Daily funding roundup - February 17, 2016

Sprout Social landed $42M; Vitagene raised $5.5M; PokitDok received funding from Mckesson Ventures

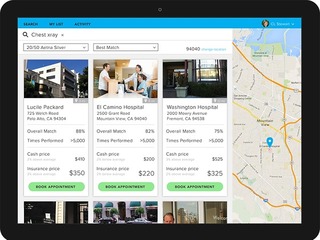

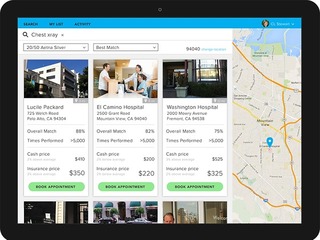

- PokitDok, a cloud-based API platform designed to make healthcare transactions more efficient and streamline the business of health, and the winner of winner of Vator Splash 2013, has taken a new round of funding. McKesson Ventures has made a "strategic investment" in the company, it was announced in a blog post on Monday, though the exact size of the round was not disclosed. PokitDok had previously raised a total of $39.6 million in total funding, most recently a $34 million Series B in August of 2015.

- Hometeam, provider of home care for seniors, raised $5 million in new funding from Kaiser Permanente Ventures, the venture capital arm of healthcare consortium Kaiser Permanente. In total, Hometeam has raised $38.5 million from IA Ventures, Lux Capital, Recruit Strategic Partners, and Oak HC/FT. (To learn more about Oak, check out our recently published interview with Nancy Brown, one of the firm’s venture partners.)

- San Francisco-based Vitagene that utilizes patient DNA, lab results, and lifestyle information, raised $5.5 million in seed funding. The round was led by Spectrum 28, with additional investors that include Viking Global Investors; Illumina, Inc.; Neil Hunt, Chief Product Officer of Netflix; Ken Goldman, SVP and Chief Financial Officer at Yahoo; and venture capitalist and entrepreneur, Yuri Milner.

- Delhi-based smartphone gaming platform, Gamezop, raised $350,000(INR 2.3 Cr.) in a seed round funding led by talent management firm Kwan. This round also saw participation from Snapdeal’s CPO Anand Chandrasekaran, redBus co-founder Phanindra Sama, US-based Powerhouse Ventures, TracxnLabs, Germany-based AECAL and Vinay Menon. The raised capital will be used by the company towards further building up its technology, distribution alliance and talent.

- Singapore-based cloud communications provider Wavecell secured a Series A investment of S$2.3 million (US$1.6 million) led by Qualgro Asean Fund, with participation from Wavemaker Partners. The self-funded startup was founded in 2010 and now claims more than 500 active enterprise customers across industries such as e-commerce, telecommunication, digital marketing and CRM (customer relationship management) platforms, finance, insurance, and transportation.

- LodgIQ, a NYC-based provider of a revenue optimization platform for the hospitality industry, secured $5 million in seed funding. The round was led by Highgate Ventures and Trilantic Capital Partners. Led by Ravneet Bhandari, CEO, LodgIQ has just launched its revenue optimization platform that leverages machine learning and data science to deliver recommendations and actionable analytics to players in the hospitality industry.

- Qualia Media, a SaaS-based marketing technology platform to target audiences based on multiple “consumer intent” signals, secured $5.5 million in Series B funding. The round was co-led by existing investor Verizon Ventures, the investment arm of mobile and broadband provider Verizon Communications, Inc. and expansion and growth stage venture firm S3 Ventures. On the heels of announcing Qualia’s merger with BlueCava and further enforcing the company’s position in cross-screen SaaS-based marketing solutions, the funding will be used to grow its fully integrated end-to-end cross-screen marketing solution.

- Rainforest QA, a San Francisco, CA-based provider of a QA-as-a-Service platform, raised $12 million in Series A funding. The round was led by BVP with participation from Rincon Venture Partners, Industry Ventures and Salesforce founder Marc Benioff. In conjunction with the funding, Byron Deeter, partner at BVP, will join Rainforest QA’s board of directors.

- YouAppi, a San Francisco, CA-based provider of a data-driven mobile customer acquisition platform, raised a $13.1 million Series B funding round. Backers included Hawk Ventures, Global Brain, Click Ventures, Digital Future, Emery Capital, Altair Capital, and existing investors Glilot Capital Partners, 2B Angels and Flint Capital. The company, which has raised $18.1 million to date, intends to use the funds to expand in China, Japan and other markets and enhance OneRun.

- Synlogic, a privately-held biopharmaceutical company developing novel medicines based on its proprietary synthetic biology and microbiome platform, closed a Series B investment round with $40 million in additional financing led by OrbiMed HealthCare Fund Management, bringing the total investment in its combined Series A and B financing to $70 million. In addition to OrbiMed, Deerfield Management Company and founding investors Atlas Venture and New Enterprise Associates (NEA) also participated in the financing.

- Sprout Social, a six-year-old Chicago company specializing in social media management software, has more than doubled its venture backing with a $42 million infusion led by the merchant banking division of Goldman Sachs. The Series C round, which also included previous backer New Enterprise Associates, brings total funding to $60 million. Sprout Social co-founder and CEO Justyn Howard declined to discuss the valuation.

If you are interested in being included in our funding roundup, submit your press release or blog post about your financing round to mitos@vator.tv.

Image source: webdesign.org

Mitos Suson

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsRelated Companies, Investors, and Entrepreneurs

NEA

Angel group/VC

Joined Vator on

NEA is the entrepreneur’s venture capital firm.

When it is time to take a promising business or business idea to the next level, entrepreneurs want a venture partner who understands and believes in the power of big dreams, bold visions and fresh ideas that have the power to change an industry, a sector, the world.

Moreover, entrepreneurs want a venture partner who knows what it takes—through first-hand experience and carefully nurtured relationships—to make a company succeed, to turn an idea into an action, and to make a plan a reality.

For more than 30 years, NEA has been helping to build great companies. Our committed capital has grown to $13 billion, including a $2.6 billion fourteenth fund closed in 2012. We invest across stage and geography in technology, healthcare and energy.

Remaining nimble as we’ve grown—with more than 65 investment professionals working out of our offices in the US, India, and China and investing across the globe—NEA is the entrepreneur's venture capital firm, consistently ranking among the top firms in portfolio IPOs each year. Since its founding, the firm has backed more than 175 companies that have gone public and invested in more than 290 companies that have been successfully merged or acquired—more liquidity events than any other venture capital firm.

Whether you are seeking investment to get your idea off the ground or looking to propel a proven idea toward greatness, NEA is the venture partner who will be there—because we’ve been there—every step of the way.

Related News

Subscription-based supplement company Vitagene raises $5.5M