UnitedHealth Group makes $10M investment in Appalachian community health

Invest Appalachia Fund will invest in affordable housing, clean energy, and community revitalization

Read more...

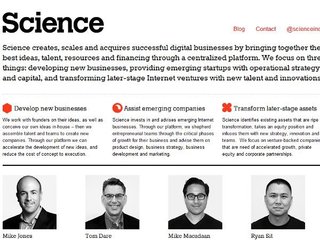

When former MySpace CEO Mike Jones launched Science in 2011, he purposely skewed away from the traditional venture model, instead deciding to become something of an incubator. That meant creating and developing its own business ideas in-house.

Since then it has seen some big successes, most notably Dollar Shave Club, as well as DogVacay and EVENTup, but one thing it wasn't able to do was continue investing in some of those big companies as they raised later rounds.

In order to stay with its companies, Science has raised $75 million fund for its first venture fund, it was disclosed in a filing with the SEC. The fund closed on Wednesday of this week.

"In the past, and currently, we incubate these businesses and at times those businesses become successful. We've always had a desire to follow on our financing path with these companies. As an incubator, we're really not set up to do that so, as these companies scale, we rely on our venture partners, typically in Silicon Valley, to provide the follow on financing. The desire here is how can we also participate in those follow on financings?" Jones told me in an interview.

He specifically brought up Dollar Shave Club, noting that, when it raised its Series A, B and C rounds, Science was not able to continue to invest. This fund gives Science the ability to move forward with its successfully incubated companies.

While this is Science's first official venture fund, it is named Science Ventures Fund II in the filing.

"The prior vehicles were incubators, which are structured a little bit differently than venture funds. It's listed as Venture Fund II because most people think it's our second venture fund because they don't really differentiate an incubator vehicle from a manager fund. It is technically it is our first fund but our second vehicle," Jones explained.

This fund does represent one big change for the firm: it plans to set aside 20 percent of the fund for external investments, meaning that it will be, for the first time, putting money into companies it has not incubated itself.

That will free the firm up, in a couple of ways, allowing it to be stage and sector agnostic, though Jones did say that these outside investments will still likely be early stage and in the sectors Science has expertise in, including mobile media.

"I think the outside companies will be a little bit more opportunistic, so if we find something that doesn't directly relate to our thesis, but it's a company we really believe in or where we believe in the management, we'd have freedom to do those deals. I do believe that we we try to leverage our expertise on what we spend time on, and there are these sectors that we've very good at, and generally we’re going to have a dominant portion of the fund invested in those sectors," he told me.

It also won't change anything in terms of the companies it incubates, in terms of what it looks for or the kind of traction it wants to see from them.

"Over and over again we see that the teams are everything, but the other things we look for are people where they're venturing into spaces where we have experience. If somebody's starting something in commerce, in mobile, in social, in crypto, we are very comfortable in those areas and I think that we add a lot to those industry segments. Who's the team, what are they going after and do we think we have a unique and propitiatory knowledge or skill to make them more successful than they would be on their own?" said Jones.

Right now, he said he couldn't tell me how much funding Science plans to invest in companies out of this fund, nor how many companies it would be putting money into, as neither is being publicly disclosed.

With this latest fund, Science now has $135.2 million under management.

Complimenting the incubator model

In a previous interview with Vator CEO Bambi Francisco at Vator Splash LA back in 2014, Jones had said that he didn't believe that a venture fund was the right way to go because it would hinder his ability to make companies successful.

"In order for us to create breakout hits, a lot of times startups need resources beyond what they can afford. Unfortunately, the way that venture capital is structured, you typically don't have the operational budgets at the VC level to really have resources to make sure those companies become successful. Generally, VCs have two things they can primarily do: they can fund companies, or they generally can replace management. Outside of that, it's really hard for them to really operationally help the growth of a business. My thought was, "If I'm going to be in the business of identifying great, early stage entrepreneurs, levering them up, hopefully become the next great leaders inside the industry of technology, I want to have a lot of resources to provide them to be very successful," he had said back then.

"I just simply couldn't do that through the financial structure that was venture capital. I could do that through the financial structure that is an operating company. So, I chose to do that because I wanted to be spending my time on building hits. And I wanted to have a lot of resources to really make sure those companies become successful, and the only was I was able to do it was as our studio."

Talking to Jones now, his attitude seems to have shifted. He now believes that a venture fund is actually a necessary component to compliment the incubator model and to make it successful.

"We believe really heavily in incubation, and we've spent quite a few years now focused on it and are really comfortable with the incubation model. I think the incubation model, if done right, is paired with a fund. It makes a ton of sense. As an incubator, we end up with a better than average view into the data and activities of our portfolio companies, and to not leverage that for future investing decisions against a traditional fund would just be silly. I would expect in the future, as more people potentially explore incubation as a method for early stage company creation, I think the fund component is a natural fit," he said.

When I asked him if he wishes he had started the venture fund earlier, so he could have invested in Dollar Shave Club's later rounds, Jones noted that it took some time to see that the incubator model worked well enough to justify raising a fund to go with it.

"There's a natural challenge in the structure and the relationship between the incubator and the fund that has not really been figured out before as far as who compensated, who owns what, how the LPs participated in what various vehicles you have active. It took us a few years to see that incubation was effective," he said.

Invest Appalachia Fund will invest in affordable housing, clean energy, and community revitalization

Read more...The firm, which now has over $4 billion in assets under management, invests across all stages

Read more...Founded by Ignition's Kellan Carter and Cameron Borumand, Fuse will invest in B2B software companies

Read more...

Joined Vator on