Updated to include comment from Saemin Ahn.

Japanese e-commerce giant Rakuten has been quite pleased with its own investment activity, and it’s decided to spread its venture capital wings. The company announced the launch of its new $100 million fund Monday, which follows on the heels of its $10 million Southeast Asia fund.

The new fund will zero in on early-stage startups in the U.S., Israel, and Asia Pacific that will provide “financial returns with strategic relevance” to Rakuten.

The fund will be spearheaded by Saemin Ahn, the Managing Partner of Rakuten Ventures, who will be the fund advisor. All operations will be run out of Singapore.

“As the fund is still young, we are still working to define the niche sector of investments that we aim to specialize in,” said Ahn in an email to VatorNews. “For now, we’re interested in the mobile sector, anything related to tangible consumption, not just data but overall financial transaction, data receivable and transferal standards. We want to see where the deficit is in innovation, and focus on opportunistic investments that fill the needs we see in the market today.”

Ahn also headed the Southeast Asia fund, which was launched in 2013 and has averaged one investment per quarter. Among its investments are peer-to-peer marketplace Carousell, visual search startup Visenze, payments company Coda Payments and file-sharing platform Send Anywhere. Rakuten also led Pinterest’s $100 million round back in 2012 that valued the company at $1.5 billion.

“If you just look at the last couple of years, companies like Waze and Viber are great examples of companies taking on massive issues like transportation and communications, breaking them down to their basics, and providing an engaging and sticky user experience that people have come to love and depend on,” said Ahn in a statement. “More Asia-based VCs are venturing out into different regions to look at investment as long-term growth vehicles. Since 2013, Rakuten Ventures has been one such VC to aggressively invest larger amounts into younger companies, to enable them to focus on product and service development.”

The company says that while the initial focus will be on Israel, the U.S., and Asia Pacific, Rakuten Ventures aims to expand and take its investment focus worldwide.

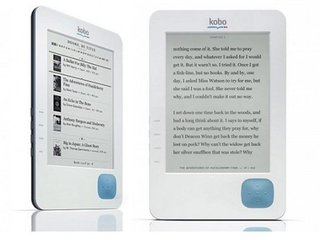

In February, Rakuten acquired messaging app Viber for $900 million—just one of a string of acquisitions Rakuten has made over the years. Last year, Rakuten seemed to be honing in on video startups with the acquisition of Spanish video streaming company Wuaki.tv, as well as video streaming platform Viki for $200 million. In 2011, Rakuten acquired the flailing e-reader Kobo for $315 million.

Rakuten cleaned out 2013 with more than $5.1 billion in revenue, up from $4 billion in 2012, and $429 million in net income. By comparison, Amazon saw $74.45 billion in revenue and $274 million in net income in 2013.