Square is rumored to be talking to Goldman Sachs and Morgan Stanley about a possible IPO

As Twitter’s talked-to-death IPO gets ready to kick off today, rumors are bubbling of another big IPO on the horizon: none other than Jack Dorsey follow-on project Square.

Word on the street is that Square execs have been in talks with banks, including Goldman Sachs and Morgan Stanley, about a possible 2014 public offering, according to the Wall Street Journal. As of yet, no banks have been hired and no date has been set in stone.

That could be due in part to the fact that Square is not yet profitable (although really, join the club, right?). While the company has been valued at $3.25 billion, as much as 80% of its sales are handed over to credit card companies. That means that while sales are projected to come in at $550 million on payment volume of $20 billion, Square’s revenue will likely be $110 million to $165 million, according to insiders who spoke with the WSJ.

But Jack Dorsey has a plan. One insider told reporters that Dorsey has come up with a strategy that will make Square profitable by 2015.

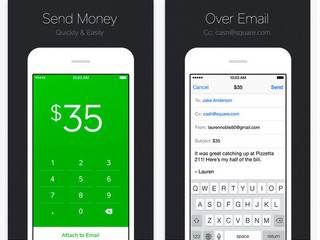

To that end, Square has been expanding its service to go beyond farmers markets to become a point-of-sale system for restaurants and stores, as well as an easy email-based payment system. Last month, Square announced Square Cash, a new service that allows anyone to pay anyone by simply sending an email.

Earlier this week, the company announced that Square Stand—the hardware for its point-of-sale system, Square Register—is now available in more than 1000 Staples stores and on Staples.com. Some 70% of businesses purchasing a Square Stand are either brand new to Square or didn’t use the service regularly before.

Square Readers are now sold in more than 30,000 stores nationwide, including at Apple, Best Buy, Staples, and Starbucks. It also sells Readers in more than 10,000 stores throughout Japan and Canada, and recently announced an expansion that will include 9,000 Lawsons in Japan and at London Drugs throughout Canada.

Last month, the company saw a major board shakeup, most notably with the departure of Starbucks CEO Howard Schultz just one year after joining the board following Starbucks’ big $25 million investment in Square. A Square spokesperson told VatorNews that it was always Schultz’s intention to only serve on the board for one year. During that year, Starbucks allowed Square users to pay by simply stating their name to the cashier (in some locations), and also set up a Square Directory, which let Square users know where the nearest Starbucks locations were.

Schultz was replaced by former Goldman Sachs CFO David Viniar. Viniar isn’t the only Goldman Sachs veteran on Square’s team. Last year, the company brought on former Goldman Sachs managing director Sarah Friar as CFO.

Square could not be reached for comment.

image source: betanews.com

Related News

Square sees a shakeup on its Board of Directors