Duncan Davidson talks COVID response: what we we did right and wrong, and what needs to happen next

Davidson will be a part of Vator's Healthcare in Politics salon on October 7

Read more...Some folks are predicting tough times ahead for venture capital fundraising in 2012 or 2013, including yours truly, and more recently by Mark Suster, outspoken entrepreneur-turned VC, whose keynote speech at Vator and Bullpen Capital's last Venture Shift event in NY, was a bit alarming.

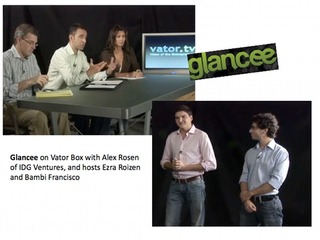

But not everyone sees the world with dark sunglasses. In my interview with Alex Rosen, partner at IDG Ventures, Alex said while we're living in "exciting times" (code word for healthy valuations) and there's some companies getting rich valuations ($20 million with no revenue), overall there will always be capital for the best companies. As for the rest that can't raise money? Good riddance.

He also said that the advent of the new seed and super Angel investors is one of the biggest changes in the venture industry. It's a profound change, with good and bad effects. "In the best cases, it's creating opportunities [for startups] to get momentum before they get a venture round. It's also creating a bunch of competitors."

Founder and CEO of Vator, a media and research firm for entrepreneurs and investors; Managing Director of Vator Health Fund; Co-Founder of Invent Health; Author and award-winning journalist.

All author postsDavidson will be a part of Vator's Healthcare in Politics salon on October 7

Read more...Artificial or not, intelligence is already woven into every part of life

Read more...Entrepreneurship is about finding solutions to challenges in real time

Read more...

Joined Vator on

Two decades of investing in, and working with, software and consumer companies.