Daily funding roundup - November 18, 2015

Ola bagged $500M; Joyable raised $8M; Test IO landed $5M

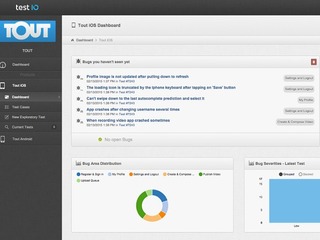

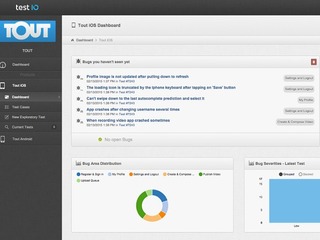

- TestCloud, a self-service crowdtesting platform for app and Web developers, has a new name and a big new round of funding, the company announced on Wednesday, all to facilitate a big expansion into the United States. Now known as Test IO, it raised a $5 million Series A round of funding from Turn/River Capital, a San Francisco-based firm that invests in growing technology, web and SaaS companies. The company had previously raised a seed round of $1.5 million, so its total venture capital raised is now $6.5 million. Previous investors included Heilemann Ventures, IBB, Richmond View Ventures and a group of serial entrepreneurs.

- Joyable, just announced an $8 million Series A round of financing, to help curtail social anxiety disorder. The round was led by NY-based Thrive Capital and Harrison Metal, who also invested in a $2 million seed round, that was announced earlier this year. That's $10 million in funding in less than two years, given that Joyable launched in January 2014. Since inception, Joyable has worked with thousands of clients. So far, 39% have seen a reduction in anxiety, based on the tests they take on Joyable. Clients pay $99 a month for a three-month service. And the goal for Joyable is that once they take the 12-month course, they've effectively treated their disorder.

- Ola Cabs, the ride-hailing company giving Uber a run for its money in India, announced today that it has closed a $500 million Series F round led by Baillie Gifford with contributions from previous backers Falcon Edge Capital, Tiger Global, SoftBank Group, and DST Global. The new round values the company at $5 billion. Also contributing to the round is Didi Kuaidi, the biggest ride-hailing threat to Uber in China, especially after new rules unveiled by the Chinese government appeared to favor locally-based services. To date, Ola has raised over $1.3 billion in funding.

- Hospitality management services startup Hostmaker has closed a $2 million (Rs 13.2 crore) round of funding, led by a consortium of new and existing investors, including early-stage venture capital firm DN Capital and Deepak Shahdadpuri-led DSG Consumer Partners. Proceeds from the seed round of funding will be used by the 18 month-old startup towards product enhancements and launching the second phase of its expansion plans to other European capitals. Hostmaker currently operates in London, Barcelona and Rome, and claims to to serve about 5,000 guests every month.

- Nuvolo Technologies, a New York, NY-based developer of enterprise applications on the ServiceNow platform, secured $2 million in seed funding. Backers included New Enterprise Associates (NEA) and ServiceNow. The company intends to use the funds to accelerate product development and the buildout of a global sales organization.

- Bengaluru-based Goodbox, a chat-based mobile application for businesses and their consumers, has raised $2.5 million from Nexus Venture Partners. The raised capital shall be used to upgrade tech, expand operations and acquire more merchants. Goodbox, which aims to get every business to create their store on the app and interact with customers, has tied up with over 1,200 merchants in Bengaluru, including supermarkets, restaurants, laundry chains, rental providers, movers and packers, canteens and salons.

- TuringSense, a Campbell, CA-based developer of wearable sports technology, completed $3 million seed funding round. Backers included Angel Plus, ChinaRock Capital, Ideosource, SV Tech Ventures, Zen Water Capital, along with several serial entrepreneurs and angel investors. The company intends to use the funds to expand R&D, marketing and sales in support of the launch of its first product, PIVOT, as well as to further develop solutions for a wide range of other potential markets such as other sport, physical therapy, insurance compliance, rehabilitation, posture correction and virtual reality/augmented reality and gaming.

- Jugnoo, a mobile aggregator for auto-rickshaws in India, today said it has raised $3 million (about Rs 19.8 crore) in funding from Paytm and others. The series B funding, which will be used to spur the Chandigarh-based company's growth, was led by Paytm, along with other participants, including FreeCharge co-founder and CEO Kunal Shah. The funds raised will also be used to streamline its operations in all new cities, Jugnoo said in a statement.

- Media and news startup ScoopWhoop has raised $4 million (about Rs 26.5 crore) in fresh funding from venture capital firm Kalaari Capital, the digital media company announced on Wednesday. Proceeds from the latest round of funding will be primarily used by the two year-old startup to expand its video production unit, ScoopWhoop Talkies, the company said in a press release. The exact terms of the transaction, however, were not disclosed.

