It’s a good time to be a venture capitalist. Even with the market squeeze, they are having no trouble raising new funds, often over $1 billion. The cash is flowing like water.

It’s not just the big firms that are raking it in, Smaller firms are also raising funds, like Forerunner Ventures, which just raised $122 million, according to a filing with the SEC on Wednesday.

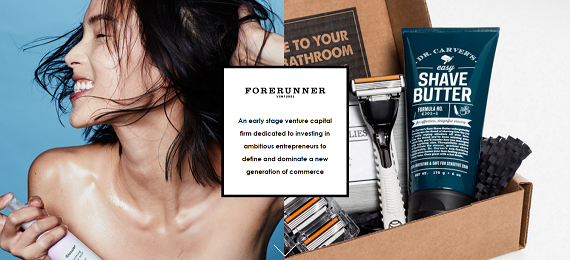

Founded in 2007, Forerunner is an all-female led early stage investment firm, with a focus on e-commerce, Internet, and retail technology. It invests in companies post-launch, and looks for startups “that are tackling big markets, bringing something new to the table, and executing scalable business models.”

Despite being relatively young, the firm has already made some very high profile investments, putting money into companies like Birchbox, Dollar Shave Club, Jet, Wanelo and Warby Parker.

“To us, an investment means joining your team. Being on your team means showing up. Showing up means being the first call you make when you need real help — honing your business model, being smarter as you scale, building your team with the right people, navigating blindspots, and developing a sound capitalization strategy,” Forerunner says on its website.

This is Forerunner’s largest fund to date. It’s first fund, closed in 2012, was $40 million. Its second was a $75.5 million fund.

VC funds in 2016

2015 was the best year for VC fundraising since 2006, with $35.5 billion in total capital committed to VC funds, and, so far, 2016 is looking even better.

Venture firms in the United States raised $12 billion in the first quarter of this year. Not only does that equal an increase of dollars by 59 percent year-to-year, it’s the best fundraising quarter since Q2 of 2006, when $14.3 billion was raised.

Some of the big fundraisings in the quarter included General Catalyst, which raised an $845 million fund, and Battery Ventures, which was able to raise $950 million, in February. In March, Lightspeed Venture Partners raised $1.2 billion across two funds.

Accel Partners raised $2 billion across two funds. That number is not far off from the record VC fundraising, which is $2.8 billion, raising by New Enterprise Associates for its fifteenth fund last year.

Andreessen Horowitz had the largest VC raise of the second quarter, with Fund V, a $1.5 billion venture capital fund the firm closed in June. That was followed by Kleiner Perkins’ $1 billion KPCB Digital Growth Fund III, which it closed last week.

The crown, however, goes to New Enterprise Associated, with closed its fifteenth fund with $2.8 billion in committed capital to its core fund, along with an additional $350 million for its NEA 15 Opportunity Fund. Together, that adds up a total of $3.1 billion, for the largest VC fund ever raised.

(Image source: forerunnerventures.com)