimately resulting in a new $600,000 seed round led by Sequoia Capital with participation from Youniversity Ventures and Ashton Kutcher.

First business model - commission fee: For every reservation made through the site, Airbnb would take a 10 percent commission fee.

Revenue milestone - in first year: In 2009, Airbnb was only making $200 in revenue per week, or just over $10,000 for the year. Offering a professional photographer to take pictures of a host's space helped encourage more reservations, doubling revenue to $400 per week.

Traction - in first year: Traction came slowly. While Facebook had 70,000 users after just two months, it took Airbnb nearly a year just to reach 25,000 users worldwide.

Media coverage - first year on VatorNews: In July 2009, Airbnb was highlighted in VatorNews' Startup Sessions (below), when a team of six worked out of the apartment all three founders lived in. See them dancing to "Walking on Sunshine" below.

— Airbnb's Second Year —

Media coverage - second year on VatorNews: On VatorBox - Sept 2009, Vator's version of Shark Tank, reviewers give Airbnb a big thumbs up. While we observed the company had a good chance of success, we did think the supply side would be there for the startup. However, in Bambi Francisco's interview with Sequoia partner Alfred Lin at the Post Seed 2015 conference, Lin revealed that supply is actually not that easy to come by as Airbnb scales—a potential reason why the company's valuation is lower than Uber's.

Revenue milestone - at nearly two years: "The photos were really bad," said co-founder Gebbia of pictures for listings on Airbnb in the early days. "People were using camera phones and taking Craigslist-quality pictures. Surprise! No one was booking because you couldn't see what you were paying for."

Professional-looking photos of a listing helped encourage more reservations, effectively doubling revenue. In the summer of 2010, Airbnb launched an official pilot program where it would send professional photographers to take pictures of a host's space for free.

— Airbnb's Third Year —

Third investment - at two years and three months: Just after its second anniversary and three months into its third year, Airbnb secured $7.2 million in Series A capital from Greg McAdoo of Sequoia Capital and Reid Hoffman of Greylock Partners. In conjunction with the funding announcement, the company also launched an iPhone app.

Since its launch two years prior, the company had booked 700,000 nights in 8,000 cities across 166 countries.

Traction - at two years and nine months: In a VatorNews interview, Chesky says the company had already booked about $150 million in revenue (1.5 million reservations to-date with the average reservation between $70 and $200) since inception and is growing revenue between 30 and 50 percent each month.

Fourth investment - at two years and eleven months: Eight months after its Series A and just a month before its third birthday, Airbnb raised a $112 million Series B financing round led by Andreessen Horowitz with participation from DST Global and General Catalyst. The round was the first that pegged Airbnb's valuation at $1 billion.

Related Companies, Investors, and Entrepreneurs

Sequoia Capital

Angel group/VC

Joined Vator on

Sequoia Capital is a venture capital firm founded by Don Valentine in 1972. The Wall Street Journal has called Sequoia Capital “one of the highest-caliber venture firms” and noted that it is “one of Silicon Valley’s most influential venture-capital firms”. It invests between $100,000 and $1 million in seed stage, between $1 million and $10 million in early stage, and between $10 million and $100 million in growth stage.

Airbnb

Startup/Business

Joined Vator on

Airbnb.com is the “Ebay of space.” The online marketplace allows anyone from private residents to commercial properties to rent out their extra space. The reputation-based site allows for user reviews, verification, and online transactions, for which Airbnb takes a commission. As of June, 2009, the San Francisco-based company has listings in over 1062 cities in 76 countries.

Greylock Partners

Angel group/VC

Joined Vator on

Greylock partners with entrepreneurs to help them build market-leading businesses. Over the past 45 years the firm has worked with hundreds of companies, 150 of which have gone on to IPOs and 100 of which have gone on to profitable M&A events. Such companies include Ascend Communications, CheckFree, CipherTrust, Constant Contact, Continental Cable, Decru, Data Domain, DoubleClick, Farecast, Internet Security Systems, Ikanos, Legato, Media Metrix, Millennium Pharmaceuticals, Openwave, Open Market, OutlookSoft, Polyserve, Red Hat, RightNow Technologies, Success Factors, Sun Edison, Tellabs, Trilogy and Wily Technology. Current Greylock portfolio companies include Cloudera, Data Robotics, Facebook, Imperva, LinkedIn, Palo Alto Networks, Pandora, Picarro, Redfin, Workday and ZipCar. For more information about Greylock Partners, visit our Web site (www.greylock.com) or blog (www.greylockvc.com) or follow us on Facebook (http://www.facebook.com/greylock) or Twitter (@GreylockVC).

Reid Hoffman

Joined Vator on

Brian Chesky

Joined Vator on

Related News

Brian Chesky on Airbnb's rapid growth

Airbnb confirms $117M round B

AirBnB should leverage Facebook's network

Travel the world with Airbnb

Airbnb raises $7.2M and launches iPhone app

Airbnb's CEO: don't let rejection discourage you

How does Airbnb make money?

Video: Alfred Lin and Bambi Francisco at Post Seed 2015