Facebook, Yahoo and Zynga all point to mobile futures

Which company has the best shot at transitioning? Their strategies, and how analysts are reacting

Facebook, Yahoo and Zynga all released their earnings reports this week. Each of them beat expectations and saw a rise in stock price accordingly. But there was another theme that emerged from these three companies, especially in their conference calls following the results. Facebook CEO Mark Zuckerberg, Yahoo CEO Marissa Mayer and Zynga CEO Mark Pincus all pointed to mobile as an integral part of their strategy going forward.

Let’s take a look at what the strategy is for each of these companies, based on what their CEOs said, and how the analysts are reacting to see which company has the best chance of transitioning to mobile.

- Strategy

On his conference call, Zuckerberg called it a "myth" that Facebook cant make money on mobile. He said that it was "the most misunderstood aspect of Facebook today,” and lamented that people underestimate how good the trend toward mobile can be for the social network.

There are three reasons mobile is so good for Facebook: it can reach more people on mobile than desktop, people on mobile use Facebook more often, and in the long-term Facebook will be able to monetize better for the amount spent on mobile than on desktop.

Facebook will be able to reach more people on mobile than desktop because, in coming years, there will be billions more smartphones than desktop computers. Facebook is already reaching one billion people worldwide, and over 600 million mobile, up from 376 million the year before.

Facebook is also the most widely downloaded app on every smartphone platform, he said, so it is well positioned to reached growing smartphone population.

People are only 40% likely to use Facebook on a desktop computer, but 70% more likely to use FB on mobile during a given day. Also, since updating its iOS app in September, Facebook has seen over a 20% increase in iOS engagement in terms of likes and comments.

Zuckerberg believes that the increased engagement, along with how ads must be integrated into the app, will lead to increased monetization on mobile. And analysts seem to so far agree.

- Analyst reaction:

After the call, JP Morgan analyst Doug Anmuth wrote that he was “encouraged by CEO Mark Zuckerberg’s reiteration that mobile can ultimately monetize better per time spent than the desktop and that the company’s overall mobile opportunity is underestimated.”

“We believe 3Q results set the stage for material mobile advertising adoption in 2013, particularly as marketers go through their annual budgeting process for the new year, which we expect will increasingly include Facebook.”

In a report, Arvind Bhatia of Sterne Agree called Facebook’s mobile advertising revenue ”quite impressive given FB began showing mobile ads only at the end of 1Q this year.”

Bhatia said the stock a “buy” because the “strong mobile performance in 3Q should help alleviate some of the concerns surrounding the ongoing mobile transition for Facebook.”

Citi analyst Mark S. Mahaney also converted Facebook stock to a “buy.”

Facebook made its mobile strategy very clear, and so far it seems to be quite impressive.

Yahoo

- Strategy:

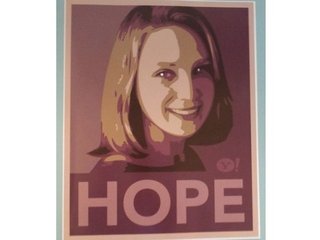

On her conference call, Mayer called mobile not “only a daily habit, but a fundamental platform shift. A platform shift we have to ride and participate in order to be relevant.”

While Mayer said that Yahoo had “made progress” on the mobile front, the company was behind because it had no effectively optimized the site for mobile, had under invested in mobile development, and had splintered the brand into 76 applications across Android and iOS.

“All of this needs to change. Our top priority is a focused, coherent mobile strategy. We’re accelerating our efforts to build a strong, technical talent base for mobile. This includes engineers, product managers and designers.”

Mayer outlined the most frequent uses of smartphones: checking the weather, checking sports scores, checking stock quotes, and other financial information, watching videos, sharing photos, getting the latest news, and playing games.

“Sound like any company you know?” she joked, saying that Yahoo, because it already had these verticals, was particularly suited for mobile.

“We will continue to work with top partners and media companies to further build and scale these opportunities. We’ll strive to make the tablet use, more social, engaging, beautiful and compelling.”

Thursday, Yahoo made what many see as its first step toward getting Yahoo onto mobile by acqu-hiring the team at Stamped, a startup that allows users to record and share recommendations. The Stamped team will be creating a new product for Yahoo that has not yet been disclosed.

- Analyst reactions:

Analysts seemed mixed on Yahoo's strategy, praising it but also remaining cautious about its ultimate destination, according to Forbes.

