M&A roundup - week ending 12/3/16

Twitter bought Yes; Apple acquired Indoor.io; Fandango purchased Cinepapaya

Read more...

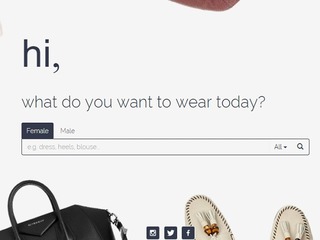

Kik, a Canadian mobile messaging app acquired fashion advice bot Blynk. No financial terms of the deal were disclosed.

Blynk, which calls itself "your free personal stylist in your pocket," is kind of like Tinder for fashion, allowing users to swipe through different looks. It then provides fashion recommendations that are personalized to each user, in order to help them determine their style.

The two-year-old Toronto-based startup, which has no venture financing, started as a mobile app and then became a chat bot on Kik, called blynkstyle. The app won Montreal’s International Startup Festival in 2014 and was also named top retail startup at the 2015 Fintech and Retail EXPO, run by Silicon Valley’s Plug and Play Tech Center.

All four Blynk employees will be joining Kik, where they will work on chat bot experiences.

Microsoft acquired messaging company Talko. No financial terms of the deal were disclosed.

The team from Talko will be coming to work on Skype. With Talko's technology and team coming over to Skype, it's no surprise that the app will be shutting down over the next few months. The plan is to have it shut down by March of next year. The company promises to allow its current users to request an export of their past Talko conversations, including voice, text, and photos.

Originally known as Cocomo, and launched in September of last year, the company raised $4 million in 2012 from unknown investors.

RNTS Media acquired Heyzap, a provider of mobile advertising for app developers. The deal is initially worth $20 million in a cash consideration. In addition, there are potential earn-out payments in cash and shares of up to $25 million upon achievement of certain ambitious targets until 2017.

Heyzap’s technology and product will be combined with RNTS' subsidiary Fyber. Heyzap expects to more than double its ad revenues under managementin the coming year and to reach USD 20m in revenues for 2016. It has been profitable in the second half of 2015.

Founded in 2009, Heyzap raised $8 million in venture funding.

Oracle, the enterprise software provider, acquired container operations platform StackEngine. No financial terms of the deal were disclosed.

All StackEngine employees will be joining Oracle as as part of Oracle Public Cloud.

Founded in 2014, StackEngine builds software to automate the scaling, resiliency, and deployment of applications, putting the power and control into the hands of developers who know how the application should run, to meet the goals of the business.

The company had raised $4.5 million in venture funding.

Salesforce acquired up quote-to-cash vendor SteelBrick today for $360 million. The deal is for $360 million in stock, according to the 8-K form Salesforce filed with the SEC.

SteelBrick provides Next Generation Quote-to-Cash apps that built native on the Salesforce Platform and Salesforce1 Mobile. SteelBrick CPQ generates accurate sales quotes, proposals, orders and contracts. SteelBrick Billing manages billing, payments and revenue recognition.

Founded in 2009, SteelBrick had raised $77.5 million in venture funding.

Aerospace company Airbus entered into an agreement to acquire 100% of the shares of the Navtech group of companies, a provider of flight operations solutions. No financial terms of the deal were disclosed.

Closing of the acquisition is subject to customary regulatory approvals for such type of transactions.

Navtech serves more than 400 aircraft operators and aviation services customers worldwide with a suite of flight ops products, including electronic flight bag solutions, aeronautical charts, navigation data solutions, flight planning, aircraft performance, and crew planning solutions.

The company generates annual revenues of around $42 million and employs over 250 employees.

CoreLogic, a property information, analytics and data-enabled services provider, entered into a definitive agreement to acquire FNC, a provider of real estate collateral information technology and solutions. The deal is worth $475 million.

FNC automate property appraisal ordering, tracking, documentation and review for lender compliance with government regulations.

The transaction is expected to close during the first quarter of 2016 and is subject to customary closing conditions including regulatory clearance. Evercore acted as exclusive financial advisor to CoreLogic and provided a fairness opinion for the transaction and O'Melveny & Myers LLP served as legal advisor. FNC was represented by Wells Fargo Securities as exclusive financial advisor and Butler Snow LLP as legal advisor.

Invoice Cloud, a SaaS payment acceptance and invoice presentment platform, acquired the majority of ImageVision.net, the company behind the HealthPay24 product. No financial terms of the deal were disclosed.

HealthPay24 is in use by hospitals across the country, to extend its high adoption, electronic bill presentment and payment (EBPP) presence into healthcare. The team at HealthPay24 is well equipped to leverage this investment into an expanded presence across the country.

Founded in 2009, ImageVision had raised $7.52 million in venture funding.

Tyco International reached a definitive agreement to acquire ShopperTrak, a provider of retail consumer behavior insights and location-based analytics. The deal is worth approximately $175 million in cash.

The addition of ShopperTrak to Tyco's recent acquisition of FootFall, a global provider of retail traffic analytics based in the U.K., will capture data from 35 billion shopper visits annually.

ShopperTrak currently generates approximately $75 million of annual revenue. This transaction, which is subject to customary closing conditions and regulatory approvals, is expected to close in Tyco's fiscal second quarter.

ShoreTel, a provider of phone systems and unified communications solutions, acquired Corvisa, a provider of cloud-based communications solutions, from Novation Companies. No financial terms of the deal were disclosed.

This acquisition allows ShoreTel to expand its cloud services in Europe as a result of acquiring Corvisa's Amsterdam and UK data centers. It expected to accelerate ShoreTel's fiscal 2017 hosted revenue growth to at or around 30%.

Founded in 2012, Corvisa had raised $30 million in venture funding.

(Image source: aksports.com)

Twitter bought Yes; Apple acquired Indoor.io; Fandango purchased Cinepapaya

Read more...Oracle acquired Dyn; Tesla completed the deal for SolarCity; Google bought Qwiklabs

Read more...FanDuel and DraftKings merged; Facebook bought FacioMetrics; Hulu acquired The Video Genome Project

Read more...