- Malaysia-based startup Kaodim today announced it raised a $4 million series A round of funding led by Venturra Capital. Other participating investors in this round are Beenext, 500 Startups, and East Ventures. The company says it will use this funding to launch in other major cities in Southeast Asia and expand its product offerings to include other services in the home, lifestyle, wellness, education, and business categories, among others.

- Tuition.io, a market leader in student loan management, announced today that it has raised $5 million in Series A financing from MassMutual Ventures LLC, the corporate venture capital arm of Massachusetts Mutual Life Insurance Company (MassMutual); Wildcat Venture Partners; and Mohr Davidow Ventures, among others. This brings Tuition.io's total funding to $8.2 million. The new round of funding will help Tuition.io accelerate its enterprise customer acquisition; grow its sales, customer success and engineering teams; and further strengthen its position as the market-leading vendor for employer student loan contributions.

- APX Labs, makers of the Skylight smart glasses development platform, announced a $13 million investment today. The round was led by NEA, but there were several others parties involved including CNF Investments, GE Ventures, Salesforce Ventures, SineWave Ventures, and other unnamed investors. Today’s round brings the total raised to $29 million.

- Stuart, an on-demand, same-hour delivery startup that is currently pre-launch and operating in stealth, has raised €22 million (approximately $23.53 million) in funding, largely off the back of an idea and based on the track record of its three founders. They are Dominique Leca (who founded Sparrow, the email client acquired by Google), Clement Benoit (who previously founded and until recently was CEO of restaurant delivery service Resto-In), and Benjamin Chemla (co-founder and previously CEO of Citycake.fr, which Resto-In acquired in late 2014). GeoPost, a delivery subsidiary of Le Groupe La Poste, has led the Series A round and that Stuart’s founders remain majority shareholders.

- First Aid Shot Therapy (F.A.S.T.), a Burlingame, CA-based consumer healthcare company focused on over-the-counter (OTC) medicine in liquid shot form (40ml / 1.35oz.), completed a $24 million Series C financing round. The round was led by Johnson & Johnson Innovation – JJDC, with participation from new investors Lumira Capital and existing investors Sofinnova Ventures, Redmile Group and HealthQuest Capital, among others. The company intends to use the funds to expand its product portfolio.

- Mumbai-based ethnic etailer, Craftsvilla, has raised about $34 million in Series C round of funding led by existing investors Sequoia India and Lightspeed Venture Partners. Besides, Nexus Venture Partners, Global Founders Capital and Apoletto also participated in this round, taking the company’s value at $200 million, post investment. The raised funds will be utilised for marketing and international expansion. The company is already operating in Malaysia and is also planning to launch in Indonesia.

- Athos, a startup clothing maker, is taking the trend to a new level by creating smart shirts and pants that measure physical performance. The startup on Wednesday announced $35.5 million in new funding led by Social Capital, with participation from apparel company MAS Holdings, Lightspeed Venture Partners and Felix Capital. Existing investors DMC, early Fitbit backer True Ventures and angel investor Joe Lacob, the managing partner and chairman of the Golden State Warriors, also joined in.

- PlanGrid, a company that digitized the construction industry, announced today that it has landed a $40 million investment. Tenaya Capital led the round. Additional investors include Sequoia, Founders Fund, YC Continuity and Northgate. Today’s investment brings the total to over $58 million. PlanGrid CEO Tracy Young says they took the money, even though most of the Series A remains in the bank, because customers have been demanding they add new functionality to the product. The money should help beef up the development team to do that.

- Aiwujiwu, a Chinese rental and second-home listings portal, has completed a Series E round of funding worth $150 million round led by Temasek Holdings and Hillhouse Capital. Existing investors Morningside Venture Capital, Banyan Capital, Shunwei Capital Partners and GGV Capital also participated. It brings the total raised by Aiwujiwu to $350 million since the company was set up in March of last year.

If you are interested in being included in our funding roundup, submit your press release or blog post about your financing round to mitos@vator.tv.

Image source: www.mentorworks.ca

Mitos Suson

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsRelated Companies, Investors, and Entrepreneurs

NEA

Angel group/VC

Joined Vator on

NEA is the entrepreneur’s venture capital firm.

When it is time to take a promising business or business idea to the next level, entrepreneurs want a venture partner who understands and believes in the power of big dreams, bold visions and fresh ideas that have the power to change an industry, a sector, the world.

Moreover, entrepreneurs want a venture partner who knows what it takes—through first-hand experience and carefully nurtured relationships—to make a company succeed, to turn an idea into an action, and to make a plan a reality.