“Overall, we’re encouraged by new management’s early comments and believe the strategy centered around daily habits – search, communications, the homepage, and mobile – is appropriate,” Anmuth wroye. “At the same time, however, we recognize that management’s views on strategy were fairly high-level and we need to hear more and see better execution over upcoming quarters to become more constructive on the story."

CLSA Asia-Pacific Markets analyst James Lee wrote that, while he finds the plan to be "ambitious," there may be too much going on at once.

"Given the intense competition in each of the segments, execution is challenging due to potential twists and turns down the road."

Noruma analusy Brian Nowak said that he was "encouraged by the strategic vision and tangible examples of action" to fix Yahoo, but that "it is important to bear in mind that these initiatives will take time to improve monetization and garner incremental ad dollars.

Zynga

- Strategy:

During the company's earnings call, Pincus talked extensively about mobile, and how Zynga plans to capitalize on its growing mobile base.

Pincus first admitted that gaming integration onto smartphones and tablets was faster than the company had anticipated, and he said that this was part of the reason that Zynga had fallen short of its own expectations and had been forced to reduce its expectations for the year.

Zynga is in a good place to capitalize on the opportunities presented in mobile.

Its mobile game network now ranks #4 in the U.S. of all mobile apps, not just games. It also has three of the five most popular mobile games in the U.S.

Zynga’s mobile network reaches 30% of all smartphone users, and they play Zynga’s mobile games for more than 10 billion minutes a month.

Mobile now accounts for 20% of Zynga’s total bookings. It has more than doubled the average quarterly mobile DAUS, and grown quarterly bookings 172% year to year.

Still, Pincus says, the real opportunies lie ahead, so Zynga now plans to launch two new Web and, and four new mobile games, per quarter.

"We have reorganized our game teams in the third quarter to unite Web and mobile development," Pincus said, noting that all new games released in the past quarter had a tablet or mobile version.

"That's a huge change for our company," he said.

- Analysts reactions:

Obviously mobile is crucial for Zynga’s survival, but analysts did not seem to overly impressed with the company's strategy going forward.

“Mobile monetization appears to be well below web monetization levels making it difficult for Zynga to offset lost game usage from Facebook,” Anmuth wrote.

“We think multiple expansion is unlikely given a tougher marketing environment for Zynga games on Facebook going forward and mobile (off Facebook) monetization remains less than half of web (primarily Facebook games) monetization levels.”

Bhatia said that the company's announced partnership with bwin.party to offer real money online Poker and Casino games in the UK market, as well as the announcement that its Board of Directors had authorized a share repurchase program, which would authorized Zynga to repurchase up to $200 million of its outstanding Class A common stock, were encouraging, they were not enough to bolster the stock.

"For any meaningful share appreciation, the core business needs to turnaround meaningfully and we think there is little visibility on this front currently."

Ben Schachter, an analyst at Macquarie Capital, said that the transition from desktop to mobile is a key one for Zynga, writes Venturebeat.

“As users migrate to mobile, Zynga has neither first-mover advantage nor, so far at least, sustainable execution,” Schachter wrote. “We are simply not willing to give them the benefit of the doubt until we see proof of execution. Stated another way, we attribute very little value to their core game business until they prove that it can be run profitably.”

Conclusions

Of all three companies, analysts seem to have most confidence in Facebook's mobile plan going forward, perhaps because it was the most clearly outlined. They are intrigued, but cautious, about Yahoo, and they seem the least impressed by the prospects for Zynga.

(Image source: https://azzcatdesign.com)

Related Companies, Investors, and Entrepreneurs

Zynga

Startup/Business

Joined Vator on

Zynga is the largest social gaming company with 8.5 million daily users and 45 million monthly users. Zynga’s games are available on Facebook, MySpace, Bebo, Hi5, Friendster, Yahoo! and the iPhone, and include Texas Hold’Em Poker, Mafia Wars, YoVille, Vampires, Street Racing, Scramble and Word Twist. The company is funded by Kleiner Perkins Caufield & Byers, IVP, Union Square Ventures, Foundry Group, Avalon Ventures, Pilot Group, Reid Hoffman and Peter Thiel. Zynga is headquartered at the Chip Factory in San Francisco. For more information, please visit www.zynga.com.

Mark Pincus

Joined Vator on

Marissa Mayer

Joined Vator on

Related News

Marissa Mayer makes first acquisition as CEO

Facebook shares pop 9% in after-hours, on solid Q3

The Marissa Mayer effect: Yahoo shares up 5.7%

Facebook stock takes off, opens up 24% after Q3 results