America's living room: More Internet, less wired cable

People are supplementing broadband Internet streaming with free broadcast TV rather than pay cable

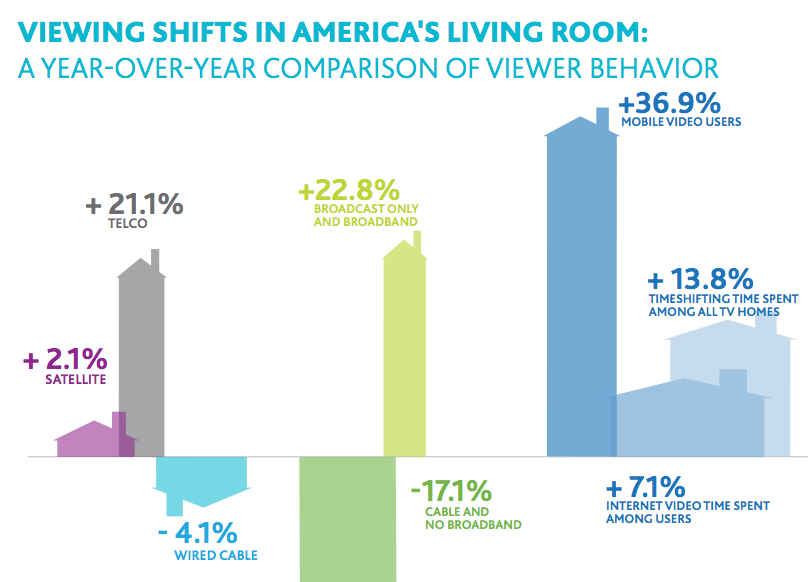

As the video viewing options trend more toward broadband support and on-demand viewing, the use of wired cable and satellite is seeing serious slumps.

The number of U.S. homes that have broadband Internet, but only free, broadcast TV, is rapidly growing in popularity, according to a Nielsen report out Thursday. Even though the percentage of the market that has broadband Internet and basic broadband cable makes up less than 5% of TV households, the slice of the market has grown 22.8% over the past year. And I am one of those people. More people accept broadband Internet as a bill that is as mandatory as water and heat, but why pay for cable when the Internet provides plenty of the content you watch, on-demand. That adjustment from paying for satellite or wired cable usually saves $100+, even after factoring in a Netflix streaming plan.

Money and audience are definately in the streaming video market, especially since we reported last month that Hulu hit the 1.5 million paying customers mark. That's a 5X growth rate from the 300,000 paying subscriber base signed up to Hulu Plus at the end of 2010. Hulu Plus offers more shows, movies, ad-free viewing and access to full series' rather than selected episodes. The company grew 60% from 2010 to approximately $420 million in revenue for a service that allows users to watch Hulu content on their computers, TV, gaming devices, tablets and smart phones.

Several other companies are also looking to democratize the streaming of content online at an affordable rate, such as the young video hosting company MoPix, which wants to take out the distribution middleman that makes streaming contnet harder to get directly from the online environment. Thus far, the companies that gain the most viewing time spent and most of the ad dollars are the big distribution companies, so companies like MPix want smaller video producers and those looking to provide a "DVD experience" (by adding in short, extras, outtakes, and interviews right in the content) a new way to play to their audience.

Households that use the broadband/broadcast-only are also streaming video twice as much as the general population -- and watch half as much TV.

While using broadcast cable isn't exactly cutting the cord, it is a big shift to focusing on the Internet video content that has been beefing up over the last two years -- as Netflix and Hulu have expanded their catalogs, YouTube has started paying for premium original content and Amazon has entered the streaming business.

Broadcast-only homes spent 122.6 minutes per day watching TV compared with cross-platform homes’ more than double time viewing video -- 265.5 minutes.

Nielsen also found numbers to support all the efforts that programmers have made to bring traditional TV to the mobile world -- finding that mobile video consumption has risen 36/9% over the last year.

This mobile trend and most of the cross-platform interest is spurred by the younger generation jumping on new technology and bringing it into the home environment. The study found that people between the ages of 12 and 34 are spending less time in front of the TV (120.56 monthly minutes) and more time in front of smartphones, laptops and tablets.

This mobile trend and most of the cross-platform interest is spurred by the younger generation jumping on new technology and bringing it into the home environment. The study found that people between the ages of 12 and 34 are spending less time in front of the TV (120.56 monthly minutes) and more time in front of smartphones, laptops and tablets.

While getting rid of the TV may never be a reality -- how we consumer TV is clearly changing. A staggering majority of TV households (90.4%) still pay for a TV subscription, and roughly two-thirds (75.3%) pay for broadband -- but the time spent on TVs versus other devices is shifting.

The time that people ages 18 to 34 spent watching video on the Internet per month was 6 hours and 52 minutes while the older age group of 55+ was just 2 hours and 10 minutes on average.

Since 2008, there has been a serious move to adopt time-shifted or on-demand viewing. Compared to the Q3 of 2008, people watching time-shifted TV has increased by 65.9%. And this growth wasn't just in the adoption of DVR technology, but also the time spent using such device popped up 66.1% over the last year.

As Americans evaluate the different ways to consume video media, it is interesting to see just which methods are more rapidly adopted and what it seems to replace. In this evolution, it appears that mobile video and Internet streaming seem to be putting any concept of watching programs when they are scheduled to run right out the window.

Related Companies, Investors, and Entrepreneurs

MoPix

Startup/Business

Joined Vator on

MoPix provides the framework content creators need to brand, distribute and sell their work via the web, Apple iOS and Android devices and other mobile platforms and digital media products. The company closes the gap between traditional distribution channels and the demand for direct distribution by giving amateur and professional content creators a turnkey way to monetize video and feature content in a digital marketplace. MoPix has offices in Los Angeles, CA and Portland, OR.

Related News

Study: 71% of Web users visit online video sites

Online video use continues to rise in U.S.