UnitedHealth Group makes $10M investment in Appalachian community health

Invest Appalachia Fund will invest in affordable housing, clean energy, and community revitalization

Read more...

Venture capital fundraising may have gone down 35% last quarter, but that is not going to stop one of the biggest VC firms from trying to get its hands on some new money.

Venture capital firm Khosla Ventures is getting ready to raise a new seed fund, according to documents filed with the Securies and Exchange Commission on Monday.

The new fund will be known as Khosla Ventures Seed B. The filed documents do not specify a specific fundraising goal, and no money has yet been raised.

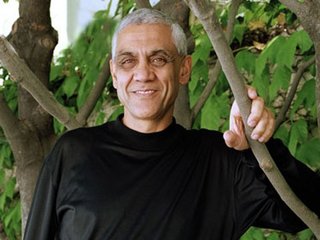

Menlo Park, California based Khosla Ventures was founded in 2004 by Vinod Khosla, a former partner at Kleiner Perkins Caufield & Byers. This will be its second seed fund; its previous fund, Khosla Ventures Seed, raised $300 million in January 2010.

Khosla Ventures also raised a $1.05 billion fund in October 2011, called Khosla IV, half of which was set to be invested in clean technology. It also closed two funds in July 2009 which raised $1 billion collectively.

Several biofuels and biochemical companies in Khosla’s portfolio have already seen some big exits, including industrial biofuels company Amyris, which raised $84.8 million in its IPO in 2010; Bio-isobutanol producer Gevo, which raised $123.3 million in its IPO in March 2011; and renewable fuels company KiOR, which raised $150 million in its June 2011 IPO.

More recently, Khosla led a $25 million round for cloud storage platform Niravnix and participated in a $30 million round for video startup Viddy in May; led a $7 million round for OneID in April; and led a $2 million round for e-signing service SignNow and an $85 million round for social networking system Yammer in March.

What kind of startups does Khosla invest in? On its website, Khosla says it is looking for “a crazy idea that may have a significantly non-zero chance of working.”

“From a seed perspective, planning for risk elimination at the lowest possible cost is the key variable we look for. Your seed plan should validate your hunches about the market and help you decide what market segment you want to enter.”

Khosla Ventures was unavailable for comment

(Image source: gallery.futureinreview.com)

Invest Appalachia Fund will invest in affordable housing, clean energy, and community revitalization

Read more...The firm, which now has over $4 billion in assets under management, invests across all stages

Read more...Founded by Ignition's Kellan Carter and Cameron Borumand, Fuse will invest in B2B software companies

Read more...