The company that has forced many financial and mobile businesses to consider their payment services, Square, appears to be hitting the pavement for new funding and an awe-inspiring valuation of $4 billion, according to multiple sources.

If the company hits its goal, and with all the buzz around the mobile payment service I bet it will, it will have quadrupled its worth in a matter of just 10 months.

The three-year-old company founded by Twitter pioneer, Jack Dorsey is changing the whole system of transactions across the nation by providing cardless, and now register less, systems of retail.

Over the last few months, Square has been rolling out new apps, services and deals with millions of individuals, restaurants, and retail locations that want to reduce hardware costs and join the techno-savvy paperless revolution.

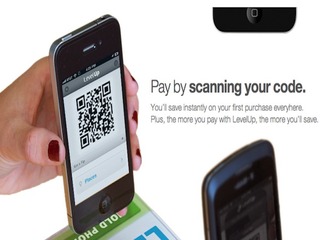

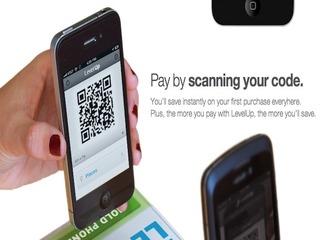

The mobile payment market is now flush with services and investments as PayPal, Google, LevelUp, Bump, PayDragon and others elbow their way to get a slice the industry Square pioneered. Just yesterday, one report came out shooing that mobile payments could become as common as swiping a credit card by 2020.

Approximately 65% of experts surveyed in the study agreed that mobile payments would take off by 2020, while 33% of experts agreed with a more negative statement, which said that consumers wouldn’t trust mobile payments to replace cash and credit cards by 2020.

I’m sure that PayPal, Square, Google, Visa, LevelUp, PayDragon and others are taking notice of what the buzz is about mobile payment adoption, especially now that users have grown more comfortable shopping and checking their banking information via their pocket-sized computers.

Recent Pew Internet surveys have found that one in 10 Americans have used their cell phone to make a charitable contribution by text message; more than one-third of smartphone owners have used their phones to do online banking services like paying bills or checking a balance; and 46% of apps users have purchased an app using a mobile device. So the comfort is growing with phone transactions, but all of these mobile payment companies that have been making waves over the last few months are hoping that you’ll feel fine leaving home with just your phone in the very near future.

Previous research from comScore found that 38% of smartphone owners have used their cell phone to make a purchase of music, e-books, movies, clothing and accessories, and daily deals as well, just as mobile retail continues to grow with vigor.

Your wallet is in danger of becoming as obsolete as the pocket watch. With tech companies zoned in on turning your mobile devices into methods of payment, consumers are going to find a lot more value in keeping their smart phones close — and merchants are clamoring to pick the services that give them the best competitive edge.

Frankly, once public transit, cars and my front door get mobile applications I will be happy to retire my beaten up wallet.

The first strong contender in this race to create the most mobile of payment services was Square, with its finger-pad-sized dongle and complimentary application that allowed vendors and merchants to enter credit card payments using their iPhone or iPad. The concept was quite ingenious and simple. Man small businesses were popping up in farmers’ markets, food truck posses and other spontaneous locales that made credit card machines logistically difficult and pricy. Square made collecting a payment as quick and affordable as using a banking app to transfer money.

Anyone could swipe their credit card through a Square dongle for quick payment and receive a receipt in their email inbox once the transaction is complete. Merchants also had no hardware or service payments to make, just a 2.75% fee per transaction.

Then, early this month, Square announced its plans to further disrupt the point-of-sale system for even more retail and restaurants around the globe with the launch of its updated iPad app: Register.

The San Francisco company founded by Twitter’s Jack Dorsey first tackled the credit card machine by creating a an iPhone accessory to mobilize, digitalize, and simplify what is needed to complete a credit transaction and now it is expanding its reach by re-thinking the whole POS for businesses.

The new Square Register was unveiled on Sunday evening to extend the credit features to now accept cash payments, lets merchants create list menu items, and tracks the history of customers’ purchases.

Currently, nearly 75% of U.S. merchants are in the market for tablets and tablet apps to incorporate into their business and more than half of retailers are gearing up to use a mobile POS device within a year to 18 months, compared with a slim 6% now.

The status quo POS systems are often cumbersome in size and pricing — many cost in the thousands per year to install and maintain, while Square has the attractive price tag of $0 and just charges a percentage fee based on the number of transactions logged into the system.

Square, which makes its money by collecting transaction fees, has helped merchants process sales for $4 billion worth of goods — double what it announced late last year. More than 1 million people are able to accept credit cards with Square. Their average purchase is $75.

Previous investors in Square’s three rounds, totaling roughly $137 million, include Kleiner Perkins Caufield & Byers, Tiger Global Management, Sequoia Capital, Khosla Ventures, Visa and Virgin-empire owner and entrepreneur Richard Branson.

Last month, the company said it was processing $4 billion in annual transactions. — with Square’s fee charging 2.75% per swiped transaction, and 3.5% plus 15 cents per keyed-in transaction, we estimate the company’s annual revenue last year was in the ballpark of $120 million. But, to be fair, some of that gets handed right over to credit card companies so its hard to tell without knowing what deals Square cut with Visa, MasterCard and the like.

As this mobile payment world excites and grows it will be interesting to see if Square remains as the company to beat or if there is still a lot of opportunities for someone else to edge ahead — all I know is that if Square gets a valuation between $3 billion and $4 billion, it will give them momentum that could place them out of reach for all except for Visa and PayPal.