(Updated with comment from CB Insight)

Anecdotally, at least, Bitcoin seems to still be a space that investors either don’t understand, or don’t fullytrust yet. There’s no doubt that this is changing, but it doesn’t seem like the mindset it altering that quickly.

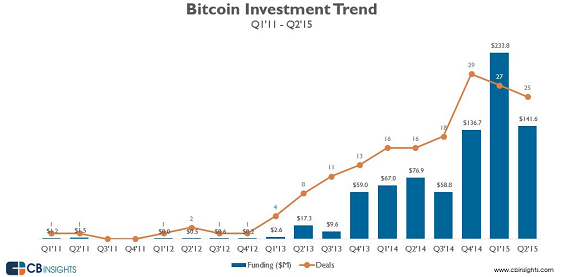

The data, however, shows something else. Bitcoin investments are up in 2015. Way up. So much, in fact,that the first six months of this year have already outpaced all of 2014, according to data out from CBInsights on Thursday.

Bitcoin startups have raised $375 million in the first two quarters of 2015, a numbers that 11% higher thanthe funding raised in all the quarters of 2014 combined. The number of deals has jumped even higher,growing 63% from the first half of last year.

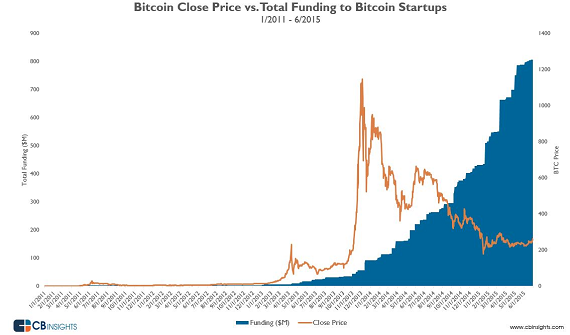

One of the reasons that investors have been somewhat weary of Bitcoin in the past is that it is, to say theleast, somewhat unstable. The price fluctuates wildly, and no investor wants to be caught with their pantsdown if the digital currency crashes.

Yet, that no longer seems to be much of an issue. Bitcoin hit a record high in November 2013, and hasbeen pretty steadily dropping since then, yet investments in the space keep rising.

Why this is happening is not really clear at the moment. It is likely that investors believing it the price, onceBitcoin truly does go mainstream, will eventually start to rise again. Or maybe they have just gotten usedto the volatility in the price, and it no longer phases them.

According to CB Insights research analyst Matt Wong, who put this data together, the price of Bitcoin hasnot had much of an effect on how investors look at the space.

“When it comes to the price of Bitcoin versus the funding amount, funding has not been tied to the price.Investors are thinking more about the long term potential of what blockchain can do, and what can be builton top of it,” he said.

“It should be noted that with some rounds, the time they announced can be after they receive funding, so it can be hard to say when those fundings happened, but, by and large, I don’t think that it has had any effect on overall interest.”

The data also showed the five biggest rounds raised by a Bitcoin startup so far this year.

The largest funding round in the space was digital currency company 21 Inc, which raised $116 million from investors that included Andreessen Horowitz, RRE Ventures and Qualcomm Ventures in March. That was followed by Bitcoin wallet Coinbase, which raised $75 million in a Series C round led by DFJ Growth, with participation from Andreessen Horowitz, Union Square Ventures, and Ribbit Capital in January.

Bitcoin consumer finance company Circle raised $50 million in a Series C round led by Goldman Sachs and IDG Capital Partners in May. All of its existing investors, including Breyer Capital, General Catalyst Partners, Accel Partners, Oak Investment Partners, Fenway Summer, Digital Currency Group, Pantera Capital, and strategic individuals also participated.

Digital currency startup Ripple Labs raised $28 million in a Series A round from IDG Capital Partners, along with AME Cloud Ventures, ChinaRock Capital Management, China Growth Capital, and Wicklow Capital in May.

And, finally, New York bitcoin exchange itBit closed $25 million in a Series A fundraising from RRE Ventures, Liberty City Ventures and investor Jay W Jordan II in May. Raptor Capital Management chairman James Pallotta also participated in the round.

As for who is investing in Bitcoin, its been a lot of the bigger firms, including Benchmark and Accell, according to Wong.

“The amount of startegic interest is not just coming from VCs. Goldman Sachs recently did an investment, so did the New York Stock Exchange. Its also financial services and strategic investors, and that’s been a development over the last year.”

(Image source: thecoincave.com)