Digital health news, funding roundup in the prior week; December 06, 2021

Harrison.ai raised $92.3 million USD, Droplette secured $15.4M,

Read more...If you are interested in being included in our funding roundup, submit your press release or blog post about your financing round to mitos@vator.tv.

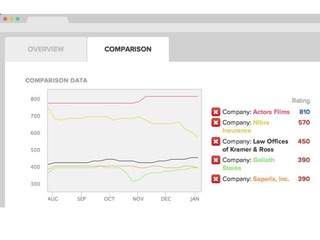

Image Source: startups.co

I produce Vator Events and enjoy the challenge. I am learning and growing a lot, being involved with Vator and loving every moment of it!

All author postsHarrison.ai raised $92.3 million USD, Droplette secured $15.4M,

Read more...Amazon Health sells healthcare services to Hilton; Athenahealth acquired for $17 Billion

Read more...How Microsoft can transform healthcare delivery; Trusted has raised $94M; Aptihealth landed $50

Read more...Angel group/VC

Joined Vator on

Spark Capital is a venture capital firm that partners with exceptional entrepreneurs seeking to build disruptive,

world-changing companies.

Founded in 2005 by Todd Dagres, Santo Politi and Paul Conway, Spark Capital is a tight-knit group of partners managing approximately $1,500,000,000 across four funds. We have offices in Boston, NY and San Francisco, but invest across the globe. Whether you need $250,000 in seed funding or $25,000,000 to establish category leadership, we can work with you.

Spark invests across a number of key market segments including: advertising & monetization, marketplaces, cloud & infrastructure, social, mobile and content. We don’t simply study these markets; we are active users of the products in which we invest. Spark’s portfolio includes companies such as Twitter, Tumblr, Foursquare, AdMeld, Adapt.tv, ThePlatform and 5Min. The Spark team has previously backed notable companies such as Akamai Technologies, Qtera, Aether Systems and Novatel Wireless.

Partnering with exceptional entrepreneurs is Spark’s first principle. From first time founders to seasoned entrepreneurs, we strive to work with individuals who aim to fundamentally transform important markets or create entirely new ones. We leverage our wide-ranging experiences, honed product & business instincts and extensive networks to help entrepreneurs build great companies.

Angel group/VC

Joined Vator on

SoftTech VC is one of the original micro VC firms, founded in 2004 and backing over 135 early-stage start-ups. Based in Palo Alto, the firm manages two institutionally-backed funds and invests in Silicon Valley, New York, Southern California, Boulder and Canada. SoftTech VC is among the most active investors in early stage consumer Internet and B2B startups, consistently investing in 20 new opportunities a year. We seek great entrepreneurs, differentiated products and large market opportunities. More information available at www.softtechvc.com.

Founder and managing partner Jeff Clavier launched SoftTech VC in 2004, making the original 20+ investments (our non-traditional ‘Fund I’) as a business angel, investing his own capital, time and experience. As one of the original ‘super angels’ in the valley, Jeff developed SoftTech VC’s implementation of the micro-vc concept which has become so popular.