Thirty Madison and Talkspace join forces to expand mental health access for women

Talkspace will be the therapy partner for femtech brand Nurx and migraine treatment platform Cove

Read more...

As we gear up for our second Vator Splash LA (swimmin’ pools, movie stars…), we can’t help but marvel at the LA tech scene. Startups are flourishing, and investors are quick to move in and pounce on raw talent. So it comes as no surprise that a number of incubators and accelerators have set up camp in the thriving metropolis.

LA presents a number of advantages for early-stage investors—most notably the density of the college grad population. LA is home to quite a few colleges and universities, including UCLA, USC, UC Irvine, Caltech, UC Santa Barbara, Pepperdine, Loyola Marymount, and more. More educational institutions means a larger talent pool from which to choose.

In addition to the highly educated population, the city also boasts one of the most diverse populations in the country. LA ranks right up there with New York and San Francisco for the plethora of different groups congregating in the area.

And as many are aware, Los Angeles is a thriving cultural capital, particularly where entertainment is concerned.

And yet it’s long been seen as something other than a tech hub.

“Why does LA get negative bias from tech community? There is a negative bias, money doesn’t flow here,” said Scott Painter, CEO of the Santa Monica-based TrueCar.com, in an interview. Painter is on the mayor’s council for LA. “It’s starting to—part of it is it's being led by entrepreneurs who are getting liquidity and doing their next deal here.”

So who are these incubators and accelerators who are getting in on the LA action? Several happen to be speaking at Vator Splash LA this Thursday. A quick glance at some of the incubators and accelerators in LA includes:

Founded in 1996, the Pasadena-based incubator spawned such noteworthy companies as Tickets.com, Picasa, Internet Brands (IB), Answers.com, Jobs.com, PETsMART.com, and more. The incubator focuses on cleantech, communications and security, Internet media and services, software, and automation. Currently, a number of Idealab companies in development are focusing on search.

“I believe the recent uptick in accelerators in both LA and Silicon Valley is driven partly by the need for venture funds to effectively source companies at the very early stages, and most have a great stable of mentors that can help identify and grow promising ideas,” said Alex Maleki, a member of the New Venture Group at Idealab. Alex previously helped lead the Proto Group at Idealab to determine how feasible some of the new business ideas really were.

Idealab has created more than 75 companies, 30 of which have exited.

MuckerLab launched just last October and kicked off its first class in January. Two companies in its inaugural class have already gone on to raise Series A rounds—Lifecrowd raised $5 million in April and Surf Air announced today that it has raised an undisclosed Series A round.

“We believe Los Angeles (and Southern California in general) is on the cusp of becoming a major technology hub, but is in need of additional funding and infrastructure at the very earliest stages of venture formation,” the company explains on its website. “Southern California is second only to the Silicon Valley in historical venture returns…Yet, it only has about 1/10 of the venture capital investment as compared to Silicon Valley.”

In addition to office space and mentorship, the three-month program also includes up to $21K in funding.

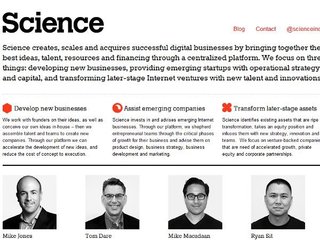

Science actually has a pretty interesting story, as it was founded by Mike Jones shortly after he left the sinking MySpace ship. Not quite an incubator, not quite an accelerator, the company calls itself a “technology studio.” In other words, it takes a movie studio-like approach to startups by both creating companies in-house and acquiring new companies, but without the timeline usually associated with accelerators and incubators.

The studio has already supported a number of new splashes in the tech world, including DogVacay and Eventup, which just raised $1.8 million in a seed round led by Lightbank.

Not only does Science eschew the typical time-frame most accelerators/incubators enforce, it also doesn’t have a set amount that it funds companies.

One of the newer incubators on the scene, io/LA launched in March 2012 with a strategic location in Hollywood. io/LA is looking to bridge entertainment and technology, so among its advisors is award-winning actor Terrence Howard. io/LA is also unique in that it not only bills itself as Hollywood’s first technology and entertainment incubator, but also as a café that’s open to the public and a co-working space that’s available for a monthly fee.

io/Labs is currently accepting applicants for its inaugural 12-week class.

Founded in 2009 by Mark Suster, Launchpad LA was evidently created to help stem the brain drain of new talent from relocating to Silicon Valley. Or as the company explains: “The idea came from Mark’s frustration with seeing too many companies receive funding from Northern California VCs and then choosing to relocate their teams.”

“LA does have a few incredible unique advantages,” said managing director Sam Teller, outlining the fact that LA is “arguably the world's leading creative city; has unparalleled access to mass distribution channels; expertise in creation, distribution, and monetization of content; incredible quality of life (and wealthy); a scrappy bootstrapping mentality; a legacy of exceptional tech companies like Applied Semantics and Overture; exceptional active companies like Factual, OneStop, IntelligentBeauty, MovieClips, Viddy, Beachmint, ZestCash, Pose, so many more; and an incredible booming community of entrepreneurs!”

Launchpad LA has been behind some interesting new companies, like Movieclips, which recently partnered with YouTube. Each company selected for one of Launchpad LA’s classes (the accelerator is currently accepting applications for its fourth class) receive $50,000 in funding, along with office space and mentorship.

Start Engine has gotten off to a good start this year. The accelerator debuted its very first class back in January and has since gone on to announce another class of ten startups for the second quarter. Co-founded by Gamzee CEO Howard Marks and Los Angeles investor Paul Kessler (who may actually have the nicest eyebrows in California), Start Engine invests $20,000 in each company and guides it to be self-sufficient within 90 days. The accelerator is a $15 million fund and hosts an interesting array of advisors—not the usual tech CEOs you’re used to seeing, but rather some big names in other fields, including Howard D. Fisk, formerly a capital partner with DLA Piper LLP (the largest law firm in the world), General Merrill McPeak, who commanded NATO’s 20th Fighter Wing, and former California governor Gray Davis.

Hatch Labs is interesting for a couple of reasons. For starters, it’s headquartered in New York with an office in Los Angeles—so it actually bypassed Silicon Valley to settle in So. Cal. Secondly, Hatch Labs is exclusively devoted to developing mobile apps.

The incubator, which is owned by IAC, has already come out with several interesting mobile apps that range from super classy wine discovery app Blush to Crowdfail, an app that lets you share and browse photos and videos of people doing stupid things.

Launched in December 2011, Amplify is a $4.5 million fund that received support from some pretty big names, including Mark Burnett, producer of Apprentice and Survivor, as well as Paige Craig, Tim Draper, and some heavy-hitting VC firms, such as Accel Partners, BC Capital, Greycroft Partners, Rustic Canyon, and Tomorrow Ventures.

Amplify differs from other accelerators in a few key ways. For one thing, it doesn’t hold typical three-month classes, but rather accepts startups throughout the year. And in addition to investing up to $50,000 in the startups it selects, Amplify also provides companies with a three-year hiatus on city taxes.

Talkspace will be the therapy partner for femtech brand Nurx and migraine treatment platform Cove

Read more...Midi is currently on track to serve about 100,000 patients this year, up from about 30,000 in 2023

Read more...Wheel clinicians will be able to prescribe Owlet's BabySat, which monitors oxygen and heart rate

Read more...