UnitedHealth Group makes $10M investment in Appalachian community health

Invest Appalachia Fund will invest in affordable housing, clean energy, and community revitalization

Read more...

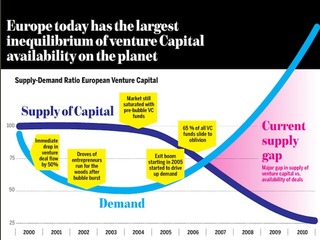

Venture capital fundraising fell 35% last quarter after being up the previous quarter, pulling VC investing down with it. But august venture capitalists with track records don't typically find it hard to raise funds.

Venture Capital firm Kleiner Perkins Caufield & Byers closed a $525 million fund, the firm announced this week.

The fund, which is No. 15, will be led by 10 managing partners: Mike Abbott, Chi-Hua Chien, Amol Deshpande, John Doerr, Bing Gordon, Wen Hsieh, Randy Komisar, Matt Murphy, Beth Seidenberg, and Ted Schlein.

“Portfolio companies in KPCB 15 will benefit from the firm’s holistic approach to company building that we pioneered more than a decade ago,” said Ted Schlein, one of the managing partners.

“We will identify promising early-stage companies in our areas of focus and bring value-added resources in key areas to help early-stage companies grow and succeed. This includes applying our considerable industry, operational and financial expertise and network of relationships to help entrepreneurs build lasting enterprises.”

Menlo-Park, California-based Kleiner Perkins Caufield & Byers has backed over 500 companies, including AOL, Compaq, Amazon, Google, Netscape, WebMD and Zynga.

In the release, the firm stated that it will use the new funds for “digital, green tech and life sciences,” but the fund will focus most exclusively on investing in digital enterprise.

The firm will also continue “to actively invest from its existing funds across both early and growth-stage companies.”

How much have other VC’s raised?

In April, early-stage venture capital firm First Round Capital announced that it was going to raise its fourth fund, with a target of $135 million, while Berlin-based Earlybird raised a $100 million fund.

In March, Groupon investor NEA filed with the SEC to raise $2.3 billion, while DST, one of Facebook's biggest investors, was looking to raise $1 billion.

Andreessen Horowitz, also based in Menlo Park, secured a $1.5 billion fund in January, announcing it had raised $2.7 billion in three years. While it has only been around since 2009, Andreessen Horowitz is already a top VC firm, raking in siginificant management fees.

In 2011, Khosla Ventures, raised $1 billion in October, Founders Fund raised $625 million for early-stage investments, General Catalyst raised $500 million, and Accel Partners closed $1.35 billion for two funds in June.

(Image source: smallbiztechnology.com)

Invest Appalachia Fund will invest in affordable housing, clean energy, and community revitalization

Read more...The firm, which now has over $4 billion in assets under management, invests across all stages

Read more...Founded by Ignition's Kellan Carter and Cameron Borumand, Fuse will invest in B2B software companies

Read more...