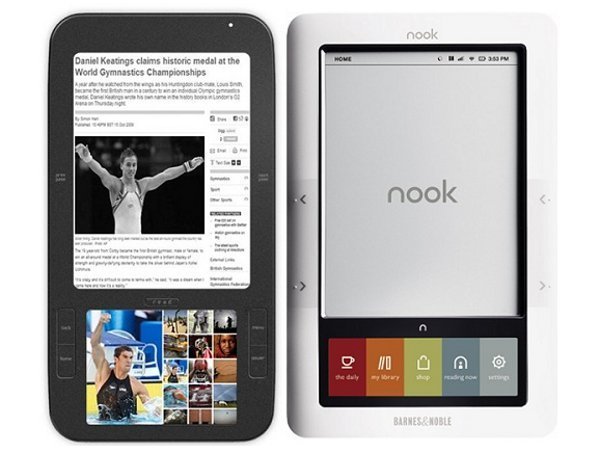

Barnes & Noble is riding the Nook wave to freedom. The company released its 2012 first quarter financial results Tuesday morning with some interesting numbers: while in-store sales continue to decline, digital sales have quadrupled.

The news is particularly poignant when considered in the context of Borders’ big nationwide shutdown, which is scheduled to finalize some time in the next couple of weeks. Granted, it would be a little overly simplistic to pin the blame solely on Borders’ failure to get on board the digital train sooner, but few would argue that that slip-up played a big role in the corporation’s downhill slide.

Barnes & Noble, on the other hand, is facing similar slides in its in-store sales, but it cobbled together a digital strategy early enough to not only save itself from ruin, but actually grow with the digital trend.

Total sales for the quarter increased 2% over last year to $1.4 billion, and sales through BN.com increased 37% to $198 million. But the real star of today’s earnings show is digital goods, sales of which quadrupled in the first quarter over last year. Barnes & Noble’s consolidated Nook business across all the company’s segments increased 140% to $277 million.

The company still incurred a loss, but it was considerably smaller than the loss suffered in the same quarter last year. B&N reported a consolidated net loss of $57 million, or $0.99 a share, compared to the same quarter last year, when the company reported a consolidated net loss of $63 million, or $1.12 a share.

So, there’s still a gap, but the company expects to see it shrink in the coming years.

“Our strategy of growing market share in the exploding digital content business while maximizing cash flow and EBITDA from our retail operations is paying off,” said B&N CEO William Lynch, in a statement. “We plan to continue investing in the significant growth areas of our business, and in fiscal 2012, we expect to see leverage as our digital sales growth is projected to exceed the growth of investment spend. Additionally, the return on investment is expected to increase in future years, as readers purchase increasing amounts of digital content on the platform we have built.”

Meanwhile, physical book purchases continue to dwindle, with store sales decreasing 3% to $1 billion.

As of 9:34 am PST, Barnes & Noble stock is up 8.05% to $12.35, compared to yesterday’s closing price of $11.47.