The rise of corporate VCs: what that means for the industry

The percentage of corporate VC dollars has doubled since 2011

There seem to be been more ways for companies to get funding nowadays than perhaps more than anytime in the past. That includes everything from micro VCs and angel funding to crowdfunding. One of the growing trends has been the rise of corporate VCs, or venture capital firms that are formed within big companies, as a way for those companies to seek out potential partners, or possibly future acquisitions.

These types of deals have been increasing in recent years, reaching nearly a quarter of all venture dollars in the United States, according to a report from CB Insights.

In all, a total $74.2 billion was invested in 2015, meaning that, of that, $17.8 billion came from investors that included Google Ventures, Cisco Investments, Dell Ventures and Twitter Ventures. That is double the 12 percent that these types of firms were investing in 2011.

The percentage of corporate venture was roughly the same in Europe, where it hovered around 20 percent in each quarter of 2015, but it actually was much higher in Asia, where it was above 30 percent in four out of the last five quarters, including 35 percent of all venture dollars in the fourth quarter of 2015.

Some of the most prominent corporate venture capital firms in Asia include Alibaba Capital Partners, Tencent, Baidu and Rakuten Ventures.

The difference between a corporate VC and an institutional VC

How different the two types of investing are may depend on how the corporate VC is structured. Some have close ties to corporation themselves, and report to executives at the company to get their approval on deals, while others have more free reign, and are not as subject to the needs of the parent company.

"There are many different models for corporate VCs and entrepreneurs need to understand which corporate VC model they are working with. Some corporate VCs are tightly integrated with the strategic initiatives of the corporation whereas others are more financially, or return, driven," Karen Griffith Gryga, Partner and Chief Investment Officer at Dreamit, explained.

"Financially driven corporate VCs can act similarly to a traditional VCs in that they offer advice, introductions and capital."

There are some inherent differences between these two types of investors, though, and it comes down to where they get their money from, and what their end goals are.

While most venture capital firms have to go out and raise funding from limited partner investors, or LPs, which can be anything from pension funds, endowments of universities and hospitals, charitable foundations, insurance companies, wealthy individuals, and corporations.

Corporate VCs, on the other hand, don't have to go begging for money. It comes from the top, and is allocated from the company that supports it.

The even bigger difference, though, is the end goal, and why each of them invest in the first place. While institutional VCs only make money if the company exits, either it gets acquired or it goes public, a corporate VC doesn't necessarily need an exit to benefit. They can find potential acquisitions, or future partners, through their investments.

One of the more recent new corporate funds is Workday Ventures, which was launched last July, in order to focus on companies in the machine learning space.

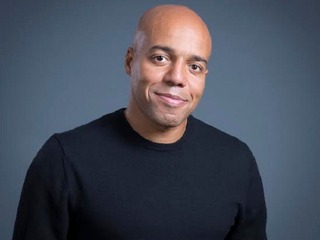

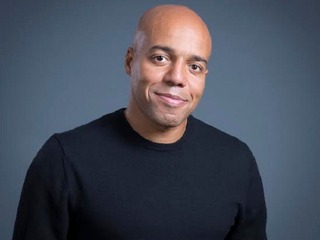

When I spoke to Adeyemi Ajao, lead investor for Workday Ventures, last year, he told me that the firm's goal was not just investing in companies but eventually "partnering with startups that are leveraging data science and machine learning to address enterprise challenges."

"We also have to make sure that Workday can help that particular company, and that they are at a stage where we can add value," he said. "Basically what I mean by helping and adding value is that, with most companies, that value comes in two buckets. One is pure engineering value. We have a lot of engineering conversations, and learning goes both ways."

Corporate investors have become " increasingly sophisticated in making venture investments," Jack Young, Head of Qualcomm Life Fund, told me.

"Many who started making LP investment in traditional venture funds have hired a high caliber dedicated professional team in house, and shifted the capital to direct investment with cogent strategic intent. They have also made the process much more transparent and streamlined matching the industry norm, while aiming to create win-win for startups and the corporate."

(Note: Young will be a speaker at Vator's second annual Splash Health event at the Kaiser Center in Oakland on February 23rd. Other speakers will include Ali Diab, CEO of Collective Health; Helmy Eltoukhy, Founder & CEO of Guardant Health; and Ted Tanner, Co-founder & CTO of PokitDok. Get your tickets here, before they jump up next week!)

So not only do the companies get resources from the corporation, but the corporation also gets some insights into the space, which is can then leverage when it wants to make its own acquisitions. This is not always a good thing for the company that is taking the investment, though, as I will discuss later.

