Bump, a mobile sharing app allowing users to exchange information by bumping their phones together is entering world of cloud-based photo-sharing.

Currently running in beta, the Photos.bu.mp lets people select a photo on their phone, bump their space bar with the phone, and then see the image instantly appear on their computer screen. Now that seems like an awesome magic trick. Once the image is transported, the user can save it in the Bump cloud, save it on their computer, post it to Facebook or send someone a link.

Photos.bu.mp seems to be the new extension that Bump has created after looking beyond the business card sharing and the instant payment options that its neighboring phone recognizing technology has. Since a photo takes up more space than a business card or a payment transaction, though, both device have to be on the same WiFi network to allow the transfer. With the phone photo technology constantly improving, it would be nice to provide more ways to push the photos off of your phone and onto device with more space — and if nothing else its a great party trick.

This new application and capability comes around the same time that the tech world is buzzing about the demand for more and better ways to transmit and share photo. With the announcement this week the Facebook didn’t even blink when signing over $1 billion in cash and stock for the young company Instagram, people are wondering what the next moves will be in mobile and social picture sharing.

Even as many in the tech world cried outrage at the sizable price tag and scorned Facebook for snatching up a company that seemed so small and hip, the Instagram followed up the acquisition announcement with even more good news: the company’s still very new Android app has attracted 5 million downloads in just six days. That is light speed — we’re talking iPhone and iPad purchase numbers now. At this rate Instagram could see its more than 30-some million usership double by May — as long as that Facebook backlash does;t take hold.

Facebook specified just what a big part of its service is centralized on the sharing of photos and images — with 250 million photos uploaded to the site every day — in fact, it is the most popular photo uploading service on the Web. Facebook, in its S-1 filing, also pointed out that it would spare no expense in product development investments that would increase engagement and I think it shown just how much it meant that.

Even more mobile opportunities

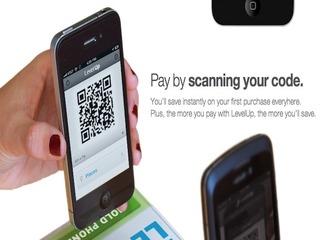

Bump, which has more than 75 million installs of its app on iPhone and Android devices, only recently entered into the mobile payment sphere against Square, PayPal, and LevelUp.

Bump released a new application a few weeks ago called Bump Pay that lets friends and businesses exchange funds with by tapping their devices together.

The iOS app allows users to transfer money via PayPal to anyone in arm’s reach.

So no more need to write your friends a check or scramble to look for cash when splitting the bill at a restaurant, just bump phones and its all even. It seems simple enough that even tech luddites could figure that one out. But there are a few disadvantages to this method. One, you have to all have iPhones — not a big issue is San Francisco, but definitely a factor elsewhere. And, you also have to be in arms reach of the person — so no pinging a friend the payment you owe them when they are at their office and you are at yours.

This is just the latest development out go the Bump Labs, Bump‘s experimental wing of app inventions. The company is currently releasing this app as a separate entity from their business card and info sharing app that has been installed 84 million times, to see if the idea gains traction.

For tapping payments, all you have to do is connect your PayPal account ahead of time, then enter the amount you want to pay, bump your iOS device against a friend’s, and confirm the payment. Bonus — as long you use a checking account connected to your PayPal, there’s no fee for the transfer. If you use a credit card in your PayPal account there is a fee, much like PayPal’s mobile wallet and Square’s mobile payment systems.

The four-year-old company with around $20 million in funding, has tried to incorporate more services in its app since 2010, but often drops them to stick with simplicity. In fact, Bump was one of the first companies PayPal looked to for its API but dropped that functionality in favor of opening a window on mobile devices.

Another advantage of this app is that Bump Pay allows users modify how secure they want the app to be. They can choose to enter their PayPal password once and have the app remember it, or they can choose to enter their password every time.

For now, the service only works with PayPal, but the company may explore more payment services to incorporate and will consider adding tools that could help people split bills, add tip and other things that would be handy to keep in app.