For more than 30 years, NEA has been helping to build great companies. Our committed capital has grown to $13 billion, including a $2.6 billion fourteenth fund closed in 2012. We invest across stage and geography in technology, healthcare and energy.

Remaining nimble as we’ve grown—with more than 65 investment professionals working out of our offices in the US, India, and China and investing across the globe—NEA is the entrepreneur's venture capital firm, consistently ranking among the top firms in portfolio IPOs each year. Since its founding, the firm has backed more than 175 companies that have gone public and invested in more than 290 companies that have been successfully merged or acquired—more liquidity events than any other venture capital firm.

Whether you are seeking investment to get your idea off the ground or looking to propel a proven idea toward greatness, NEA is the venture partner who will be there—because we’ve been there—every step of the way.

Lightspeed Venture Partners

Service provider

Joined Vator on

Lightspeed Venture Partners is a technology-focused venture capital firm that manages $1.3 billion of capital commitments. We closed Lightspeed VII, a $480 million fund, at the end of 2005. Over the past two decades, our partners have invested in more than 120 companies, many of which have gone on to become leaders in their respective industries. Our team invests in the U.S. and internationally from offices in Menlo Park, China, India, and Israel.

We are proud to have partnered with many exceptional management teams. Our investment professionals have contributed domain expertise and operational experience to help build high-growth, market-leading companies such as Blue Nile (NILE), Brocade (BRCD), Ciena (CIEN), DoubleClick (DCLK), Informatica (INFA), Kiva Software (acquired by AOL), Openwave (OPWV), Quantum Effect Devices (acquired by PMCS), Sirocco (acquired by SCMR), and Waveset (acquired by SUNW). Some of our recent exits include the top-performing tech IPO of 2006, Riverbed Technology (RVBD), and the top enterprise software acquisition of 2006, Virsa Systems (acquired by SAP).

Visit our website at www.lightspeedvp.com

Founders Fund

Angel group/VC

Joined Vator on

We are company founders first and investor second: we have built companies from the ground up, including PayPal, Facebook, Napster, Plaxo, Palantir Technologies, and Clarium Capital. We have experience from concept to realization, from shared offices to public offerings. Every stage of the company creation process is familiar to us, from finding seed capital, to building defensible products, scaling up the organization, and realizing lasting value for employees and shareholders.

Our current investments include Facebook, Slide, Geni, Powerset, IronPort Systems, Zivity, Quantcast, and Project Agape. Our fund is $50 million and we focus on investments in early-stage consumer Internet companies. We typically invest $500,000 - $1 million per investment. At the end of 2007, we raised $220 million for The Founders Fund II.

Nexus Venture Partners

Angel group/VC

Joined Vator on

Nexus Venture Partners is India’s most successful venture capital fund, with offices in India and Silicon Valley. Nexus team consists of former entrepreneurs and corporate executives, who have founded and scaled large global companies. The team has invested in a variety of companies that led to numerous public offerings and M&A transactions.

Nexus has an active portfolio of over 40 companies across technology, Internet, media, consumer, and business services sectors. The Nexus team plays an active role in helping entrepreneurs and management teams build market-leading businesses.

Nexus investments include Cloud.com (Cloud provisioning platform acquired by Citrix), Gluster (Open source cloud storage, acquired by Red Hat), Pubmatic (Publisher Ad revenue optimization), DimDim (Open Source Web Conferencing acquired by Salesforce.com), Snapdeal.com (Ecommerce marketplace), MapMyindia (Digital Navigation), Netmagic (Managed Services and Cloud infrastructure provider, acquired by NTT), Komli (Online ad network), Prana (Animation services), Druva (computing end-point protection), Unmetric (Social media analytics for business applications) and Bigshoebazaar (Online wholesale cash & carry platform).

500 Startups

Angel group/VC

Joined Vator on

500 Startups is an early-stage seed fund and incubator program located in Mountain View, CA. They invest primarily in consumer & SMB internet startups, and related web infrastructure services. Their initial investment size is typically $25K-$250K.

Selected areas of interest include financial services & e-commerce, search/social/mobile platforms, personal & business productivity, education & language, family & healthcare and web infrastructure.

Sequoia Capital

Angel group/VC

Joined Vator on

Sequoia Capital is a venture capital firm founded by Don Valentine in 1972. The Wall Street Journal has called Sequoia Capital “one of the highest-caliber venture firms” and noted that it is “one of Silicon Valley’s most influential venture-capital firms”. It invests between $100,000 and $1 million in seed stage, between $1 million and $10 million in early stage, and between $10 million and $100 million in growth stage.

Related News

Joyable gets $8M to tackle 3rd largest mental health problem