Wallaby secures $1.1M to combine all your credit cards

No more trying to remember which card gets bonuses on gas, travel or others, Wallaby has it set

The cloud-based wallet that helps consumers pay for different items based on the credit card rewards that fit best, has just secured a $1.1 million seed round.

The round was led by Founders Fund Angel and included participation from WI Harper Group, SLP Ventures, Lion Wells Capital and other individual investors. The startup a part of the Santa Monica incubator MuckersLab's inaugural class this year.

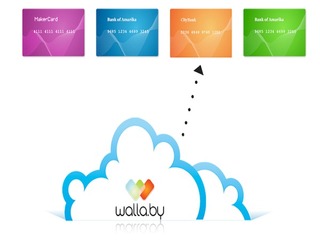

Launched in June, this new company combines all of your existing credit cards onto one card and then decides which of your credit card to route your transactions to.

The young Santa Monica company provides you with a single physical credit card and digital wallet where you register all of the cards you wish and allocate which ones you want to use for gas purchases, retail purchases and grocery purchases, then when you swipe the Wallaby card it will automatically route payments to the rewards card in your digital wallet that gives the best rewards.

The service also has a companion mobile app that also lets you override the defaults on the spot so you can take advantage of other deals on the spot.

And since it can be hard to remember on the spot which card is giving cash back for groceries right now, Wallaby thinks that creating defaults will get people the most rewards for their spending.

The first 1,000 users to sign up for the company’s beta will receive a lifetime membership benefit and the next 5,000 users will get a free card for twelve months. New users beyond these first beta users will receive six months of free service. After that, Wallaby will cost $50 per year.

Wallaby also supports card linked offers, allowing retailers to provider social and loyalty promotions to consumers without the need for point-of-sale modifications or in-store training. Wallaby cardholders benefit from additional savings on top of their rewards earnings automatically when they use their Wallaby Card.

The card will carry a network brand (it is unclear if it will be Visa or MasterCard just yet), so it can be used just like any other credit card anywhere that brand is accepted.

It will still be a few months before it opens its system, allowing anyone to create an account.

Are you tired of playing the card game where you debate which credit card to plop down based on which one has the best rewards and the most available credit? I know I am. And this is why I am intrigued by a new company that claims to be able to track all of your cards and spending preferences and consolidates it into one card that transmits the transaction to the appropriate credit or debit card.

I guess we will just have to wait and see how it works when it becomes available to all.

Related News

Wallets ready? Groupon to IPO at $25B

Wallaby wants to consolidate your wallet

Lemon adds digital wallet, $8M funding round