The financial industry is ripe for social innovation and NY-based Finect wants to be leading the charge when it comes to servicing the financial services industry.

Finect, which was founded last year, officially launches Tuesday as a professional network for financial service providers, such as investment advisors and asset managers. It’s meant to address the growing need for the highly-regulated finance industry that needs to stay compliant in a world where communication and marketing often take place across disparate social media channels, and not just emails.

In the financial world, every email communication must be recorded. So if you’re using social media to market yourself or communicate, that information must also be recorded. That’s a big pain in the butt to do, especially for smaller financial services firms or independent advisors.

Finect wants to help independent advisors and smaller firms be compliant with record keeping and tracking, as well as social.

“There are many shortcomings of other social networking sites that prevent professionals from using social media in an easy and compliant way,” said Jennifer Openshaw, President of Finect, and a former columnist colleague of mine when I worked at Dow Jones MarketWatch.

“We’ve talked to over 100 firms and advisors,” she said. “They all feel that LinkedIn is great for general networking. But it’s not created with a specific focus for our industry – connecting around finances.”

As one customer said of Finect, “Compliance – yuck. The fact that Finext has integrated everything – compliance for dummies – makes ist a no-brainer.”

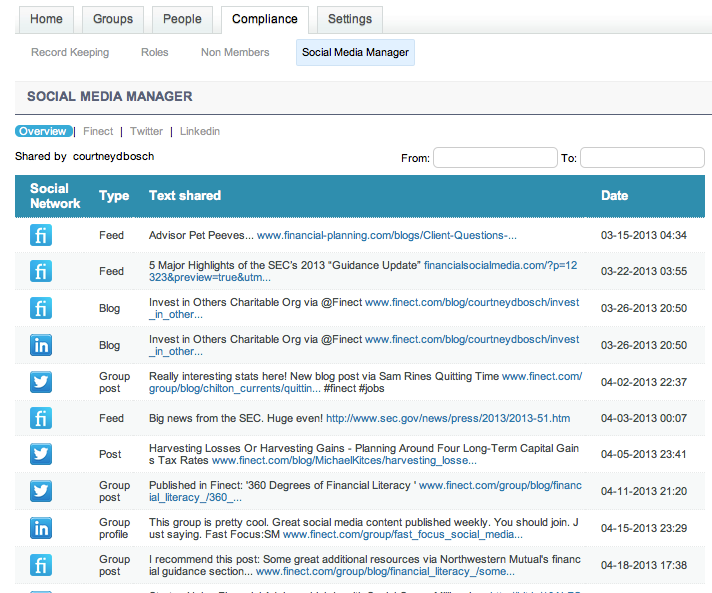

As you can see in the below screen shot, a person – the asset manager or compliance officer or social media manager of a financial services company – can see all the social media posts on one dashboard. They can also be sure to have it all tracked and recorded for compliance issues.

Anyone managing the social media communications can easily see the latest activity of the group of people they’re tracking.

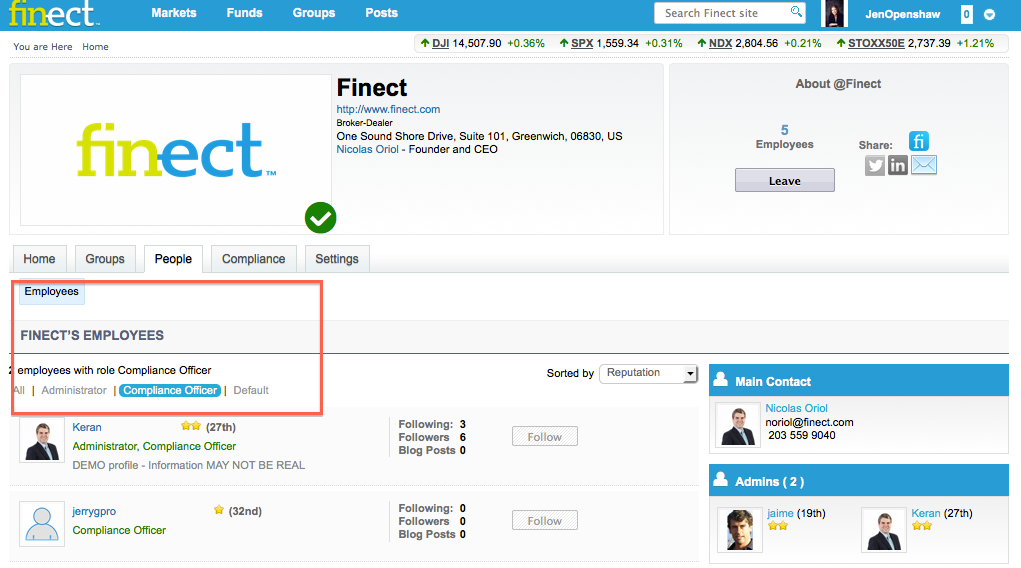

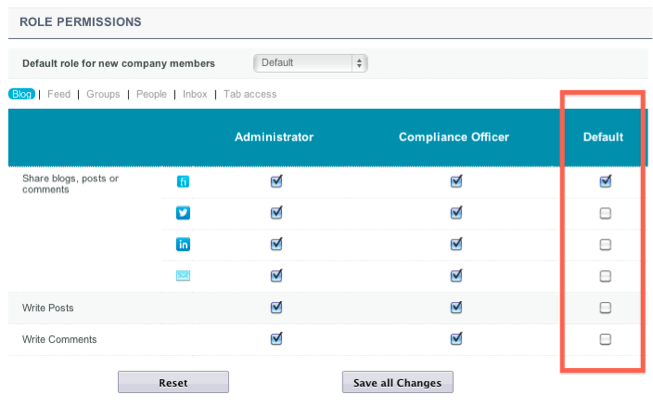

A manager can also manage social media rights and approve who can do what and where.

Finect currently has around 200 financial service advisors using the system right now. Among some of the organizations using the platform include Chilton Capital, an investment advisor based in Houston, and the National Investment Company Service, a non-profit trade organization for investment professionals.

The company, which was funded by European angels, including Santiago Satrustegui, a former managing director at Morgan Stanley, has been testing with some European companies, such as Fidelity Spain and the European Financial Planning Organization.

If you’re an investment advisor who wants to take advantage of the Finect platform by managing your social media, such as LinkedIn, Twitter and Facebook, while ensuring all your communications is recorded, then Finect would be useful. You can join for free. The free version gets a person a profile, plus verification of their credentials, an ability to blast updates to your social media channels with one post and have that recorded for compliance purposes and to create basic groups, such as “Avoiding the next [Bernie] Madoff’ group,” said Openshaw.

The verification is a big deal as Finect wants to maintain a high-level of credibility.

While anyone can create a profile on Finect, the company does background checks on a person’s credentials. Finect has a strategic alliance with Discovery Data, a database company with data on 35,000 companies and two million professionals to do verifications.

But the key to Finect’s long-term future is to get the financial advisors to pay up. Their hope is to have them pay $40 a month (to up to $500 down the road) to have premium services, such as the ability to create more groups or send more messages, similar to the models that are working for LinkedIn.

Among the differences between Finect and LinkedIn are:

- Verification of professionals – allows people to find you knowing you are a professional, view content/opinions by pros vs others

- Integrated content approval, compliance (tracking, archiving etc)

- Single source to post and distribute content to LInkedIn, Twitter, and FB with seamless integration; high ability to remove comments, posts if desired

- Ability to track all employees using social media channels from a single location (CCOs love this)

- Investment products that can be followed and have real-time sentiment integrated in (twitter)

- Significant privacy controls to control who can reach you and content you want displayed