JOBS Act - who's for it and who's against it?

Will the bill spur new jobs the way proponents say it will?

The Jump-start Our Business Start-ups (or JOBS) Act has already passed the House and the Senate. Now, all that has to happen is the House needs to pass the Senate revisions, which is expected to happen this week, and then President Obama will sign it into law.

The bill has many supporters in Silicon Valley, including Google, AOL co-founder Steve Case, investor Ron Conway, Lotus founder Mitch Kapor, and the National Venture Capital Association (NVCA). The bill is also supported by Vator.

On the other side, there are also numerous opponents, including AARP, which came out opposed to the JOBS Act because it "lacks vital investor protections and undermines regulations that guard against fraud and abuse," and former New York Governor Eliot Spitzer, who accused it of pulling back on key regulations that were designed to protect investors in the past 10 years.

The question becomes: what kind of impact will this bill have on small business start-ups and the economy in general? Another question is: Will this bill open the door for new IPOs? Or will it provide more incentive for companies to stay private?

These are open-ended questions that change depending on who you're talking to: the opponents or proponents.

Emerging Growth Companies

One part of the bill essentially creates a new category of public companies. The JOBS bill would exempt businesses that have under $1 billion in annual revenue to conform to certain regulations for up to five years. These companies are called “emerging growth companies.”

Under normal circumstances the regulations, which were put in place in the last decade, would require a company to hire an independent auditor to assess the way the company is operating internally. Companies would also be allowed to prolong registering with the SEC, as the bill raises the number of shareholders they must have to 2,000, up from the previous number of 500.

This part of the bill appears to provide incentive for companies to stay private longer since they don't have to register with the SEC until they reach 2,000 shareholders. This part of the bill also seems to make it easier for companies to go public because it loosens the laws around regulatory requirements that is often cost-prohibitive for companies considering to go public.

So how does it create jobs? The $1 billion ceiling on regulation would spur job growth since it would provide an incentive for companies to go public, instead of selling.

The the cost savings for new IPOs would allow them to spend more money on growing and hiring.

“We don’t want the next generation of great companies that have the potential to go public to be sold.We want them to raise their own capital by going public and growing as stand-alone enterprises. Imagine if Microsoft, Apple, Intel or FedEx were acquired instead of going public. Ninety-two percentof job growth comes after an IPO; if companies keep choosing to be acquired we are sacrificing significant job growth over the long term,” the NVCA wrote.

Conflict of interest deregulation

In the most controversial part of the JOBS act, limitations that are normally placed on how a company would be allowed to work with investors promoting their stock are repealed. The JOBS Act now prohibits the SEC “from adopting or maintaining any conflict-of-interest rule or regulation.”

The language in the bill specifically states that, “A broker, dealer, or member of a national securities association may arrange for communications between a securities analyst and a potential investor” and the SEC cannot stop “a securities analyst from participating in any communications with the management of an emerging growth company that is also attended by any other associated person of a broker, dealer, or member of a national securities association whose functional role is other than as a securities analyst.”

Mitch Kapor, founder of Lotus, told me that he is “most enthusiastic about the clarifications regarding accelerators, incubators, and exchanges that make clear a set of conditions under which they don't need to register as broker-dealers” but the wording of the bill provoked harsh condemnation from Spitzer, who wrote an op-ed for Slate last week, in which he called the bill "appalling" and "Orwellian."

Spitzer blasted it as "a bill that should in fact be called the 'Return Fraud to Wall Street in One Easy Step Act'.” He also accused Congress of "merely respond[ing] to the commands of Wall Street capital."

Crowdfunding

Crowdfunding is another part of the bill that will ignite job growth and promote investment as companies will be able to raise money from non-accredited investors, in other words: anybody.

It is almost the same thing as an IPO, but with the company not having to provide as much disclosure. The company will be allowed raise up to $1 million annually, and will not have to make its shares public. This number goes up to $2 million if the company provides the SEC with audited statements.

Kapor told me that he is “pleased the Senate bill added more small investor protections on crowdfunding which were lacking in the House version,” and Google has stated that crowdfunding “could jumpstart a new model of job creation and investment” and that it “could be a critical piece of the economic recovery puzzle.” This section of the bill was even cited by AARP as a section they supported, despite their reservations with the bill as a whole.

There are some who fear that it will lead to massive fraud due to a lack of regulation and oversight, but the bill passed by the Senate does require the business to warn investors that there are risks when it comes to investments, requires that the business “takes reasonable measures to reduce the risk of fraud with respect to such transaction” and that they give the investor their address and website, which must be kept up to date."

Key supporters of the bill

The JOBS Act has turned out to be something quite rare in Washington these days: it has bipartisan support. It originally passed the House by a vote of 390 to 23, and then passed the Senate 73 to 26.

Its key supporters include Republican members of the House, Represenative Patrick McHenry of North Carolina, Majority Whip Representative Kevin McCarthy of California, House Majority Leader Eric Cantor of Virgina and Representative Spencer Bachus Alabama, as well as Republican Senators Scott Brown of Massachusetts, John Thune of South Dakota and Pat Toomey of Pennsylvania.

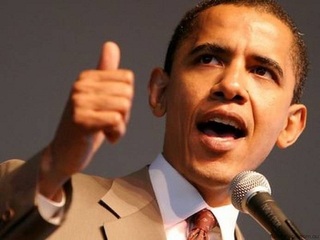

On the Democratic side it is supported by Representative Anna Eshoo of California and Representative Barney Frank of Massachusetts, as well as Senate Majority Leader Harry Reid of Nevada, Senator Jeff Merkley of Oregon, Senator Michael Bennet of Colorado and President Obama.

(Image source: crowdsourcing.org)

Related News

Small Business Factoring 101

Barack Obama, CEO of a new startup: America