Apple stock still slips ahead of Q2 earnings report

Tech giant expected to share mixed results that could continue to sink stock

Apple shares have been experiencing a steady slide since hitting a record high two weeks ago, raising concerns about the company growth just as the quarterly earnings report is set for release at the close of trading today.

Apple (NASDAQ:AAPL) has been trading down 11% from the stock’s record high of $644 (on April 10) and opened this morning at $562.61.

Early morning trading also had the company down about 1%.

This market slippage is, lets not forget, happening to the most valuable company with a market cap of $600 billion -- to keep everything in perspective.

Analysts have described this drop in price as a technical correction after all the booms it has experienced from iPhone and iPad launched and report after report securing the company as the leader in mobile technology.

Shares of Apple hit the $600 milestone for the first time in March -- just ahead of the new iPad release.

The numbers everyone will be looking for

Aside from the always relevant revenue number, everyone will want to know just how many iPhones and iPads the tech giant has sold and what percentage that is of the company's total sales.

Bernstein Research, in a note to investors last week, pointed out the lackluster Mac sales estimates and reduced number of launches as reasons for the falling share price. Nonetheless, the firm still held Apple as its "top pick," giving it a target price of $710.

Many are anticipating that the company has sold close to 30 million iPhones, which would be up more than 10 million from the 18.6 million the company sold during the same quarter last year, but down from the 37 million from Apple's holiday quarter.

Analysts also expect Apple to announce iPad sales close to 12 million, up significantly from the 4.6 million iPads Apple sold the same quarter a year ago, but down from the 15.43 million Apple sold in its previous quarter.

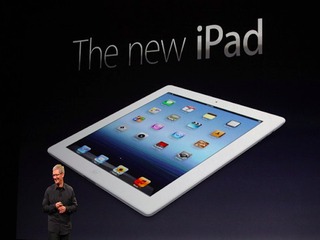

Apple sold more than 3 million new iPads during the product’s first weekend in stores. That was at least triple the number of iPad 2 tablets that analysts estimated the company sold during that product’s opening weekend last year. While breaking the previous releases' record is now an expected move, the fact that it is triple is astounding and shows that there is no slowing rate at which people are snapping up these amazing screens.

The new iPad, released in March offered the best display screen in the market, a better camera, a faster processor and support from AT&T and Verizon’s LTE network.

Apple CEO Tim Cook announced those record-breaking iPad sales numbers the same weekend when he explained that Apple would initiate a dividend and share repurchase program.

The tech giant will use $45 billion over the next three years of the near $98 billion of cash it has on hand.

The company said it plans to offer a quarterly dividend of $2.65 a share sometime in the fourth quarter of its fiscal 2012 -- which begins July 1.

So for the second time in the history of the company, it will offer a dividend.

Related News

Apple losing tablet market share, but still on top

Apple hits all-time high in tablet market-share demand

Tim Cook: "Apple is not going to change"

Apple on track to be market leader by 2013

NEW iPad looks the same as iPad 2, but better specs

Apple fans download 100M apps on Mac App Store in 2011