We’ve all likely been in the position at one point or another of wanting, or needing, to make a big purchase, but we either don’t have the money to pay it off all right now, or we don’t want to pony up $1,000 in a single purchase. Of course, there’s the option to still put the charge on your credit card and pay it off monthly, but trust in banks and financial institutions is pretty low at the moment.

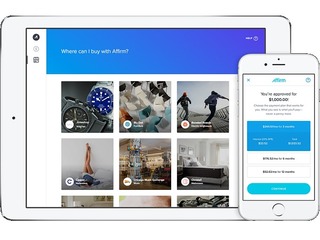

Instead people can turn to Affirm, a company that offers installment loans to consumers at the point of sale. The company says it is looking to reinvent personal credit by helping people finance large purchases by breaking them down into small, monthly payments.

Here’s how it works: Customer shop online and see the option to pay over time with Affirm. They select Affirm as their payment method at checkout, then fill out a few fields for a real-time decision.

They choose the payment plan that fits their budget, which breaks down to paying off the loan in either three, six or 12 months. The merchant processes their order, Affirm settles the full amount with them, and the customer pays Affirm over time.

Affirm makes it easy to repay the loan, send out email and SMS text messages to remind the customer of upcoming payments. Users can pay theur Affirm bills online, by debit card or ACH transfer, and sign up for autopayment.

The company makes money the same way that a credit card does: by charging interest of between 10 percent and 30 percent.

So, let’s say, for example, that you buy something for $1,000, you have 20 percent interest and you pay it off in three months. The total interest will be $33.52. At six months it will be $59.14 and at 12 months you’ll pay an additional $111.61.

That’s all the customer pays on top of their purchase, as Affirm does not charge for paying off the loan early, or any late fees.

“The corresponding finance charge is the only fee associated with an Affirm loan – we don’t charge late fees, service fees, prepayment fees, or any other hidden fees. We strive always to be more transparent and fair than any other form of financing,” the company writes.

That doesn’t mean that the customer is fine not paying their loan on time, though, of course. There are pretty drastic consequences for not paying off a loan, including negative affects on their credit score.

“You won’t incur any late fees, but late payments may make it harder for you to qualify for credit from Affirm in the future. Late payments may also negatively affect your credit history. For loans requested on or after August 3, 2016, Affirm reports information about your loan and payment activity to Experian,” the company says.

It may also refer delinquent accounts to collection agencies. So, in short, pay your bills!

Founded in 2012, Affirm has raised $520 million in funding from investors that include Khosla Ventures, Spark Capital, Lightspeed Venture Partners, Andreessen Horowitz and Founders Fund. Its most recent funding, a $100 million round in April of last year, valued the company at $800 million.

Some of the companies that accept Affirm include Expedia, Wayfair, Casper, Eventbrite and TheRealReal.

In April, Affirm issued its one millionth loan.

(Image source: affirm.com)