JLL Spark, which launched a $100 million real estate technology fund this summer, has been pretty busy putting its capital to work.

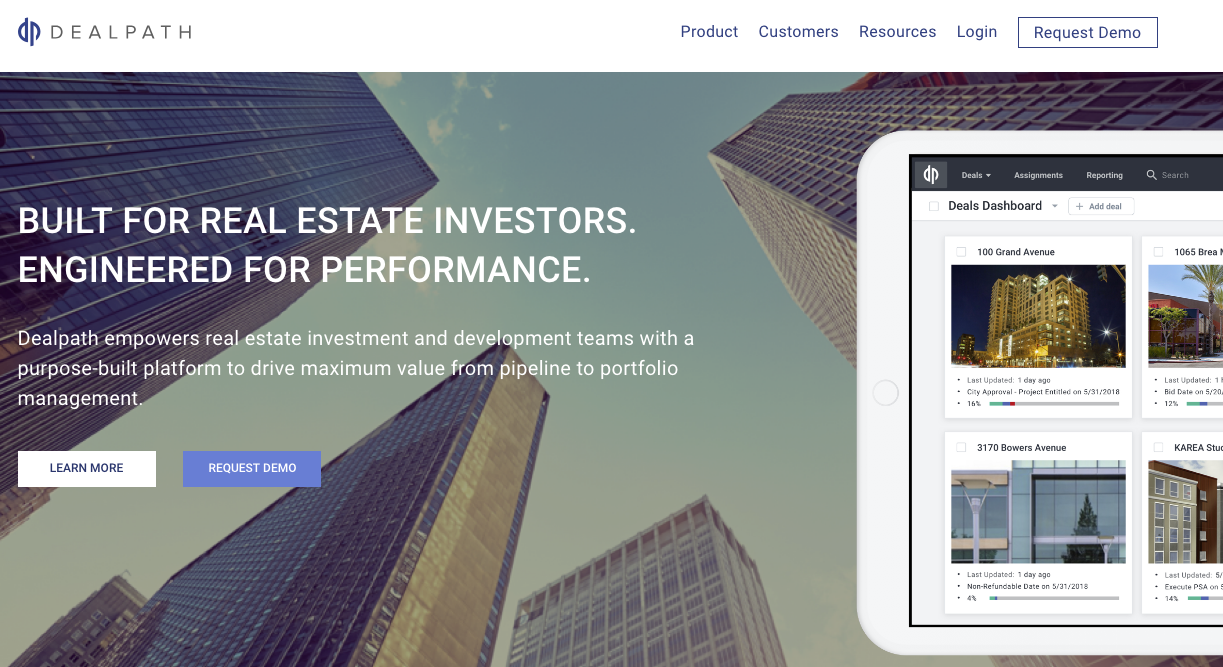

The firm announced its investment in Dealpath, a deal-management SaaS solution for real estate investors to collaborate on investment opportunities.

The amount was not disclosed but is a single investment at the same terms as Dealpath’s $8 million Series A round almost two years ago in October 2016. At that time, the company, which was founded in 2014, raised financing from Formation 8, LeFrak, Milstein, Bechtel, Goldcrest Capital and Deep Fork Capital.

“What they are doing is addressing a pain point for our clients,” said Mihir Shah, Co-CEO at JLL Spark, which makes investments between a few hundred thousand dollars to a couple million. As we wrote this summer, JLL Spark’s investment sweet spot is startups developing products that can help JLL investor customers [people who buy and sell commercial real estate]. As you can imagine, the deals are complex, requiring collaboration from different parties and a number of material that has to be accessed, evaluated and organized. The platform also allows investors to access their deal history.

Dealpath is unique and has a competitive advantage because its platform is focused solely on real estate deals, said Shah. “Once they become the de facto platform managing those workflows, they become a great starting point to build upon.” Today Dealpath has several hundred firms using its platform and get paid based on the number of investment partners, which can be as few as five and into the hundreds.

And JLL has a good way to start building on Dealpath’s progress since its clients are similar to Dealpath’s.

“When we looked at their target list of investor clients, we saw a lot of overlap. And this is a big criteria for us as we want to show the company and ourselves a clear path to value.”