What's behind this rise?

Some believe the rise of this type of investing has to do with the current pace of innovation, with companies simply trying to keep up with the rest of the tech world, and not wanting to fall behind their competitors.

"The pace of disruption has increased exponentially, to the point where an established corporation can seemingly have their core business dramatically changed almost overnight. Companies can explode positively, and experience exponential growth, very quickly. Or, in the opposite extreme, explode and disappear. Corporations are embracing innovation in a way like never before," said Gryga.

"Corporations are seeking innovative solutions to add to their portfolio or innovations to drive better and more efficient customer acquisition, communication, engagement and management. Given that offense if often your best defense, corporate VC are a manifestation of corporations embracing innovation as a means for growth and defense from being marginalized."

It might just be, though, that so many companies are doing so well at the moment that they have the money to throw into venture, which they may not have had the resources to do before. And they are using that opportunity to get a better view of their own market.

"As pure speculation , the top tech companies control enormous amounts of capital. They need to generate returns on that capital. They also are active acquirers of companies that are strategic to them, and by getting involved in those companies earlier through investment they can gain insights, advantage and early access for acquisition at lower costs than when the companies develop fully on their own. The last point is exactly what concerns traditional VCs as it means lower multiples and sometimes fewer bidders," Ben Narasin, General Partner at Canvas Venture Fund, told me.

"The major growth in corporate VCs corresponds largely to the major growth in balance sheet cash among those same corporates."

This, too, can also lead to another big problem, if those companies suddenly find themselves in a situation where they have less money to throw around. These funds are not subject to whims of the market, so much as the whims of the company that is backing them. That can have a negative impact on the companies that need to raise their next round of capital.

The risks and the rewards

The ultimate question about the rise of the corporate VC model is, of course, whether or not it's a good thing for the VC industry, and for the companies who take money from them. Overwhelmingly, the response from VCs I spoke to was positive, with many of them having co-invested with corporate VCs themselves.

"At Illuminate Ventures we work closely with several corporate VCs and believe that both we, and our portfolio companies, have benefited from these relationships. Salesforce.com and Intel Capital, for example, are each co-investors in several companies in our portfolio," said Cindy Padnos, co-founder and Managing Partner of Illuminate Ventures.

"Both organizations came into these companies at fairly early stages, have added value well beyond just the capital they have provided and in most cases have become, or already were, customers of the companies’ products. Both Intel and Salesforce have been in venture for many years with dedicated teams focused on this effort."

"They are typically terrific investors and bright people. They are good corporate employees of their parent corporation. Corporate VCs, of course, are more likely to make investments that are strategic to the corporation that created that fund, so their breadth, in some manner, is restricted," Nat Goldhaber, co-founder of Claremont Creek Ventures, told me. The firm has worked with funds from GE, Johnson Control, Astor and Google, among others.

"We have very good relationships with them. In the end, having a corporate VC available is terrific, as they are additional source for investments we'd be interested in making."

However, many also warned of potential downsides to getting into bed with big corporatations, especially given that, in some cases, corporate VC funds can sometimes come and go very quickly, based only on the whims of the parent company.

"It's true that corporate VC funds tend to be more tied to the marketplace. If a corporation had a lousy quarter, sometimes they won't make investments even if it's a great deal, so they may not be as reliable for a second or third round for participation," said Goldhaber.

"Imagine just it's just Claremont Creek and a corporate VC investing. Now it's time for a big expansion round, and the corporate VC fails to invest. Now the CEO has to go out and find another investor, rather than being able to rely on having everyone to participate. If a VC in early round ceases to participate, it can have a negative effect. Other investors might ask, 'Why did they not continue to invest?' So it can have a negative effect. It's much more work to replace that VC."

"There is a time delay in the cycle of when they come out and hit the market. Some corporations have an established track record of doing deals, while others start investing based on the emergence of the corporate VC structure, but then will retract when the market shrinks," Stephanie Palmeri, Partner at Softtech VC, said. "It's predicated on what is the mandate from the parent company. Are they structured to have longevity, or are they testing the waters to put some money into the workforce?"

On top of that, there are also potential issues with those corporations gaining too much information about the companies they invest in, which they can use to their own advantage.

"Where you have to be careful as an entrepreneur is if the corporate VC represents a company which is a likely acquirer of your company or could itself compete with you at some point. That could complicate future exit opportunities," Alex Gurevich, Partner at Javelin Venture Partners, said.

