Crowdfunding debate - Dave McClure vs Michael Stocker

Should we protect grandma? Or aren't housing, gambling, stock markets just as risky as startups?

The JOBS Act crowdfunding provision may well be a game-changer for the average American. Now the average retail investor has the opportunity to invest in startups. But investing in startups is extremely risky business. A recent study showed that 75% of venture-backed businesses fail. And, VCs are investing for a living. It may be the case that allowing retail investors to invest in this risky asset class will make them all broke.

At the same time, the stock market has been flat for a decade, interest rates are low and homes (once considered a good nest egg) have not been the best investment. So why should investing in startups be any riskier? For that matter, why should gambling be considered less risky?

To figure out whether the crowdfunding act is a good law or a reckless one, we held a debate at Bullpen Capital and Vator's Venture Shift event this past summer.

Dave McClure, 500 Startups founder, and securities lawyer Michael Stocker from Labaton Sucharow LLP debated the pros and cons of the law. Dave McClure was pro, and Michael Stocker was con. Roger Royse, attorney at Royse Law Firm, was the moderator.

In a nutshell, here's the take-away arguments (edited):

Will crowdfunded startups be considered super risky, second-tier assets?

Stocker (con): Any startup that opts to raise money via crowdfunding may not be able to raise money from venture capitalists or sophisticated angels. Kate Mitchell, founder of Scale Venture Partners, said she'd prefer to look at investments that were funded by angels vs retail investors. There will be a negative view of these startups. They will be considered second-tier investments.

McClure (pro): It doesn't matter how these startups raise money, as long as they can produce a great product, I'd invest. Also, I don't think tech companies will be the primary issuers on these portals.

Are we bringing together the highest-risk assets with the least financially able?

Stocker (con): There is the Grandma's going to eat dog food risk: Crowdfunding will bring together the highest risk investments with those who can least afford it.

McClure (pro): It's a free country. We should all be able to take risks. There are other "riskier" or at least as risky ways to lose money (e.g. housing, stock market, gambling).

Are these assets just too illiquid? Or are they as illiquid as other assets?

Stocker (con): It’s a very illiquid market. It’ll be a long time to unload it. Grandma is going to be stuck with that. The risks stay with the retail investor for a very long time.

McClure (pro): The same grandmother who buys the condo in Florida, that’s underwater also has a security on her books that she’ll have a very difficult time selling. This law already provides restrictions on maximum ownership, based on available and percentage of income. There’s vast other parts of our economy that have no restrictions possible.

Is crowdfunding good for startups or is there too much liability for them?

Stocker (con): There's substantial liabiliy for startups. If you were sloppy, and someone gave you information that you should have checked out and you didn’t, retail investors can sue you with a very easy standard.

McClure (pro): I think we should be concerned about the lobbying ability of plaintiff lawyers. I don’t think it’s good for the United States to put undue legal cost structures on companies. Right now accredited investors have to self-declare themselves to companies they invest in. I think this just opens up the market to other players.

Bambi Francisco Roizen

Founder and CEO of Vator, a media and research firm for entrepreneurs and investors; Managing Director of Vator Health Fund; Co-Founder of Invent Health; Author and award-winning journalist.

All author postsRelated Companies, Investors, and Entrepreneurs

Roger Royse

Joined Vator on

Michael Stocker

Joined Vator on

I represent institutional investors in securities litigation, corporate governance, and regulatory matters.

Dave McClure

Joined Vator on

Kate Mitchell

Joined Vator on

Kate co-founded Scale Ventures & invests in software. Active in policies for start-ups, she chaired the IPO Task Force – the basis for the JOBS Act. Kate is also on the board of Silicon Valley BankRelated News

Dave McClure: Get your laws off my startup!

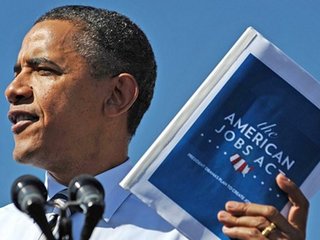

President Obama to sign JOBS Act this week

Is the JOBS Act evil? Or just misunderstood?

Is the JOBS Act evil? Or just misunderstood?