Oxford Cancer Analytics raises $11M to detect lung cancer via a blood test

OXcan combines proteomics and artificial intelligence for early detection

Read more...

After the Facebook IPO disaster, it was reported that 13 companies, including Kayak, Tria Beauty, Corsair Components, CyOptics.Graff Diamonds, Formula One, and Vkontakte, the largest social media website in Russia, had all withdrawn its IPOs for fear of a downward trending market. The companies were seemingly afraid of what the market would look like, and for good reason.

In May, Bloomberg reported that its IPO Index, which tracks companies for a year after they go public, declined by 15% that month, the same decline the Index saw during the collapse of Lehman Brothers in October 2008, which many cite as the beginning of the current recession.

Indeed, IPOs have been down in recent months. But on the positive side, mergers and acquisitions (M&As) are trending upward, according to the latest report from Dow Jones VentureSource.

The second quarter of 2012 saw only 11 venture-backed companies in the United States go public, down from 20 the previous quarter, but those 11 companies raised $7.7 billion through its IPOs, an increase over the $1.7 billion raised by 14 IPOs in the first quarter of 2011.

The quarter also saw 110 M&As of venture-backed companies in the United States. While the overall number of deals were down 6% from the same quarter in 2011, it is still up from the 98 in the first quarter of 2012.

Despite the worsening European crisis, and the terrible Facebook debut, the increase in M&As from the previous quarter could indicate good things are on the horizon, Jessica Canning, global research director for Dow Jones VentureSource, said in a release.

“The silver lining this quarter may be M&A as deals are up slightly over the first quarter and have a solid start for the third quarter when Microsoft’s acquisition of Yammer is expected to close.”

Some 47 of the mergers and acquisitions came from information technology (IT), which, together, raised $5.3 billion.

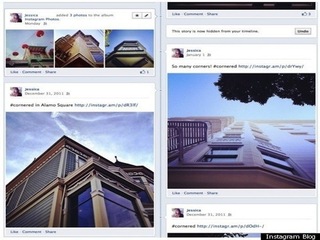

The top five consumer internet deals were Facebook’s purchase of Instagram for $1 billion; GREE buying Funzio for $210 million; Bazaarvoice purchasing PowerReview for $168.2 million; LinkedIn’s acquisition of SlideShare for $118.75 million; and Google’s purchasing of Meebo for $100 million.

So what can possibly account for the pendulum swinging back so soon after what happened with Facebook?

It say be surprising to hear but Valerie Foo, senior research manager at Dow Jones VentureSource, says that the Facebook IPO might have actually been a good thing, as it just might have set expectations back to the normal.

“Entrepreneurs and corporate buyers were not seeing eye-to-eye on price but Facebook’s IPO delivered a dose of reality. The uptick in M&A may be a result of entrepreneurs resetting their valuations so that they’re now in line with what acquirers are willing to pay,” Foo told VatorNews.

While IT was soaring, healthcare saw a big drop in the second quarter, going from 25 acquisitions to 18. A big part of this was attributed to uncertainty over regulations, which will hopefully become less of a concern now that the Supreme Court has ruled on the Affordable Care Act.

(Image source: articles.michelletay.com)

OXcan combines proteomics and artificial intelligence for early detection

Read more...Nearly $265B in claims are denied every year because of the way they're coded

Read more...Most expect to see revenue rise, while also embracing technologies like generative AI

Read more...Startup/Business

Joined Vator on

SlideShare is the world's largest community for sharing presentations.

- Individuals & organizations upload presentations to share their

ideas, connect with others, and generate leads for their businesses.

- Anyone can find presentations on topics that interest them. They can

tag, download, or embed presentations into their own blogs &

websites.

SlideShare is the best way to get your slides out there on the web, so your ideas can be found and shared by a wide audience. Do you want to get the word out about your product or service? Do you want your slides to reach people who could not make it to your talk? Are you a teacher looking to share your lesson plans? It only takes a moment - start uploading now, and let your slides do the talking!

Some of the things you can do on SlideShare

- Embed slideshows into your own blog or website.Startup/Business

Joined Vator on

Bazaarvoice brings the power of social commerce to the world's best brands. Social commerce happens when you connect customers to one another in ways that drive measurable results to your business. Our mission is to help your customers build your business. Through outsourced technology, community management services, analytics, and syndication, Bazaarvoice is the best-of-breed solution for using consumer-generated content to drive customer loyalty and multi-channel sales.