"It might still make sense to work with that corporate VC, but the pros have to outweigh that con. The ideal relationship is where the corporate VC is a potential customer or operating a non-competitive business."

Ultimately the message from venture capitalists was this: taking money from corporate VCs can be rewarding, but there are some big risks. Companies can certainly benefit from their resources, and the connections they make, but they should also know to protect themselves, both from giving away too many of their secrets, and from being potentially left out in the cold on subsequent funding rounds.

(Image source: tebogomogashoa.com)

Related Companies, Investors, and Entrepreneurs

Illuminate Ventures

Angel group/VC

Joined Vator on

Illuminate Ventrues is a Micro VC focused onEnterprise/ B2B cloud and mobile computing. Our team is made up of experienced investors with significant operating and investment track records, complemented by a world-class Business Advisory Council. We invest in US-based high growth, capital efficient companies, typically as the first institutional investor. Specific areas of interest include cloud computing, SaaS applications, Big Data , enterprise mobile, IIoT. Our portfolio includes game changing business solutions from companies like Bedrock Analytics, BrifhtEdge, Influitive, Yozio, Peerlyst, ChannelEyes and LitBit. Our recent exits include companies like Xactly (IPO), Opsmatic (acquired by New Relic), Sense Platform (acquired by Cloudera) and SimOPs Studios (acquired by Autodesk).

Illuminate Ventures is different - we don't rely on "pattern recognition" or following the herd. We seek new and innovative business ideas led by committed, talented teams. We recognize that great investment opportunities come in a variety of packages - sometimes looking a bit different from the norm.

Illuminate works closely with founders to support them in building truly great companies and teams. We've been there ourselves and know that teams made up of individuals with diverse backgrounds and skills deliver innovative thinking with outstanding results.

Javelin Venture Partners

Angel group/VC

Joined Vator on

Invests in early-stage tech companies with incredible potential, managed by teams of energetic, trustworthy and capable leaders. Key focus areas include digital media, Internet commerce, mobile and healthcare IT. Javelin looks for advanced bleeding-edge innovations, where the addressable market size is substantial and strong competitive advantages exist. A typical investment is between $1 to $4 million, with reserves for follow-on investments. In addition, Javelin also considers smaller seed investments for unique companies just getting started. Located in downtown San Francisco, while invests throughout the world. Javelin is a very active investor with a long-term outlook and the objective of creating substantial value.

Workday Ventures

Angel group/VC

Joined Vator on

Workday Ventures works with promising, early stage companies to fuel the next generation of enterprise applications. In addition to receiving funding to accelerate growth, portfolio companies will have the opportunity to gain strategic guidance from Workday's executives, board members, engineers, customers, and partners. Workday Ventures will focus on companies that apply data science and machine learning principles in the areas of analytics, applications, security, and platform technologies.

Canvas Venture Fund

Angel group/VC

Joined Vator on

Early-Stage Venture-Capital Investors

Not everyone is cut out for startups. There are easier ways to make a living. Yet you insist. Dismiss the odds. Defer the niceties that others take for granted.

At Canvas, we celebrate entrepreneurs. We have founded startups, worked at startups, and honor startups. We know it’s not just a job. It’s your life’s work.

- See more at: http://www.canvas.vc/#sthash.BzXmRdwL.dpufEarly-Stage Venture-Capital Investors

Not everyone is cut out for startups. There are easier ways to make a living. Yet you insist. Dismiss the odds. Defer the niceties that others take for granted.

At Canvas, we celebrate entrepreneurs. We have founded startups, worked at startups, and honor startups. We know it’s not just a job. It’s your life’s work.

Karen Griffith Gryga

Joined Vator on

Ben Narasin

Joined Vator on

Jack Young

Joined Vator on

Jack heads up the Qualcomm Life Fund (QLF) at Qualcomm Ventures, which has been ranked as one of the most active venture investors in digital health. He is also a fund manager at dRx Capital, a Novartis and Qualcomm joint investment company.

Alex Gurevich

Joined Vator on

Principal at Javelin Venture Partners. Investor in Thumbtack, WellnessFX, and Prismatic. Board observer at Skytree, PowerCloud, and AppFirst. Previously first employee at ooma and Principal at DFJ.

Adeyemi Ajao

Joined Vator on

Cindy Padnos

Joined Vator on

Cindy Padnos is founder/managing partner of Illuminate Ventures, an early stage VC firm focused on enterprise cloud and mobile computing. A prior founder herself, she is an entrepreneurial enthusiast!Related News