Healthtech shoots up as VC funding grows 125% in 2014

Venture funding for healthtech surpassed $4 billion, 258 companies raised at least $2 million

On February 12th, Vator will be holding its first ever Splash Health event in Oakland, where speakers such as Tom Lee, Founder & CEO of One Medical, and Ryan Howard, Founder & CEO of Practice Fusion, will be talking about the state of the healthtech space, and where they think it is going (get your tickets here).

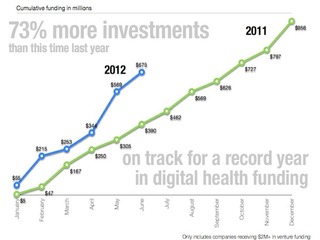

With that in mind, we will be spending the next month or so diving deeper into the healthtech space, starting with the 2014 Year in Review Funding Report from Rock Health, an accelerator-turned-VC fund, which has tracked digital health funding since 2011. The report shows how much money is flowing, how many deals have been made and how the space grew from 2013 to 2014.

Here is what it found:

Funding for health companies more than doubled year-to-year in 2014. By the second quarter of the year it had already surpassed the totals for 2013, and in the end rose 125% to a total of $4.1 billion. That is significantly higher than the 30% growth rate the space saw in 2013.

2014 was significant in another way as well: it saw average deal size grow for the first time in three years. After falling under $10 million in 2013, it ballooned 43% to $14 million in 2014. In all, almost 8% of all venture capital funding in the year ending with the third quarter of 2014 went into digital health, which is a new record, with 258 companies raising at least $2 million.

"This increase in average deal size was combined with record growth of 56%, leading to an overall record year for digital health companies," the report says.

In all, there were six significant categories that raised funding in 2014. From lowest to highest:

In all, there were six significant categories that raised funding in 2014. From lowest to highest:

- Population health management took in $225 million

- Personalized medicine took in $268 million

- Telemedicine took in $285 million

- Digital medical devices took in $312 million

- Health consumer engagement took in $323 million

- Analytics and big data took in $393 million

Telemedicine, or the delivery of healthcare services through virtual channels, such as phone or video, was also the category that saw the biggest year-to-year increase, growing by 315%. Payer administration grew by 269%, and digital therapies went up 266%, though neither was able to pass the $200 million marker.

When it came to venture stage, 2014 saw big growth in Seed and Series A. The round size of Series A went up 38%, while the Series B round size increased 61%.

According to the report, the most active investors in the healthtech space right now are Kleiner Perkins and Khosla Ventures, each with seven investments in 2014. Sequoia Capital and Andreessen Horowitz each made six.

Healthtech has also taken advantage of the recent rise in crowdfunding sites, including Indiegogo and Kickstarter.

Interestingly, there was an increase of campaigns on crowdfunding in 2014, with 187 in all, but that also lead to a decrease in success rate. It dropped 8% on Indiegogo, 20% on Kickstarter and 60% on MedStartr.

Kickstarter also seems to be the place for healthtech companies to go; even though it had fewer campaigns in had a much higher success rate and the 17 successfully funded campaigns made $4.5 million, almost at much as the $5 million that was spread across 30 companies on Indiegogo.

In terms of merger and acquisitions, Rock Health tracked 95 deals in all, which represented over $20 billion changing hands. The average amount per deal, for those that disclosed it, was $591 million.

There were also five health companies that went public over the last year: Care.com, Castlight, Everyday Health, IMS and Imprivata. The most likely companies to go public in 2015 include Fitbit, ZocDoc and Practice Fusion.

Rock Health recently raised its third fund, an undisclosed amount from Bessemer Ventures, Kaiser Permante Ventures, with participation from existing investors, such as Kleiner Perkins, Great Oaks Ventures, and Montreux Equity Partners. It will use the new money to invest in 20 to 30 companies.

(Image source: entrepreneur.com)

Related Companies, Investors, and Entrepreneurs

IndieGoGo

Startup/Business

Joined Vator on

IndieGoGo is a collaborative funding platform. Anyone with an idea (creative, cause, or entrepreneurial) can create a campaign on IndieGoGo, offer perks and raise the funds needed for execution - all while keeping 100% ownership. Customers range from artists (musicians, writers, filmmakers, etc.) who pre-sell their work as a way to fund it, to people raising money on behalf of charities to small businesses offering limited edition items or access to fund their start-up capital.

IndieGoGo launched the beta in 2008 within the film vertical. By 2009 IndieGoGo became the largest online film funding platform and brand. In 2010, IndieGoGo focused on further developing its funding tools and opened the platform to more verticals. Recent growth has been excellent at IndieGoGo including:

* Revenue up 24x in last year

* Funding projects from 134 countries

* 11,000+ projects

* Webby Award Nomination (versus Flickr, Vimeo & Digg)

Related News

Healthtech is taking off as the must-fund sector

Healthtech takes off with $2.2B in nearly 70 deals

Rock Health reveals 8 new startup investments

Rock Health startups to receive $100K each